The tax law in the Netherlands offers a preferential regime for corporate taxation with the aim to promote activities related to investments in novel technologies and development of innovative technology. This is the Innovation Box (IB) regime. For profits meeting the requirements for IB, companies owe a total of 7% corporate tax, rather than the 19 – 25.8% usually levied (according to the rates for 2024).

Description of the IB regime

To be eligible for taxation under the IB regime, companies should have fixed intangible assets that meet certain requirements. According to the IB rules, qualifying assets are determined taking into account the taxpayer’s company size. Small taxpayers have a total 5-year group turnover below 250M Euro, while the total gross benefit derived from the eligible intangible assets for the 5-year period is below 37.5M Euro. Companies exceeding these thresholds are qualified as large taxpayers.

In these terms:

qualifying assets of small taxpayers are fixed intangible assets developed in-house and derived from Research and Development (R&D) activities benefitting from remittance reduction (WBSO – R&D tax credit / R&D certificate);

qualifying assets of large taxpayers (excluding cases of software or biological products for plant protection) must meet some additional conditions. Besides R&D certificates, the companies must also have an EU license for medicinal products, a breeder’s right/(requested) patent, a certificate for additional protection or a certified utility model. Assets related to qualifying fixed intangible assets or exclusive licenses may also qualify under particular circumstances. Logos, brands and similar assets are not eligible for tax reduction.

If the eligibility conditions are fulfilled, then such profits are not taxed at the usual rate of corporate tax, i.e. 25.8%, but at a reduced rate of 7%. Therefore the actual tax amounts to 7%. Before applying the reduced tax rate, the expenses for the asset’s development need to be recaptured from the profits, which means that their amount will be taxed using the full general rate).

It is important to mention that R&D certificates allow both large and small taxpayers to apply for a tax credit with respect to wage tax liabilities. Since 2016 the basis for remittance reduction related to R&D consists of the costs for wage tax plus other R&D expenditures and costs.

Determination of the profits from technology and benefits of the IB regime

The profits eligible for reduced corporate income tax are determined by the expenses of the taxpayer related to the qualifying assets’ development. The expenditures for development are split in two categories: eligible and non-eligible, using the so-called nexus approach. Eligible expenditures are all direct costs related to the fixed intangible asset’s development, except any costs for outsourcing R&D tasks (costs incurred for outsourcing can reach a maximum of 30% of the eligible expenditures). Therefore, the formula below is applied:

eligible costs x 1.3

eligible profits = -------------------------------------------------- x profits

total costs

The profits are determined by tailoring. A simple functional analysis and transfer pricing can be used for a start.

Losses

The IB regime is structured so that it can also bring advantages to companies that aren’t currently paying taxes, e.g. due to accumulated tax losses in the past. In this case, if the company uses the IB regime, the full recapture of its accumulated losses from tax can take longer, so the period for which the entity is not liable for taxes will be extended.

If the developed assets in the field of technology lead to losses, the lost amounts can usually be deducted for the means of taxation at the usual 25.8% rate, and not the low effective 7% rate. Also, any initial losses that were incurred before the start of business operations can also be deducted at the general corporate tax rate of 25.8%. The reduced 7% rate is applicable again only after recapture of IB losses. A taxpayer can only have one IB. Therefore the amounts relevant to the intangible fixed assets under IB regime are consolidated.

Application submission and certainty for future taxes (Advance Tax Rulings, ATR)

A company can use the reduced corporate tax rate by selecting the relevant items in its yearly corporate tax return. In Holland, it is not only possible, but it is a standard procedure to go over the practical aspects of the IB principles and the question of profit allocation with the Tax and Customs Administration (Revenue Service). Taxpayers have the option to conclude binding agreements (ATRs) with the administration and, by doing so, have certainty with respect to future taxes. It is important to mention that the information on tax rulings is exchanged with international tax authorities. Read more on the Advance Tax Rulings in the Netherlands

If you need more details or legal support, please, get in touch with our Dutch tax agents.

Holland has long been attractive for entrepreneurs looking to establish a business due to numerous social, cultural and geographical factors. Its comparatively favorable tax climate is also an important prerequisite in the process of decision-making.

