Frequently Asked Questions

1. Can I start a company in the Netherlands if I am not living there?

Yes, citizens of all countries are allowed to register companies in the Netherlands. We have procedures to register a company remotely.

2. Do I need to have a Netherlands business address?

Yes, the company must be registered in the Netherlands, it is also possible to set up a branch or representative office of a foreign company. A business registration address will generally cost around €60 - €150 per month, depending on the city and provider you choose.

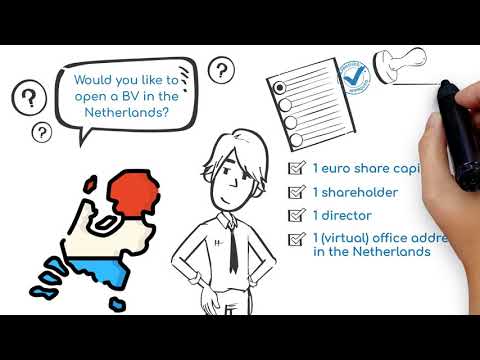

3. Is there a minimum share capital in the Netherlands?

No, there is no longer a minimum share capital for the Dutch limited company. The official minimum is €1 share capital. But it is recommended to opt for a slightly higher share capital.

4. Do I need to have a local Dutch director?

A foreign entrepreneur, who starts a small- or medium-sized company in the Netherlands, in most cases will be the director of the new company himself. This is also the case for foreign entrepreneurs that do not live in the Netherlands. By Dutch law, it is fully allowed for a foreigner to be the owner and director of a company.

Lately, substance requirements are becoming more important. For example, for requesting a local VAT number or local bank account.

For the corporate income tax, the substance requirements may play a role. Especially if you have any specific tax treaties that are very important for your business, you should consider the substance requirements with your local tax advisors. In this case, a local director or staff can play a role for your tax status.

Substance is what the tax office uses to determine the 'connection' of the company to The Netherlands. To determine this, they consider aspects such as: Where are the companies directors located, or where are the companies' operations taking place? Where is the companies' staff located and what type of company office do you have in The Netherlands?

5. What is the cost of incorporation of a BV company in The Netherlands?

We charge an all-in price of €1499 for remote incorporation. This includes the notary, legalisation and Chamber of Commerce fees. All our services are deductible expenses for the new company you will be setting up in The Netherlands.

6. What will Intercompany Solutions assist me with?

We will assist you with all-in services from start to finish. We ensure your company formation filings are legally correct and in order with the Dutch authorities, the notary and tax office.

If you opt for our accounting and secretarial services, we will ensure to arrange all legal requirements to get your company up and running. Such as, VAT number application, corporate tax filings, publishing of annual statements and more.

7. What company types are there in The Netherlands?

For foreign residents and foreign entrepreneurs we recommend the Dutch BV company. This is comparable as a limited company. 99% of our clients choose this company type.

If you perform charity you can look into the Dutch Foundation.

For publicly listed companies, the Dutch NV company is an option.

Other questions? Feel free to send us a message. Our consultants will be happy to assist you further.

1. How does the process of incorporation work if I am not a resident in the Netherlands?

We are specialized in this type of company formation procedure. We can form the company remotely with video legalization or by legalising a power of attorney. That means you do not have to travel to The Netherlands.

2. How long will the incorporation take?

Generally it takes around 5 working days after we have received all your documents until the company is formed. The procedure can take longer in busier periods.

3. Can I be the shareholder and director (as a non resident)

Yes, the Dutch law requires 1 director and 1 shareholder. The director and shareholder can be the same person. There is no requirement for being a resident in The Netherlands.

4. What do you need to start?

We ask for a intake form, your desired company name and activity, as well as your ID document and proof of address.

5. Can you give me a quick summary of the mandatory steps in the process of company formation that ICS will perform for me?

- When you send us the required documents, we will check all identification documents according to Dutch regulations and prepare all required forms.

- We will present the concept formation deed and documents to our notary.

- The notary will register the company in the Chamber of Commerce.

