Netherlands Company Formation

Our incorporation agents and notaries have over 10+ years industry experience with entrepreneurs from over 50+ countries. Saving you time and effort. Your new company is just a short call away!

The corporate tax in the Netherlands is 19% up to EUR 200.000 profit a year, the profit of EUR 200.000 and more is taxed at 25,8%.

The Netherlands has a 21% VAT rate on goods and services delivered in the Netherlands. Between European countries, goods and services may be offered at a 0% VAT rate. Corporations with a VAT number may claim back the VAT.

For non-EU investors, starting a business in the Netherlands and obtain a residency visa through business immigration is a possibility.

Memberships And Associations

Why Work With Us?

Media

Intercompany Solutions CEO Bjorn Wagemakers and client Brian Mckenzie are featured in a report for The National (CBC News) ‘Dutch Economy braces for the worst with Brexit’, in a visit to our notary public on 12 February 2019.

We perfect our quality standards to deliver services of the highest degree.

Featured In

Why Dutch Company Formation Is A Good Opportunity For Your Business

- 19% corporate tax, one of the lowest tax rates in Europe

- 0% VAT for business between EU member states

- Core member of the EU

- High-tech infrastructure

- The Netherlands ranks 3rd place in Forbes Global Business list

- 5th place in Global Competitiveness

- Leading world banks (ING bank, ABN Amro, Rabobank)

- Excellent international business climate

- 93% English-speaking natives

- Netherlands is a logistical hub as a gateway to Europe

- Qualified personnel (3rd in the world)

- Possibility of business immigration

- Remote formation of a business is possible

The Netherlands And Company Formation:

What Type Of Company Should You Choose?

The Dutch BV (limited company) is the most chosen type for a Netherlands company registration by foreign investors. The Dutch limited company can be registered with a minimum share capital of 1 EUR, according to corporate law. A Dutch BV is deemed tax resident by law in the Netherlands.

Required documentation for the formation will consist of a legalized and apostilled copy of valid identification and proof of address. A power of attorney is required to be signed by a notary for remote incorporation. But: it is not necessary to travel to Holland to do this. The shareholders can authorize us to take care of the necessary filings on their behalf.

A personal visit is not required to incorporate a Netherlands company, the formation procedure can be completed from abroad. We can also assist with remote bank account applications. With certain banks, the director has to be present to apply for a bank account.

A limited company in the Netherlands may have corporate shareholders and directors. For the registration process, the corporate shareholders must be verified and have the authority to sign the deed of incorporation or formation. Furthermore, an extract from the business register of the corporate entity must be received from the entities, which will act as shareholder or director. If registration is performed remotely, a power of attorney must be received and signed on behalf of the shareholder or director.

In the case of corporate shareholders, the Dutch company will be a subsidiary. It is also possible to register a Dutch branch; a branch office has less substance than a subsidiary and may be treated differently by the Dutch tax authorities. Substance may come from appointing a resident director.

Video explainers on the Dutch BV:

Starting A Business In The Netherlands:

Company Types In Depth

The Dutch Foundation

Dutch NV company

Branches and Subsidiaries

General partnership

Dutch Limited partnership

Professional Partnership

Ready To Start Your Company?