Value Added Tax (VAT)

Value Added Tax has a great influence on corporate cash flows. Generally, a business can request a VAT refund for the amount it has incurred. Still, it may take several months until the tax is recovered through the periodical return. The period for foreign VAT reclamation may even be longer than a year and its duration depends on the EU member involved with the application for refund.

Negative influence of VAT on cash flows is also observed in the process of import of products in the European Union. Importers are obliged to pay VAT that can be reclaimed only retroactively, in the VAT return, or in a time-consuming process requiring a separate refund application. As a consequence, companies have to prepay the VAT on their imports with adverse effects on their cash flows. On this background, few member states of the EU have adopted schemes for deferral of VAT payments that would otherwise be due at the time of import.

Article 23 license

Companies established in Holland have the option to apply for the Article 23 VAT deferral license. This document makes it possible to postpone the import VAT payment until the submission of the periodical return. In the statement, the VAT can be included as payable, but at the same time, its amount is also deducted under input VAT. This means that businesses do not necessarily have to pre-finance VAT. Without Art. 23 license, the VAT due for import would become immediately payable at the country’s border. Its subsequent reclamation occurs either through the periodical return or through a lengthy process for refund requiring a special application. As mentioned above, the refund of this VAT may take months, even years, depending on the case. VAT deferral licenses are granted to companies registered in Holland and international businesses without local establishment that have assigned a Dutch fiscal representative (a tax service provider holding a general licence) for the purpose of VAT.

In most members of the EU, the VAT payable at import has to be transferred to the customs and tax administration at the time of importation or shortly after. Countries like Ireland, Germany, Italy, Great Britain, Spain and Sweden do not offer options for postponed accounting. In other countries, the payment of VAT can be deferred, but only in specific cases and under strict conditions. The only country that provides an option comparable to the Dutch deferral license is Belgium. There the transfer of due VAT can be postponed until the submission of the periodical VAT return.

The EU Directive on the common system of value added tax provides the option to grant an exemption from VAT on import goods destined for another member state straight after import. Import goods intended for storage or sale in the respective member state cannot be exempt from import VAT. However, there is a possibility to suspend the payment of VAT and duties due at the time of import for a particular time period.

When goods enter the territory of the EU, companies the option to store them in the so-called customs warehouses. Such warehousing is possible in all member states, although the formal procedure varies depending on the state. In this case, the payment of duties and VAT is deferred until the goods’ removal from the customs warehouse. Thus VAT and duty payments are temporarily suspended to the advantage of cash flow. At some point in time, these taxes become payable. On the other hand, if the goods’ next destination is unknown, their storage in a customs warehouse can be beneficial. For example, if the goods are subsequently shipped to third countries, no VAT and customs duties become due.

Why should you choose the Netherlands as your gateway to Europe

Considering the above, one can conclude that logistic and geographical factors are just some of the significant reasons to import goods through Holland. The option to avoid VAT pre-financing can be decisive for companies in planning the routes of their import goods.

There is also another factor that must not be overlooked: the level of responsiveness of the different customs and tax administrations across the European Union. Some adopt a strictly formal approach, while others welcome dialogue. The customs and tax administration in Holland is open to discussions. It is acknowledged for its high quality of service and proactive approach. The officers are also ready to confirm particular arrangements in written form, guaranteeing certainty (in advance) to taxable entities. The responsiveness of the Dutch administration is a valuable quality and a strong motivator, along with the favourable VAT arrangements at import, for businesses to choose Holland as a European gateway.

Are you interested? Our company has the network, local competencies, and experience to assist you in the efficient structuring of your import/export operations, both in Holland and abroad. We are here to consider your needs and meet them. If you would like to receive more information on the possibilities, please, do not hesitate to get in touch with us.

Holland has a well developed regulatory framework for private businesses, partnerships and corporations. The main elements of the framework consist of: clear rules on financial statements, auditing, and the publication of audits.

Because of the clarity and relative simplicity of the regulations, corporations are able to have a stable base of operations where they can plan for the long term. In this article, we lay out a summary of the requirements for accounting, auditing and publication in the Netherlands. If you would like to receive more detailed information, please contact us.

