What kind of entity is the BV?

The BV is the equivalent of a private company with limited liability (LLC) in the Netherlands. Therefore its shareholders are liable (financially) only for their own investments in the business and do not carry personal liability for the company’s debts. This is why, among other reasons, Dutch BVs are preferred by international entrepreneurs.

Who owns the BV?

The owners of the BV are its shareholders that have acquired privately registered shares. There must be a minimum of one shareholder. Any shareholder can be either a Dutch or a foreign physical or legal entity.

If the shareholder is only one, the shareholder’s details are available to the public at the Chamber of Commerce. If the shareholders are more than one, only the details of the BV’s directors are listed in the public registry.

How much cash is needed for share capital?

In October 2012 the Government of the Netherlands passed a new act on the requirements for establishment of BVs to stimulate entrepreneurship. The share capital necessary for incorporation was reduced from EUR 18 000 to EUR 0.01. Our advice, however, is to start your BV with a capital of EUR 100 with a nominal share value of EUR 1.00. If you would like to opt for a share value above EUR 1000, please, let us know, because in this case, the procedure for incorporation will be a bit different.

What are the other requirements for incorporation?

Director(s)

The limited liability company should have a minimum of one director. There is no need to appoint a secretary. The director’s position can be taken by the single shareholder or by nominated directors.

In principle, the director is the official representative of the BV under any circumstances, unless his powers are limited by the provisions of the Articles / Memorandum of Association (AoA / MoA), or supplementary agreements with shareholders and managers.

Registered office

Dutch BVs are obliged to have registered addresses in the country. The address has to be physical, P.O. boxes are not acceptable.

What obligations does a BV have in terms of legal and financial requirements?

The limited liability company is required by law to submit a yearly report and financial statements at the Commercial Registry in the Chamber of Commerce. If the company is categorized as a VAT liable company, it is generally obliged to submit a VAT declaration quarterly.

External audits are required when (two out of three conditions have to be fulfilled) the BV’s turnover is above 12 million Euros, its total balance exceeds 6 million Euros and its average staff number is 50.

Understood, now what should I do to start the procedure for incorporation?

The incorporation of a Netherlands BV can be finalized only by a public notary. After all shareholders agree on the incorporation deed, the same is executed before the notary. After incorporation, the company must submit its documents at the commercial registry and the tax authorities. Public notaries can execute deeds of incorporation through Power of Attorney (PoA), therefore the shareholder(s) do not have to be present in person.

In order to initiate the incorporation procedure, we need basic information including the number and the details of the shareholders and the main scope of operations of the BV. According to the law in the Netherlands, the deed must be prepared in Dutch. A translated version is also necessary so that the shareholders understand the documents requiring their signature. In case you would like to see an example of AoA, please let us know and we will send you a free sample.

The process of incorporation can be finalized within 3 days, but the actual period depends on the particular situation, the issue of a PoA and the fulfilment of all identification requirements.

Great, Pepsi BV sounds fantastic!

One last thing you need to know before you start. It is not allowed to incorporate a company with a name already in use by another BV or included in the list of official trade names, like Pepsi. Contact us to check whether the name you like for your company is available at the beginning of the process of incorporation.

The name also has to start or end with “BV”. Along with the main name you are free to include additional commercial names. In this way, you will be able to represent multiple brands with one and the same legal entity.

All companies established in The Netherlands must be included in the Netherlands company register (‘Kamer van Koophandel’ in Dutch). When starting a business in the Netherlands, one of the first steps you should take is to enlist your business officially in this register. This database can help you to search business names, activities, registration numbers, and accounting information. You can find out if a company you are engaging in business with is real and legally capable of conducting business.

The Netherlands Trade Register can also help you find out if someone is an authorized signatory for a certain company. If you do not have such a registration, you cannot do business with your company at all. The Dutch business register includes both Dutch companies and branches of international companies operating in the country. They must all be included in the trade register.

The available information for each company includes the name and address of the business, telephone number, the number of employees, and details about the company’s representatives. You can also find out about the company’s financial background, such as any bankruptcies that may have occurred in the history of the business. Most of the information found on the Chamber of Commerce is free of charge, yet, financial statements, documents that have been filed on behalf of the company, history of the company, and corporate relationships are among the extras that can be purchased.

How Intercompany Solutions can assist you

Are you looking for local experts who know the Netherlands corporate register to help you incorporate a Dutch BV? Then you are at the right address. Our firm has the appropriate expertise to assist with your company registration in the commercial register Netherlands. Any entity providing goods or services to clients and generating profit from this activity is defined as a business. If you would like to make a new entry in the Netherlands’ corporate register, or register a company established abroad, our experts can provide you with the necessary assistance:

- Our team can register your business in the company register of the Netherlands.

- We can assist you in setting up a company and complete the registration in the Commercial register Netherlands.

- We can also register а subsidiary of your international company in the Netherlands trade register. Thus, your branch will be able to easily do business in the EU by obtaining an EORI number, a value-added tax number and an account at a Dutch or European bank.

What do you have to prepare?