- When the company is opened, we will send you the incorporation documents and final deeds.

- If applicable, we will perform the additional services, such as: Requesting a VAT number, perform accounting services, secretarial services, tax filings or other requirements.

In short: We will take care of everything from start to finish.

Other questions? Feel free to send us a message. Our consultants will be happy to assist you further.

You can also view our Company Formation page for more information.

1. Is it easy to obtain a business visa in The Netherlands?

It is very different case by case. We work closely together with an immigration lawyer. An intake consultation is possible from €190.

2. Do I need a business license in The Netherlands?

In general, we do not work with business licenses in The Netherlands.

Generally only regulated industries such as: Energy, Healthcare and Financial sector have business licenses. This also means that you are very free to add new business activities and have very few restrictions.

3. Why make a company in The Netherlands?

The Netherlands scores extremely high on all international business rankings, most of the country speak English and The Netherlands has one of the highest educated workforces in the world. See our videos and download our brochure below for more information.

The Netherlands also has an excellent network of double tax treaties and is considered one of the most reputable jurisdictions in the world.

4. Do I need to perform trademark registration?

The Netherlands Chamber of Commerce protects your trade name in the trade register (Within The Netherlands). So not many companies in The Netherlands opt for a trademark registration in The Netherlands.

If you need a trademark because your company relies on products or a strong brand name, you can register a trademark in The Netherlands and Benelux, Europe or Worldwide. We can refer you to a trademark lawyer if you need to register one.

Other questions? Feel free to send us a message. Our consultants will be happy to assist you further.

1. Can you invoice my holding company for the initial company formation?

Yes, this is possible.

2. What are the payment methods you accept?

Bank transfer and creditcard.

3. Are your services tax deductible?

Yes, all our services are 100% tax deductible as a corporate expense.

4. Is the VAT on the invoice tax deductible?

VAT is never a cost for the entrepreneur. If you have to pay VAT, you can always deduct it.

Other questions? Feel free to send us a message. Our consultants will be happy to assist you further.

1. What is the corporate tax rate in The Netherlands?

The corporate tax rate is 19% corporate tax for any profit up to €200,000. And 25.8% for profit above €200,000. For more information, see our corporate tax article.

2. How does the Dutch VAT system work?

All companies with VAT activities need to request a Dutch VAT number.

The company is required to levy VAT on certain services and goods sold within The Netherlands. The company collects and holds the VAT, and will pay it to the tax office. All VAT paid by a company is refunded to the company. All VAT received is paid to the tax office.

VAT is not a cost for Dutch businesses.

Other questions? Feel free to send us a message. Our consultants will be happy to assist you further.

5. What are the some of the largest headquartered companies in The Netherlands?

Netherlands Founded:

- Royal Dutch Shell (Oil and gas)

- Unilever (Consumer goods)

- ING Group (Bank)

- Philips (Technology)

- Heineken (Beer)

- KLM Royal Dutch Airlines (Airline)

- Akzonobel (Chemical, paint)

- ASML (Semiconductor / Chip maker)

- Randstad (Human Resource and consulting)

Large startups that have originated in The Netherlands:

- Booking.com (Hotel booking)

- TomTom (Navigation systems)

- Adyen (Payment provider)

- Bunq (Online bank)

- Mollie (Payment provider)

- Picnic (Online Supermarket)

- Messagebird (Cloud communications)

- Bux (Trading app)

As of 2023, there are also multinationals that originated abroad, with a Dutch headquarters or subsidiary.

- Nike

- Starbucks

- Alphabet (Google)

- McDonalds

- IBM

- Microsoft

- Dell Technologies

- Visa

- Intel

- Coca-Cola European Partners

- And many more

Explainer video

How to start a business in The Netherlands - Explainer Video

Company Types in The Netherlands - Explainer Video

Would you like to open a BV in The Netherlands - Explainer video

Download brochure: Set up a Dutch Limited Liability Company

Our brochure describes the possibilities of The Dutch BV (besloten vennootschap) as the most popular entity to be used as a financing, holding or royalty company in international structures.