Mandatory preparation of financial statements

Practically all corporate entities registered in Holland are obliged to present financial statements. The requirement is statutory and often included in the entity’s Articles of Association (AoA).

Foreign companies are obliged to submit their yearly accounts in their home countries and provide a copy to the Dutch Commercial Chamber. Branches are an exception to this rule as they are not obliged to prepare separate financial statements.

Importance of the financial reports for Dutch businesses

Financial statements constitute the foundation of corporate governance and, as such, are a vital element of the legal system in Holland.

Their main purpose is to report to shareholders. Once the shareholders accept the statements, they discharge the directors’ board for its performance. Their equally important secondary purpose is to protect creditors. Practically all corporate entities are obliged to register at the Trade Registry of the Commercial Chamber and publish annually particular financial data. The Registry is publically accessible and represents an important information source with regard to the national market.

Financial statements also have to do with taxation. Even though the tax law provides independent rules for determining the tax basis, the first step of the process is to consider the statements.

Contents of Dutch financial statements

As a minimum, the statements contain a profit/loss account, balance sheet and notes on the accounts.

Generally Accepted Principles in Accounting (GAAP) in Holland

The Dutch rules for accounting are regulated. The accounting principles are primarily based on European directives.

The GAAP apply to private and public companies with limited liability and to other entities, e.g. some partnership forms. Companies listed on the stock market, insurance companies and financial institutions are subject to special rules.

The Dutch accounting principles differ from the international standards for financial reporting (IFRS) but they are continuously harmonized. As of 2005 all companies listed in the European Union are obliged to follow the IFRS. This rule also applies to the Dutch insurance companies and financial institutions. The question whether private limited liability companies (BVs), non-listed public limited liability companies (NVs) and other local business entities can follow the IFRS is still being discussed.

The Dutch accounting principles

According to the principles of accounting all financial information has to be understandable, reliable, relevant and comparable. All financial statements have to reflect realistically the position of the company in line with the principles.

The profit & loss account, balance sheet and notes must present truthfully and dependably the equity of the shareholders on the date of the balance sheet, the annual profit and, if at all possible, the liquidity and solvability of the company

Companies participating in international groups may choose to prepare their statements in compliance with accounting standards accepted in another member of the EU, if a reference to these standards is included in the attached notes.

The principles of accounting need to be presented in the statement. Once implemented, these principles can be changed only if the change is well justified. The reason for the change must be explained in the respective notes, together with its consequences with respect to the company’s financial position. The Dutch legislation lays out specific requirements for disclosure and valuation that must be respected.

The official reporting currency is the Euro, but depending on the specific company activities or its group structure, the report may involve another currency.

Consolidation, audit and publication requirements in Holland

The consolidation, audit and publication requirements depend on company size: large, medium, small or micro. The size is determined using the criteria below:

- number of staff

- asset value in the balance, and

- net turnover.

The following table summarizes the parameters used for classification. The asset values, staff and net turnover of group companies and subsidiaries qualifying for consolidation must also be included. Companies qualifying for the large or medium category must meet at least 2 of the 3 criteria in two consecutive years.

| Criterion | Large | Medium | Small | Micro |

| Turnover | > 20 M Euro | 6 – 20 M Euro | 350 K – 6 M Euro | < 350 K Euro |

| Assets | > 40 M Euro | 12 – 40 M Euro | 700 K – 12 M Euro | < 700 K Euro |

| Employees | > 250 | 50 - 250 | 10 – 50 | < 10 |

Dutch requirements for consolidation

In principle, corporations must include the data of any subsidiaries and companies in their group in their financial statements in order to present a consolidated report.

According to the law in Holland controlled subsidiaries are legal entities in which companies can exercise indirectly or directly >50 percent of the rights to vote at the meeting of shareholders or are authorised to dismiss or appoint >50 percent of the supervisory and managing directors. Partnerships where companies are full partners also fall within the scope of the subsidiary definition. Group companies are legal entities or partnerships in the structure of company groups. The decisive consolidation factor is the control (managerial) over the subsidiaries, regardless of the percentage of held shares.

The financial information of subsidiaries or group companies does not need to be presented in the financial statements (consolidated) if:

1. It is insignificant compared to the whole group:

- it takes too much time or resources to obtain the subsidiary’s / group company’s financial data;

- the company is held with the intention to be transferred to a different owner.