We will give you a checklist of questions you need to answer, concerning the company name, the shareholders’ names, etc. This is everything we require to initiate the setup of a Dutch company from a distance in the beginning of the process.

Intercompany Solutions Company Register Netherlands Services

Intercompany Solutions can help you with every step in the process of setting up your new business. We can help you with applying for local banking, company establishment, and local representative services if you are working out of the country. Once your business is up and running, we can also be of service when it comes to bookkeeping and taxation. Leaving the heavy lifting to us allows you to focus on the more important aspects of the business. Our full-service package consists of:

- Opening a Dutch BV company (1-2 working days)

- Opening a Dutch Company Bank account

- Assisting services in the first year

- Obtaining VAT number

Requirements for Registering a Netherlands Company

*We always provide incorporation deeds in English translation, this is included in our pricing.

** Are you buying products from suppliers in the Netherlands, are you selling to Netherlands customers, are you living in the Netherlands, do you have local staff? Any of these points will benefit your position with the tax authorities.

Dutch company register online

Whether you are a natural-born citizen or a citizen of another country that is looking to open a business, the Netherlands can suit you well. Due to the bilingual capabilities of most residents, the Dutch Company Register, also known as the Dutch Chamber of Commerce, is also set up with a bilingual website. English and Dutch versions of the site are available to create ease of use by people even beyond the borders of the Netherlands. This adds to the user-friendly website that makes information easily accessible in both languages. Another key feature to the website is the ease of payment for any additional information you may want to obtain. Online payment is available by using your credit , or iDeal, and you can also choose to use direct debit from your bank account.

Incorporating a BV company in the Dutch Business Register

The process of becoming registered can be fairly simple with the help of Intercompany Solutions. You must have the deed of incorporation, shareholder’s details, details about the company’s managers, bank references about the deposited share capital, and authorization for Intercompany Solutions to act on your behalf. Once all of this information is gathered and submitted, you will be issued an access code. Only people with access codes are able to view the information contained in the Netherlands Trade Register.

A Netherlands company registration is finalized by a registration in the Netherlands Trade Register. For representation purposes, you will be seen as a company in the Netherlands and with the Netherlands’ excellent reputation, this will allow you to do business in Europe easier. A company registration in the Netherlands may be performed from anywhere globally. Our service is to guarantee a smooth company registration in the Netherlands and assist you to start your new business. We can also assist you with a Dutch VAT number and apply for a Netherlands company bank account.

The most popular company type for foreign entrepreneurs in the Netherlands is the Dutch ”BV company”. The Dutch BV company is comparable to a Private Limited Liability company. The BV has its own legal rights and the owners and directors are not liable for the actions of the BV company. The current type of BV company may be formed with as little as a €1 share capital deposit. The BV company is nowadays also known as ”Flex BV”, which has to do with the regulations that came into effect on 1 October 2012. This change made it much easier to open a BV company, especially for people with a low amount of starting capital.

To register a BV, you might need a Netherlands incorporation agent to assist you with this rather complicated matter, especially if you don’t have any experience doing this. Such an incorporation agent is specialized in working with foreign entrepreneurs and the particularities of forming a Dutch BV as a foreigner. The incorporation agent has to perform due diligence on the client, identify him and prepare incorporation forms. The incorporation forms will be certified by a notary public and published in the company register Netherlands. When the company register has the information for the new BV company, they will publish this immediately on the ”handelsregister” website.

The BV is fully incorporated when the notary has passed the deed, the company register has published the information in its register and the shareholders have paid up the share capital to the BV company bank account. Intercompany Solutions can assist you during every step of this entire process, since we have many years of experience with the incorporation of foreign firms in the Netherlands. Just contact us for professional personal advice.

Video explainers on starting a Dutch company

What we do

We have assisted hundreds of foreign entrepreneurs from over 50 different nationalities. Our clients range from small one-person startups to multinational corporations. Our processes are aimed at the foreign entrepreneur, we know the most practical ways to assist with your company registration.

We can assist with the full package of company registration in the Netherlands:

- Opening of a local bank account

- Administration services

- Application for VAT or EORI number

- Tax services

- Startup assistance

- Media

- General business advice

Registering a Dutch corporate bank account

To apply for a bank account for your firm, you first need to have your company incorporated. After incorporation you may pay the share capital to a bank account, that you open after the incorporation, to complete the process. Your bank account can be used right away for business transactions. We can assist you with the application for a business bank account in the Netherlands, since we work together with several banks.

Netherlands company register search

The Netherlands Chamber of Commerce regulates the Netherlands Trade Register, which is a register of all active companies in the Netherlands. For a new company registration in the Netherlands, the first step you will have to perform is a name check. Is the name of the new Dutch company already taken? A quick search in the company register Netherlands will show if your preferred name is available. Our firm can assist you with registering a name for your Dutch company.

By the Netherlands law, every legal entity will have to deposit annual account information with The Trade Register. The Dutch Chamber of Commerce’s function is to register this information. All annual accounts of Dutch companies are kept up to date by the Netherlands Trade Register.