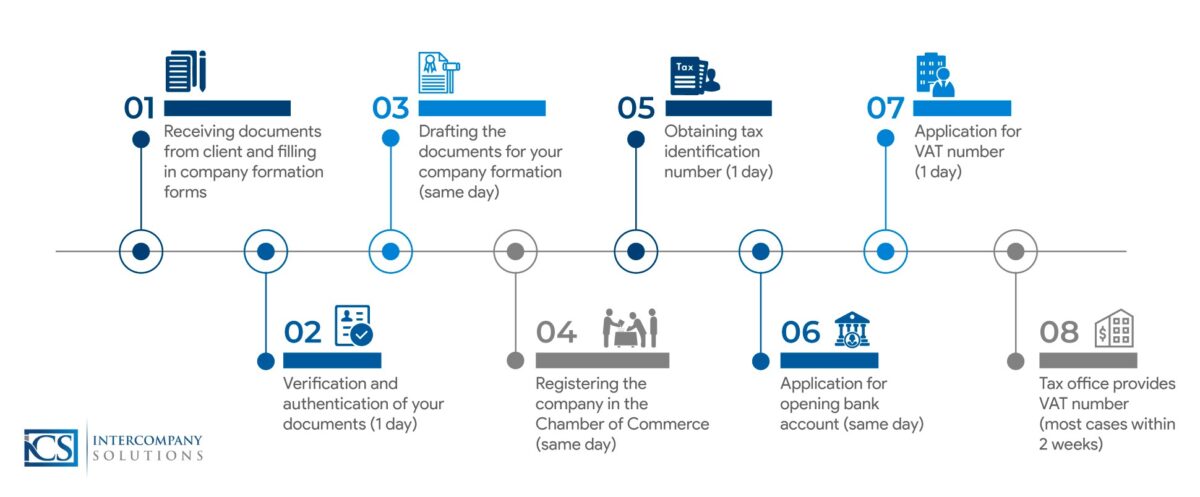

Company Formation Netherlands: The Procedure

Fulfilling all information requirements to our team for preparing the formation of your business. For the formation of a Dutch BV, which is the most common type in the Netherlands, the formation procedure will be as followed;

Step 1

- Identity information on the directors and shareholders of the BV company.

- A copy of passport of all the directors, shareholders and other ultimate beneficial owners.

- Our filled-out form regarding the formation of a business.

- Preferred company name, this has to be verified in advance for availability.

Step 2

Step 3

Our firm will process the company formation in the Netherlands, and file the company in the Dutch company register. We can assist a bank account application, we have solutions for applying with certain Dutch banks remotely.

Update 7 February 2024.

Our notary is still able to perform remote formation. That could save time and effort with your documents, as you do not need to legalize them.

In the normal procedure: If the documents are signed in your home country, the documents will have to be legalized by a local notary public. There is no need to visit the Netherlands, we have options for remote Netherlands company formation.

The company name needs to be unique and available. Our firm will perform a check before the company is formed. The company name will then be reserved for the new company.

The notary public will sign the deed of incorporation to form the company and submit the formation deed in the Chamber of Commerce. A few hours after the company register receives the formation deed it will assign a registration number, this is your company identification number.

After the company is formed, the entrepreneur will receive a corporate extract from the company. With this corporate extract, it is possible to apply for a bank account at certain Dutch banks. The shareholders need to pay the share capital to the bank account. This can be done to the own bank account after the company is formed, or the capital can be sent to the notary public before.

After the formation is complete, the company must receive a tax number or VAT number. A registration at the local tax office is needed. It is recommended to have an accountant or use ICS services for the VAT application. After this is complete, the company needs to have accounting services for quarterly VAT filings (4x per year), corporate tax filings and 1 annual statement, balance sheet, which needs to be published at the chamber of commerce.

Cost Of Dutch Company Formation

Taxation Of Netherlands Companies

Any businessman forming a company in the Netherlands should be aware of the Dutch tax system. When your business is registered with the tax office, your Netherlands company will pay tax on the profits of the company. The lower corporate tax rate is currently 19% up to €200.000 profit a year. The higher tax rate is 25,8%.

Many international companies have found the Netherlands to be an excellent country to optimize their global tax rates. This is primarily because of the interesting regulations and tax benefits for international companies.

Profits taxation

2024: 19% until €200.000, 25,8% above

The VAT rates Are:

21% standard VAT rate

9% lower VAT rate

0% tax-exempt rate

0% for transactions between EU countries

Economic Opportunities In

The Netherlands

The Netherlands is known for its accessibility to large markets. The ports of Rotterdam and the Europoort port area are connecting international trade with the mainland of Europe, ‘Europoort’ is Dutch for: ‘Gateway to Europe’.

The country has maintained a 3rd position as the most competitive business climate in the world thanks to the Dutch trade mentality and strong transportation infrastructure. The Dutch workforce is stable, well-educated, and fully bilingual, making it easy for recruitment purposes and dealing with other cultures. This and the Netherlands company formation low cost makes the Netherlands more attractive compared to other Western European countries.

Some Of Our Recent Clients