2. Consolidation can be excluded if the group company or subsidiary:

- meets the criteria for a small business from statutory point of view (these criteria are presented in the point on publication conditions);

- is not listed on the stock market.

3. Consolidation can also be excluded under the following circumstances:

- the company hasn’t been informed in a written form of any objections to the lack of consolidation within six months following the financial year’s end by a minimum of 10 percent of the members or holders of ≥ 10 percent of the capital issued;

- the financial data pending consolidation has already been presented in the statements of the parent corporation;

- the consolidated statements and yearly report meet the requirements of the 7th EU Directive;

- the consolidated statements, the yearly report and the audit report, if not already translated to Dutch, were translated to or prepared in German, English or French and all documents are in one and the same language;

- within six months of the date of the balance sheets or within 1 month of permitted postponed publication, the papers or their translations mentioned above were submitted at the Trade Registry office where the company was registered or, alternatively, a notification was made with reference to the Trade Registry office where these papers are available.

Requirements for audit in Holland

The law in Holland requires that large and medium companies have their yearly reports audited by qualified, registered and independent local auditors. Auditors are appointed by shareholders, members of the general meeting, or, alternatively by the managing or supervisory board. In principle, audit reports should include points clarifying whether:

- the statements give information in line with the generally accepted principles of accounting in Holland and represent accurately the company’s yearly result and financial position. The company’s liquidity and solvency may be assessed;

- the report of the Managing Board fulfils the statutory requirements; and

- the necessary additional information is provided.

The appointed auditor reports to the supervisory and managing boards. The competent institution should first consider the audit report and then approve or determine the financial statements.

If it is not mandatory to carry out an audit, the parties may do so voluntarily.

The Dutch publication requirements

All financial statements should be finalized and accepted by the members of the managing board within 5 months following the financial year’s end. After that the shareholders have two months to adopt the statements after their approval by the management directors. Also, the company has to publish its yearly report within 8 days of the shareholders’ approval or determination of the statements. Publication means submission of a copy at the Trade Registry, Commercial Chamber.

The period for preparation of the statements can be extended by up to five months by the shareholders. Therefore the publication deadline is 12 month following the financial year’s end.

If the entity’s shareholders also act in the capacity of managing directors, then the date of approval of the documents by the Management Board would also be the date of adoption by the meeting of shareholders. Under such circumstances, the publication deadline is five months (or ten months, if an extension of five months has been given) following the financial year’s end.

The requirements for publication depend on the company size. They are summarized in the table below.

| Document | Large | Medium | Small | Micro |

| Balance sheet, notes | Fully disclosed | Condensed | Condensed | Limited |

| Profit & loss accounts, notes | Fully disclosed | Condensed | Not necessary | Not necessary |

| Valuation principles, notes | Fully disclosed | Fully disclosed | Fully disclosed | Not necessary |

| Management report | Fully disclosed | Fully disclosed | Not necessary | Not necessary |

| Statements on cash flow | Fully disclosed | Fully disclosed | Not necessary | Not necessary |

Can we help you?

We can offer you a full list of services for accounting, including the preparation of financial statements/yearly reports, administration, tax compliance and payroll services.

Please, contact us with any questions related to this article or in case you want us to send you a specific proposal for engagement.