Why the Netherlands is an interesting country for new business

The Netherlands has always been at the forefront of innovation, cooperation and unique concepts that fuel a very vibrant yet stable corporate climate. In addition to housing many excellent universities that actively cooperate with all sectors, the Dutch are also very open to new entrepreneurs who can shed some new light on any given situation. Especially foreign investors and potential business owners are welcome here, due to the diversity and challenging perspectives this provides. This open mindset has been a Dutch trait since early history, providing for an excellent business atmosphere that always stimulates growth and evolution. We will shortly outline some interesting factors below.

Why the Netherlands is an interesting country to register your business

The Netherlands Provides A Very Good Business Climate

Forbes magazine ranked the Netherlands 3rd place in the world as ‘’Best country for doing business’’. The world Economic Forum mentions the Netherlands as the 5th most competitive and innovative economy in the world. The Netherlands is simply the most convenient location to start a business inside the European Union. With a very competitive corporate tax rate.

The Netherlands Is A Core Member Of The European Union

The Netherlands Has An Excellent Location

The Dutch Speak Your Language

Associations and memberships

We are constantly improving our standards of quality to deliver impeccable services.

Media

Intercompany Solutions CEO Bjorn Wagemakers and client Brian Mckenzie are featured in a report for The National (CBC News) ‘Dutch Economy braces for the worst with Brexit’, in a visit to our notary public on 12 February 2019.

Intercompany Solutions Dutch Trade Register Services

Intercompany Solutions can help you with every step in the process of setting up your new business. We can help you with applying for local banking, company establishment, and local representative services if you are working out of the country. Once your business is up and running, we can also be of service when it comes to bookkeeping and taxation. Leaving the heavy lifting to us allows you to focus on the more important aspects of the business. Our full-service package consists of:

- Opening a Dutch BV company (1-2 working days)

- Opening a Dutch Company Bank account

- Assisting services in the first year

- Obtaining VAT number

Need assistance?

Intercompany Solutions is a well-known brand in the Netherlands and abroad as a trusted incorporating agent in the Netherlands. We are constantly looking for opportunities to share our solutions with foreign entrepreneurs.

Forming a company from abroad? Contact us!

Contact us directly. Our company formation specialists will be eager to assist you with a free initial consultation to answer all questions you may have about doing business in the Netherlands

Owners of businesses in the Netherlands, including non-residents and immigrants, have to open a Dutch bank account to manage their income and obtain access to different bank services.

Many Netherlands banks open corporate and personal accounts. Service packages can include the benefits of mobile and online banking, extra features and banking advice.

Opening a bank account in the Netherlands

Opening a corporate bank account is mandatory in order to set up a business in the Netherlands. The account is necessary for completing different business transfers and transactions. A bank reference with the history of transactions is also required for the annual financial statement.

Persons employed locally can also open accounts in Dutch banks to their benefit. Their salaries can be transferred directly to the accounts, payments are easier and international money transfers are possible.

The procedure for opening a bank account is simple, especially for personal accounts. Most banks can complete the first steps automatically with the help of an application form available online.

Foreign residents who face difficulties opening an account due to lack of knowledge of the Dutch language can contact our lawyers for assistance. Our teams are able to prepare a power of attorney allowing a particular person to open/manage an account on behalf of business owners who cannot be present in the Netherlands.

Documents needed for opening a Dutch bank account

If you want to open your account personally, you have to present a number of documents to the branch you plan to work with. A personal identification card/passport and a Dutch Citizen Service Number (BSN) (issued upon registration at the municipality) are among the required documents. A contract for employment and a personal or Dutch business address is required.

The papers required for opening a corporate bank account can vary. Documents such as the Business Registration Certificate of the company will also need to be presented.

If you have any questions with respect to corporate banking, please, contact our law firm in the Netherlands. Our team can offer you a wide range of solutions and consultancy with regard to working and living in the country.

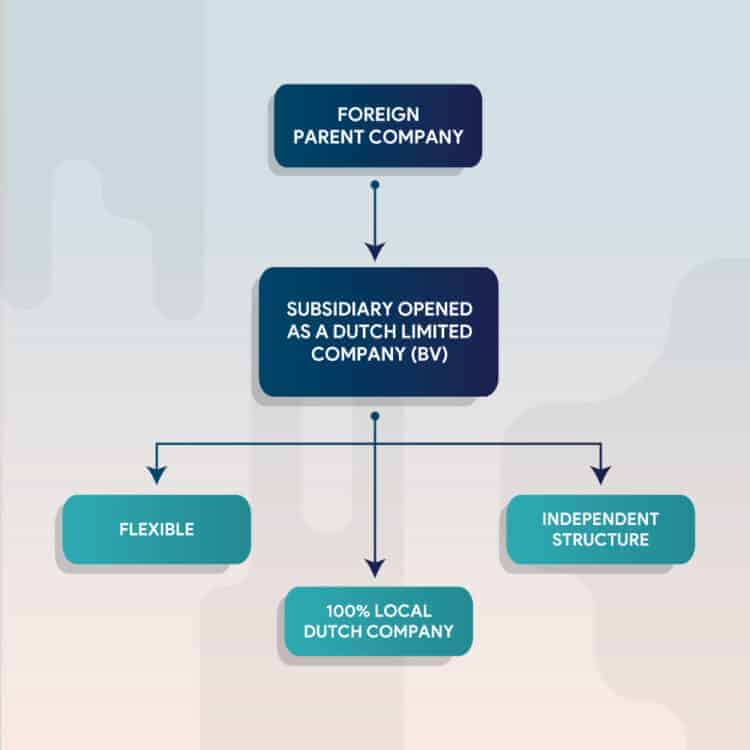

The Dutch holding company has proven to be an ideal structure for many different ventures. The Netherlands’ laissez-faire practices give businesses little to no regulation, minimal taxation, and generally, ease the stress of many entrepreneurs. In this article, we will analyze the main characteristics and benefits of opening a Dutch holding company.

What is a Netherlands holding company?

A Netherlands holding company is a type of business with the intention to ‘hold’ the stock of other corporations with the aim of controlling and possibly even absorbing them.

A holding company achieves this by purchasing enough shares of an already existing corporation to gain voting rights, which then enables it to influence the actions of the company, if not control it completely.

What are the benefits of a Dutch holding company?

While there are many benefits to holding companies in general, they are even more uniquely advantaged when located in the Netherlands. The explainer video covers the BV incorporation requirements, as well as advantages of a Dutch holding structure. A Dutch holding structure is where you would incorporate 1 BV and 1 holding BV.

Low Taxation

Thanks to many international treaties, such as the Double Tax Treaty Network, taxes for foreign or local holding enterprises within the Netherlands are significantly reduced. This tax code also promotes equality among investors and entrepreneurs, ensuring that the same regulatory standards given to domestic companies are extended to foreign enterprises as well, including their low tax standards for dividends. Holding companies generally face low taxation, since they are only investing their equity and are not a fully operating business. Moreover, certain companies may be fully exempted from taxation based on their income. Read more on dividend tax in the Netherlands.

Minimal Overhead

Overhead is the monetary cost of running a company. This can include employee salaries, office rents, sales team, and any other expenses devoted to running and organizing the business. Since holding companies rely on the foundations of already established businesses, they have minimal overhead expenses.

Easy Establishment

Establishing a Dutch holding company is a relatively simple process. The Netherlands holding companies can be listed as limited liability companies or limited liability partnerships. The capital minimum for limited liability companies is 1 euro and there is no minimum capital required for the limited liability partnerships. Additionally, no official audits are needed until the holding company has 10 million turnover a year or more. Professional financial management is also not needed, although it may come heavily recommended. The Netherlands remains one of the most favourable places for corporate establishment throughout all of Europe. If you would like to receive more information on how to establish a holding company in the Netherlands, please contact one of our incorporation experts.

The Netherlands is one of the main import/export locations in Europe. With its exceptional infrastructure and major ports, such as those in Rotterdam and Amsterdam, this country is a great place to set up a trading business. Those companies who engage in international trade will have easy access to Europe and the rest of the world because of the Netherlands’ particular geographical and infrastructural advantages.

Trading companies in the Netherlands

Trading companies engage in a wide variety of business activities, including but not limited to importing and exporting; wholesaling; buying and selling; the intermediary sale or purchase of goods; and assisting and counselling other companies in sourcing their supplies.

Dutch trading companies do not have to limit themselves to importing or exporting just one type of item. They can easily diversify their business to suit market conditions anywhere in the world. Trading companies can also specialize in a specific type of product if they desire. Anything from food products to health and beauty items can be traded from a base in the Netherlands.

Trading companies in the Netherlands can also set up their offices in whichever Dutch location they feel would be best for them. They can take advantage of the opportunities in larger cities, like Amsterdam or The Hague. Or, they can set up a shop in one the Netherlands’ smaller cities. All locations will benefit from the same transportation and communication infrastructure that make the Netherlands such a great place to do business.

Setting up a trading company in the Netherlands

An investor who wants to set up a Dutch trading company can either open a branch of an existing international company or create a new legal business entity based in the Netherlands. Opening a branch is easier, but it does not offer as much flexibility as creating a new entity. In terms of potential liability, forming a Netherlands company is also a better option.

Like many other types of businesses, trading companies must also acquire special permits and license in order to operate legally in the Netherlands. There are also rules and regulations regarding the import and export of controlled goods that have been imposed by the Dutch government and must be followed carefully. We can assist you in acquiring all necessary licenses and permits so that your trading company can operate legally. We can also advise you about laws that may affect the types of goods you wish to trade and distribute, and tell you what you must do to follow them.

Our agents in the Netherlands can walk you through the entire process of forming a Dutch trading company. We can assist you in choosing a company name, preparing the necessary documents to form a company, and registering the new business with the Dutch Company Register.

Please contact our Dutch agents to find out how to open a trading company in the Netherlands. We are also happy to discuss with you general details about investments in the Netherlands.