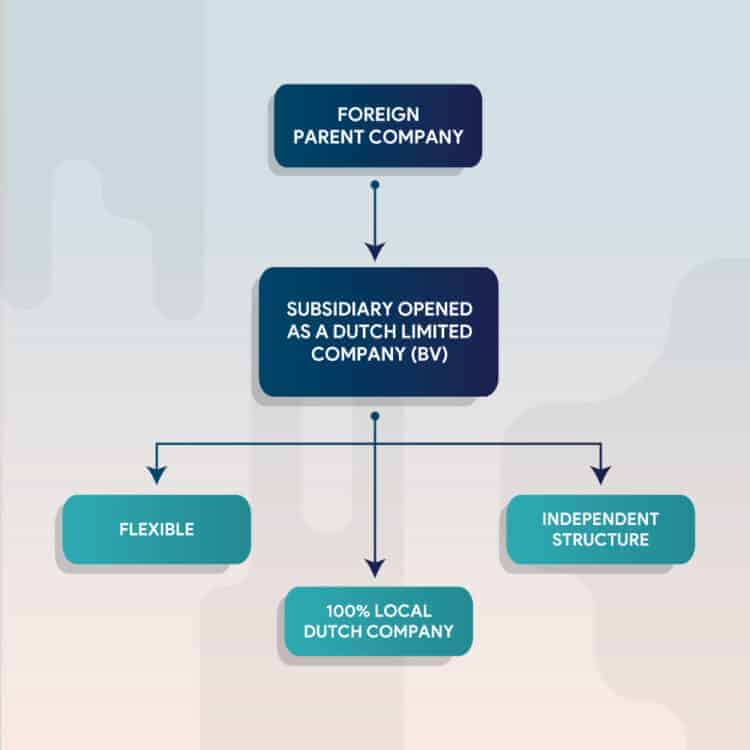

The Private Limited Company (BV in Dutch) holding structure saves money and mitigates business-related risks.

As a minimum, the holding structure includes two companies: one is the active company performing business operations, and the other is a personal company holding shares issued by the active company. The law does not differentiate between BVs with respect to their function, therefore the terms “Active BV” and “Holding BV” have no legal meaning.

What is the general structure of a BV holding?

Two Dutch BVs are incorporated using the services of a notary. The first BV performs the business operations of the structure (Active BV). The second BV is a holding company which remains mostly inactive (Holding BV). The owner of the business holds all shares issued by the Holding which, in turn, holds the Active BV’s shares. Our explainer video explains different aspects of the Dutch BV and the Holding structure.

If two shareholders (SH 1 and SH 2) plan to set up a single active company and to hold equal amounts of its shares, the usual scenario is the following: One active BV performing real business operations is incorporated using the services of a notary. Then two holding companies are incorporated above the active company. Both of them own 50% of the active BV. Holding 1 is fully owned by SH 1, while Holding 2 is fully owned by SH 2.

Advantages of the holding structure

The Dutch holding offers two main advantages to entrepreneurs with respect to their business: lower tax burden and decreased business risk. Holding structures may provide tax advantages. The main benefit is the Dutch participation exemption (“deelnemingsvrijstelling” in Dutch).

For instance profits generated by selling the active company and transferred to the holding company are exempt from profit tax. Also, operating from a local holding structure involves a lower risk. The holding BV serves the function of an additional layer between the owner of the business and the actual business activity. Your holding structure can be set up to protect the equity of the company. You can accumulate pension provisions and profits safeguarded from business risks.

How to know if a Dutch holding structure is suitable for your company?

Most tax advisors in the Netherlands would say that setting up just one private limited company is never enough. The incorporation of a holding where the owner of the business is the shareholder is usually more beneficial in comparison to a single BV. In particular situations we certainly recommend setting up a holding, e.g. in case your industry involves higher business risks. The holding BV provides an additional layer of protection between you as the business owner and your actual business activities.

Another valid reason to open a holding is if you are intending to sell the company at some future point. The profits from selling the business will be transferred free of tax to the holding BV thanks to the participation exemption or “deelnemingsvrijstelling” (described in more detail below).

Practical advantage of the holding structure

When you sell (partially or entirely) the shares issued by your Active BV, the profits from the sale are transferred to the Holding BV. Holding companies do not pay taxes on realized profits from selling shares issued by Active BVs. The resources accumulated by the holding can be used for reinvestment in another business or retirement benefits.

If you own shares of the active company, but you have not yet established a holding, you will need to pay from 19 to 25,8% corporate tax with respect to the profit in 2024.

Profits taxation

2024: 19% below €200.000, 25,8% above

In case your holding owns shares in multiple private limited companies, you don’t need to pay off a wage from each stake. This saves money from income tax, administrative procedures and fees. If the holding owns ≥95% of the active BV’s shares, the two private limited companies can file a request to be treated as a single fiscal unit by the Tax Administration.

This allows you to easily settle expenditures between the two companies and gives you an advantage with respect to the annual tax liabilities. The active company (subsidiary) and the holding (parent company) are considered as one taxpayer and therefore you are obliged to submit one tax return for two private limited companies. By keeping shares and profit reserves (including real estate, pensions savings, company cars) in a holding, you are protected from losing accumulated gains if the active company goes bankrupt.

Participation exemption (deelnemingsvrijstelling)

Both the holding and the active limited companies need to pay income tax. Still, double taxation of profit is avoided thanks to the so called participation exemption. According to this measure profits/dividends of the active business can be transferred to the holding free of taxes on corporate income and dividends. The main condition that needs to be met in order for this measure to take effect is that ≥5% of the active company’s shares are owned by the holding. Our specialists can support you throughout the process of company establishment. Please, contact us, to receive guidance and further information.

Headquarters in the Netherlands

The Netherlands has a strategic central location with respect to the largest markets in Europe. The country is a veritable magnet for foreign businesses and firmly holds its place among the leading sites for regional or European headquarters. In this respect particularly the conurbation of Western Holland offers enough space and locations.

The Netherlands is recognized for its business supporting environment, international orientation, superior technology infrastructure & logistics, and highly qualified workforce. It is among the most dynamic industrial and trading hubs in the EU, offering companies the perfect atmosphere for successful competition in Europe.

Distribution and logistics

The Netherlands is 6th in the global rating for overall performance in logistics. It is a centre for international distribution and logistics operations. Actually the country hosts more European centres of distribution than its major neighbours combined.

The national infrastructure for transportation and logistics in combination with the presence of first-class providers of logistic services is a significant asset to businesses intending to start international distribution/logistics operations on the European continent.

Start-up in Holland

Holland is internationally recognized for its welcoming culture and highlight on innovation and entrepreneurship. The country has developed a collaborative, vibrant start-up ecosystem. As a matter of fact, Holland is rated first in the European Union for its business climate for start-ups, according to EDF’s report for 2016.

Ranked fourth in the European Union in the 2018 edition of the Innovation Scoreboard, Holland hosts more than 10 major innovation hubs, offering start-ups excellent incubators and facilities for Research and Development (R&D). The country grants residence permits valid for 1 year to ambitions entrepreneurs intending to start innovative companies locally.

Dutch R&D

Holland is an R&D hub fostering innovations fuelled by dedicated supportive tax credits, top research institutes and numerous strategic partnerships of the government with scientific and industrial organizations.

The global index for innovation (2018) puts Holland in the 2nd place in the list of most innovative countries worldwide. The country has consistent high scores in fields like creative outputs, business sophistication, technology and knowledge outputs, and Foreign Direct Investment net outflows.

Sales and marketing

With its flourishing creative industry, Holland is very attractive for foreign sales and marketing operations and hosts divisions of large multinational corporations. Its strategic location on the European continent offers instant access to the most profitable markets in the EU. Furthermore, the availability of international talent allows foreign companies to advertise their products and services to an extensive range of clients worldwide.

Data centres in The Netherlands

Holland is rated among the best wired states worldwide and boasts a particularly advanced market for operations related to data centres. Approximately a third of the data centres in Europe are situated in the area of Amsterdam and benefit from the services of AMS-IX, the biggest internet exchange in the world. The national Datacenter Association confirms that almost all key digital economy players have establishments in Holland with head offices and equipment. Currently 20% of the foreign investments in the country are motivated by digital operations.

The national telecommunication network is among the best in the world in terms of reliability, quality and speed. Also the mild local climate and the robust cluster for renewable energy production provide affordable and sustainable options for the establishment of energy efficient date centres.

Service centres

Holland’s convenient geographic location, well developed infrastructure for transport and telecommunication and open service-oriented mindset provide the perfect environment for establishment or consolidation of centres for shared services on the European continent.

As a European multilingual hotspot, Holland boasts a skilled, productive and diverse labour force. The country’s cultural amenities, high living standard and comparatively low living costs allow corporations to easily attract skilled personnel and expats to their shared services centres.

Manufacturing

The well qualified engineering workforce in the Netherlands, as well as the developed supplier collaboration network offer significant advantages for manufacturers intending to start or move their operations to Europe.

As a matter of fact, big multinational corporations active in a variety of industries, from life sciences and agriculture/food to IT, chemicals and maritime industry, already have manufacturing operations in progress in Holland.