When starting a business in the Netherlands one of the first steps is to enlist your business in the Dutch Company Register (Dutch: Kamer van Koophandel). This database can help you to search business names, activities, registration numbers, and accounting information. You can find out if a company you are engaging in business with is real and legally capable of conducting business. The Netherlands Company Register can also help you find out if someone is an authorized signatory for a certain company.

The Dutch company register

Every company that does business in the Netherlands is listed on the Dutch Company Register, also known as ”Chamber of Commerce”, ”Dutch Trade Register” and ”Dutch Business Register”. The available information for each company includes the name and address of the business, telephone number, the number of employees, and details about the company’s representatives. You can also find out financial background such as any bankruptcies that may have occurred in the history of the company. Most of the information found on the Chamber of Commerce is free of charge, yet, financial statements, documents that have been filed on behalf of the company, history of the company, and corporate relationships are among the extras that can be purchased.

How to register in the Dutch trade register

The process of becoming registered can be fairly simple with the help of Intercompany Solutions. You must have the deed of incorporation, shareholder’s details, details about the company’s managers, bank references about the deposited share capital, and authorization for Intercompany Solutions to act on your behalf. Once all of this information is gathered and submitted you will be issued an access code. Only people with access codes are able to view the information contained in the Netherlands Trade Registry.

Before you can be registered with the Dutch Company Registry, however, you must complete the necessary forms to obtain approval for your company name. This will ensure that you are legally allowed the rights to the company name you wish to do business under. Intercompany Solutions can also help you submit your company name to the Dutch Company Registry for approval. Intercompany Solutions can assist you with registering at the Dutch trade register. Most commonly for a Dutch company registration would be a B.V. company, a BV needs to be registered at a Dutch Notary. The registration in the Chamber of Commerce finalizes the process of your Dutch business registration.

Netherlands company register online

Whether you are a natural-born citizen or a citizen of another country that is looking to open a business, the Netherlands can suit you well. Due to the bilingual capabilities of most residents, the Dutch Chamber of Commerce is also set up with a bilingual website. English and Dutch versions of the site are available to create ease of use by people even beyond the borders of the Netherlands. This adds to the user-friendly website that makes information easily accessible in both languages. Another key feature to the website is the ease of payment for any additional information you may want to obtain. Online payment is available by using your credit card or iDeal and you can also choose to use direct debit from your bank account.

Dutch Business Register Services

Intercompany Solutions can help with every step in the process of setting up your new business. We can help you with applying for local banking, company establishment, and local representative services if you are working out of the country. Once your business is up and running we can also be of service when it comes to bookkeeping and taxation. Leaving the heavy lifting up to us allows you to focus on the more important aspects of the business. Our full-service package consists of:

- Opening a Dutch BV company (1-2 working days)

- Opening a Dutch Company Bank account

- Assisting services in the first year

- Obtaining VAT number

Associations and memberships

We are constantly improving our standards of quality to deliver impeccable services.

Media

Starting a Dutch Foundation

Thanks to the Netherlands’ loose government regulations and minimal taxation burdens, as well as their fair international codes, the Netherlands, provides entrepreneurs with a unique location to build a prosperous enterprise. If, however, one is unaware of the appropriate steps needed to found a Dutch foundation, they may easily breach the country’s guidelines and procedures. In this article, we will detail all necessary topics to know prior starting a foundation in the Netherlands.

What is a foundation?

A foundation is a private legal entity, not associated with the government, that has no members and in which the revenues are used for non-profit purposes, such as a charity fund.

Unlike other Dutch companies, foundations within the Netherlands do not have to follow the regulations of the Dutch Commercial Code. They belong to the Civil Code. The Civil Code provides foundations with the opportunity to be recognized as a separate, legal identity, distinct from its founder(s). When under the Civil Code, no shareholders can be acquired, and profits must be used for non-commercial purposes if registered as a Special Purpose Entity.

Read here on other company types in the Netherlands.

Taxation on foundations

Dutch foundations are a peculiar organization when it comes to Dutch tax regulations. While they are an enterprise, they differ from businesses as their profits aren’t used to accumulate personal wealth, but rather to give back to the community in some way. This is the reason why the Netherlands provides foundations with options to choose how their taxes will be mandated. The options are broken down into two paths: special purpose entity or commercial registration.

Special Purpose Entity

Special purpose entity, or SPE, for short, applies when a foundation strictly agrees to engage in no commercial commerce in regards to their enterprise. While they are still allowed to make a profit and use the money to fund overhead costs such employee salaries, there are many restrictions on how their net profits are spent. This is to avoid companies claiming they are non-for-profit organizations to get a tax deduction while still earning profits and not donating the funds.

Commercial Registration

Commercial registration can be achieved for foundations. This option is for foundations who want to allocate a significant portion of their money for non-profit purposes but still would like to be involved in retail service applications. Since commercial foundations engage in commerce, they face Dutch taxation, although it is still generally less than other corporate entities.

The Dutch STAK foundation

The Dutch STAK is a legal entity that differs from a regular foundation. The STAK foundation is formed to hold the shares of a private company. By using the STAK to hold the shares, you are able to separate the economic ownership from the voting rights. This feature of the STAK could be useful for estate planning, where the heirs can receive economic benefits, without having voting power in the company.

If you would like to receive more information on Dutch Foundations, please contact our local incorporation agents.

There are several types of legal entities (rechtsvormen) that entrepreneurs can establish in the Netherlands. They can be classified into two groups: Incorporated (compulsory legal form) and unincorporated (legal form is not mandatory).

Our Netherlands-based company formation agents can assist you in selecting the correct company type for your business.

Incorporated business structures (Rechtvorm met rechtspersoonlijkheid)

Incorporated businesses must have a legal form (i.e. a corporate personality or legal entity) represented by a deed prepared by a notary. This form protects the owner from potential debts incurred by the company.

In the Netherlands there are five types of incorporated structures:

1. The Dutch Private Limited Company (BV)

Dutch: Besloten Vennootschap

Private limited liability companies are the most common form of companies within the Netherlands. It is similar to the German GmBH, the American LLC, or the English’s Ltd. Limited liability companies are businesses in which equity is divided by shares. The private limited company Dutch BV is commonly employed by entrepreneurs investing in the Netherlands. The Dutch company act is renewed, therefore a Dutch BV no longer requires a minimum capital deposit. One shareholder is the minimum requirement for a Dutch BV and the liability is limited to the capital deposited. The shares of the Dutch BV are transferable by notary deed.

2. The Dutch Public Company (NV)

Dutch: Naamloze Vennootschap

The Netherlands public company or NV is the most popular legal form for companies who may be listed in the public Stock Exchange. The capital requirement for the NV is 45,000 euro. Public companies are businesses in which a portion of the stock or share is available on the Dutch stock exchange for members of the general population. They can invest capital in order to garner shares in the business. The characteristic of the NV company is that shares are freely tradeable, as compared to the Dutch BV where the shares are privately tradeable and involve a notary deed. The current largest public Dutch company title belongs to the oil industry giant, Royal Dutch Shell.

The Dutch Private Foundations

Dutch: Stichting

A Dutch foundation is a legal private entity with the sole intent to benefit a certain cause, whether for personal profit, social causes or charity. The process of incorporation is fairly straightforward and ideal for charities, small family businesses, and estate planning. The Dutch Stichting may be used to minimize tax.

1. STAK Foundation

Dutch: Stichting Administratiekantoor

The Stak Foundation is commonly used for separating the economic ownership and the control of the company by certifying the shares. The certificates may be granted to an heir, while the board of the foundation is in charge of the management of the entity. This results in unique tax planning capabilities

2. Charitable Foundations

Dutch: ideële organisatie

The Dutch law differentiates between two foundations with specific purposes, the ANBI and the SBBI. The ANBI is commonly used for general purpose charitable foundations and may be granted by the tax authorities to charitable foundations (this may result in significant tax advantages for the ANBI and the donators). The SBBI is a foundation with the purpose of unifying members in a certain goal, such as an orchestra.

3. The Dutch Associations and Cooperatives

Dutch: Vereniging en coöperatie

Associations are usually established as non-profit entities. Most local sports associations use this type of entity, the members pay a contribution to fund the associations’ collective costs. Cooperatives are characterized as associations which pay directly to the members. A cooperative could be a group of small shops in the same neighborhood making a collective marketing effort.

Notary services

All legal entities established for the purpose of doing business are set up through a Latin notary (notaris). The notary prepares a deed and registers the entity at the Commercial Chamber (KvK). It should be noted that incorporated structures usually pay additional taxes. A notary can assist in making deeds for company incorporations. To change your current company type we recommend to seek the guidance of a professional corporate agent.

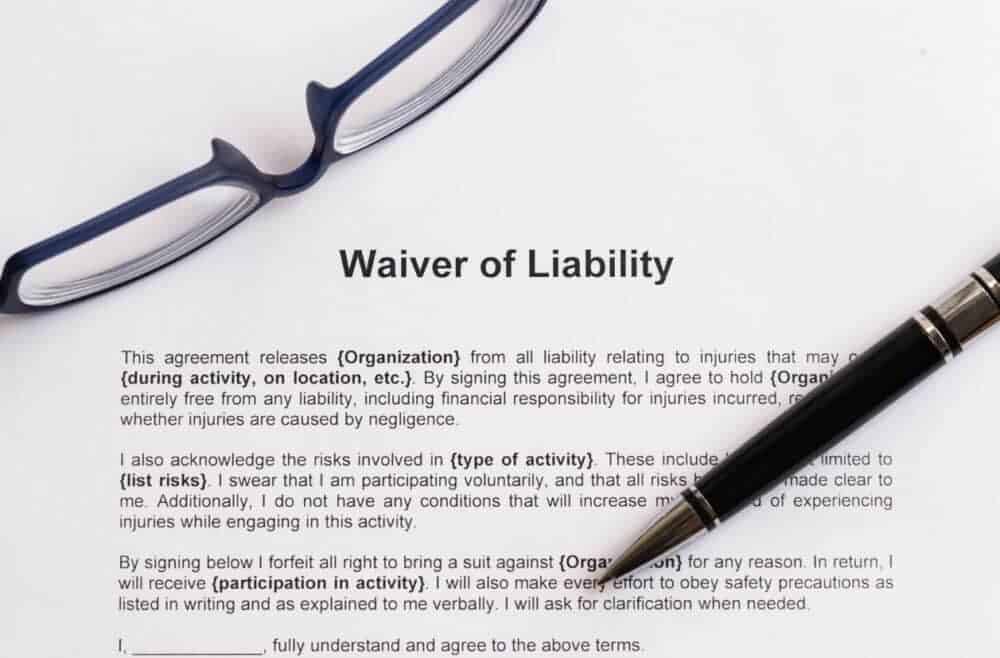

Liability of incorporated business forms

All incorporated businesses have a common defining aspect: when you set up a firm as a legal person or entity your private property cannot be seized to cover any debts of the business. In case of negligence, however, you may be considered personally accountable. You need to be fully aware of the responsibilities you are taking on by registering an incorporated entity. If you do not fulfill your tax and administrative obligations, you may be fined by the Tax Office (Belastingdienst).

Taxation of incorporated entities

In the Netherlands businesses having a registered legal entity are subject to different taxes in comparison to unincorporated structure or individuals.

Corporate tax A distinct requirement for all legal form businesses is the payment of corporate tax (venootschapsbelasting) which is a type of income tax levied on profits. In some cases, associations and foundations are not liable for corporate tax. The rate of corporate tax is lower than that of income tax. This is one of the major factors for entrepreneurs to set up incorporated businesses such as private limited companies. The administration, however, is rather complex and yearly costs may be higher. Usually, a significant turnover is necessary to compensate for these expenses.

Corporate tax rates in the Netherlands The corporate tax for taxable amounts up to or equal to 200 000 EUR is 19% and 25,8% for amounts higher than 200 000 EUR.

Tax on dividends Private and public limited companies are liable for dividend tax (or dividendbelasting in Dutch) at a rate of 15% on profits paid to the shareholders. Then the shareholders must pay 25% tax on the received amount.

Yearly financial statements Businesses with legal forms are obliged to prepare and submit yearly financial accounts and reports to the Tax Office and the Chamber of Commerce.

Profits taxation

2024: 19% below €200.000, 25,8% above

Unincorporated business structures (Rechtvorm zonder rechtspersoonlijkheid)

Unincorporated business structures are not required to have a legal form (e.g. notarial deed). The private assets of the owners, however, can be seized to cover outstanding debts of the business. Such businesses can be established at the Commercial Chamber without the participation of a Latin notary.

1. Taxation of unincorporated businesses

Businesses without a legal form need to pay VAT, income tax and payroll tax (if they have employees). Several tax incentives are available. In contrast to incorporated companies, businesses without a legal form do not owe corporate taxes.

2. Liability of unincorporated business owners

The main disadvantage of having a business without a legal form is the lack of distinction between business and private property. If the company has outstanding debts, the debtors can claim the owner’s personal assets. Therefore, in case of bankruptcy of the business, the owner goes personally bankrupt, if he/she does not have sufficient assets to cover the debts. The assets of the owner’s spouse can also be seized, if their marital property is common. In order to avoid this problem, spouses are advised to change their nuptial agreements.

Business structures without legal form

In the Netherlands there are four types of unincorporated business structures:

1. The Dutch Sole Proprietorship

Dutch: Eenmanszaak

The Dutch sole proprietorship is the business form most independent workers choose for. The tax filings for the one-man-company are the same filing as for natural persons. The business’ tax number is the social security number of the owner. If the company has any debts, the owner is personally liable, therefore many entrepreneurs prefer to establish a limited liability company to mitigate the entrepreneurial risk.

2. The Dutch Partnerships

Partnerships have two shareholders, or a group of investors equally liable and responsible for the actions or repercussions carried out by the enterprise. In the Netherlands, there are two categories of these partnerships, private and public. The partners of a general partnership can be jointly held responsible for the full liabilities of the partnership, while severally accountability may apply under normal circumstances regarding the company’s obligations and debts. The limited partnerships in the Netherlands consist of a general partner and a silent one.

The General Partnership (Dutch: Vennootschap onder firma) Private partnerships are when two or more individuals hold the same amount of equity stake in the corporation and therefore are equally liable for the actions, debt, and litigation accrued by the company.

The Professional Partnership (Dutch: Maatschap) The professional partnership includes two or more partners, each of which is responsible for his or her own claims. The professional partnership is suitable for dentists, lawyers, accountants, and other self-employed occupations.

The Limited Partnership (CV) (Dutch: Commanditaire vennootschap) The Dutch CV consists of 2 or more partners. One of the partners assumes the role of the general partner who will manage the company. The general partner is not limited in liability. The other partner(s) is referred to as a ”silent partner”. The silent partner is limited only to his capital contribution. The silent partner may not be involved in the management of the company.

Are you interested in establishing a business in the Netherlands? Our incorporation agents can guide you throughout the whole process!

Private or Public Liability Company (BV vs. NV)

The Netherlands is ranked as one of the most favourable locations for corporate ventures in all of Europe. That being said, while the Netherlands does provide unique advantages for a business to thrive, it is vital to find the right type of company to suit your needs. In this article, we will make a distinction between a private limited liability- and public liability company Netherlands, also known, in Dutch, as BV company and NV company. We will also discuss what is best suited for your individual business.

Private Liability Company (BV)

A private liability company differs from a public liability company in the way that a private company does not have their stock available for public purchase on the stock exchange. However, a private Dutch company is still considered a legal entity separate from its shareholders and has its own identity in the eyes of the law for litigation or taxation purposes. Additionally, private liability companies must also register in the Dutch Trade Register in order to engage in commercial activity.

Public Liability Company (NV)

There are many steps to forming a public liability company, but with the right guidance, these actions are quick and simple. Furthermore, as a public liability company, a portion of your shares will be available for purchase on the stock exchange. Be diligent how many shares are available on the international stock exchange, as, although rare, some companies have been bought out by random members of the public.

Characteristics of the Dutch NV

- A minimum share capital of EUR 45,000 has to be deposited before the company may be publically listed

- A Dutch NV needs to be formed by notary deed, similar to the Dutch BV

- Limited in liability if all formation responsibilities are fulfilled

- May be publically listed and shares publically traded

- Lead by a board of directors

- May require a committee of commissars to supervise the board of directors

- Specific accounting requirements apply to publically traded companies

- Shareholders are not listed in the Dutch company register

The Dutch Trade Register

Both the Dutch BV company and the Dutch NV company need to be registered in the Trade Registry in the Netherlands, registering your business is mandatory for almost all legal business practices. The Dutch Trade Register serves to provide a legal framework that enables a corporation to act as its own entity in terms of liability and taxation. Moreover, the Dutch Trade Register provides an authenticity for companies when dealing with customers and interacting with other businesses. The business register includes the following information:

- Legal name

- Address

- Phone number

- Fax (if applicable)

- E-mail contact

- URL (if applicable)

- Description of business, including service, product, the number of current employees, branches, etc.

- A liable correspondent of business

What is best for me?

First, we should make one thing clear: there is no clear answer to the above question. As a business evolves throughout its lifecycle, it’s priorities change, and its benefactors to either public or private may alter. Thankfully, if this occurs, a private company may change its listing to a public listing and start selling on the stock exchange. This exchange is known aptly as ‘going public.’

Nevertheless, private companies are usually suited for companies who would rather gain strategic investors in exchange for greater portions of equity, or those who simply do not meet the 45,000-minimum euro requirement. Moreover, public companies are able to gather large amounts of revenue fairly quickly in exchange for their stock.

If you would like to receive more information on starting a BV company in the Netherlands, please contact our experienced business advisors.

In the wake of the Brexit referendum, entrepreneurs are taking steps to safeguard their businesses.

Although Article 50 has not been invoked yet, many entrepreneurs are already planning how to secure the future of their business.

Many United Kingdom based businesses have to cope with the economic uncertainties after the outcome of the Brexit referendum; to separate from the European Union. There is no saying whether the Brexit will be beneficial or highly unfavourable for UK-based companies.

Entrepreneurs are now choosing for stability and security by incorporating a Netherlands-based company or subsidiary.

Why should you consider moving to the Netherlands?

Even though most of the population voted ‘’out’’, there are many international UK-based businesses that are ultimately dissatisfied with the decision. Many corporations, from trading companies to large financial institutions have considered the opportunity to move their business to the Netherlands or are in process of doing so. The decision to establish a business in the Netherlands could turn out to be essential. As the Netherlands is located in close proximity to London, it seems like a practical and efficient move to relocate your company there. The Netherlands is considered a stable location in terms of its position in Western Europe and its accessibility to the Eurozone, both in economic and logistical terms.

As the Netherlands is located in close proximity to London, it seems like a practical and efficient move to relocate your company there. The Netherlands is considered a stable location in terms of its position in Western Europe and its accessibility to the Eurozone, both in economic and logistical terms.

Read more on opening a company in the Netherlands

Opening a subsidiary

Some companies like the idea of relocating to the Netherlands, however, they do not want to move their business entirely. These companies have the option to transfer just a part of their organisational operations to the Netherlands.

Foreign companies are able to open a branch or a subsidiary in the Netherlands and test the traits of the market by forming a virtual representative office for their company.

The process of moving a company from the United Kingdom to the Netherlands is easily manageable with the right help from an experienced party. Foreign investors in The Netherlands will need a Dutch legal entity to conduct their business. The most popular type of business is a private limited liability company. There are several options for legal entities in the Netherlands. If you want to relocate and open a firm in The Netherlands you will need to know what kind of legal entities can be used and which are recommended.

Moving to the Netherlands in light of the Brexit vote can ultimately improve and change your business and life, providing more stability and security for your business.