Do you plan to start a business in Holland? Please, contact our expert advisors in incorporation who will assist you throughout the whole process.

The present article describes the legal and tax aspects and some practical matters concerning office establishment in Holland. It summarizes information about the Dutch legal and tax system relevant to the required procedures. The article also presents Holland as an international centre of commerce and highlights the location advantages gained by opening a Dutch office. Finally, it discusses other matters of practical importance such as living and labour costs.

Please, do not hesitate to call our tax and incorporation agents if you have legal or tax issues or in case you need any additional information.

Tax aspects of establishing a Dutch office

Company establishment in Holland has numerous tax advantages. Many entrepreneurs choose to incorporate an international structure under an efficient tax regime such as the one in Holland. Dutch legal entities within company structures bring many tax benefits. The main advantages can be summarized as follows:

1) The benefit of double tax avoidance thanks to agreements concluded by Holland and to the EU directives on direct tax;

2) The participation exemption;

3) The option to negotiate agreements with the national tax authorities regarding advance pricing (APAs) and tax ruling (ATRs). Such agreements provide certainty about future tax payments;

4) Holland’s bilateral treaties on investments (BITs)

5) Dutch tax credits for income from foreign sources;

6) The Innovation Box (IB) regime for R&D activities;

7) No withholding tax levied on outbound royalty and interest payments; and

8) The scheme for highly qualified migrants (30 percent ruling).

These tax benefits will be explained in detail below.

Benefits of Dutch holdings

A Dutch holding can serve as an investment centre for companies established in various countries worldwide. Holland is recognized for its favourable regime with respect to holdings, particularly thanks to the participation exemption, coupled with an extensive network of tax treaties and bilateral agreements on investments. The main benefits prompting international businesses to use Dutch holdings as intermediaries are the lower withholding tax in the country where profit is generated, the untaxed receipt of funds accumulated by foreign subsidiaries and the protected status of these subsidiaries. These advantages will be clarified below.

The Government of the Netherlands has declared its general intention to keep and preserve these benefits, considered figuratively as jewels in the crown of the national tax system, regardless of the attempts of the Organisation for Economic Co-operation and Development and the European Union to combat tax avoidance strategies aimed at shifting profits from higher- to lower-tax jurisdictions.

The participation exemption in the Netherlands

As already mentioned, Holland is popular with the so-called participation exemption. If particular conditions are fulfilled, capital gains and dividends obtained from qualifying subsidiaries are not subject to Dutch corporate tax.

This exemption applies if an eligible subsidiary holds no less than 5 percent of the company’s shares. One eligibility criterion is that subsidiaries must not hold the shares with the sole purpose of passive investment in a portfolio. However, even in cases where this purpose is predominant, the exemption still applies if the subsidiaries are paying profit tax of no less than 10 percent (under the rules of tax accounting in the Netherlands) or if less than half of their assets are allocated to passive investments. When the exemption cannot be applied, companies usually have the option for tax credit.

The system for tax ruling in the Netherlands (Advance Pricing Agreements, APAs and Advance Tax Rulings, ATRs)

The Dutch system for advance tax ruling provides clearance in advance by concluding APAs and ATRs with Dutch companies with respect to their tax position. The conclusion of such agreements is voluntary. In general, companies use the system for tax ruling to become aware in advance about the tax liabilities relating to planned intercompany transactions. ATRs provide advance certainty with respect to the tax repercussions of envisaged transactions by clarifying, for example, if they will be eligible for participation exemption. APAs, on the other hand, define when the arm’s length principle can be applied to international transactions between associated companies or different parts of the same company.

Bilateral treaties on investments (BITs)

When investing in a foreign country, one should consider both the respective taxes and the protection of the so-called bilateral treaties on investments, especially if the investments are made in a country with a serious risk profile.

BITs are concluded between two countries to establish the terms for protection of entities from one country investing in the other country. These treaties ensure reciprocal protection and promotion of investments. They secure and protect the investments of entities residing in one of the contracting parties on the other party’s territory. Therefore BITs represent institutional safeguards with respect to foreign investments. Also many BITs provide for alternative mechanisms for dispute resolution where investors whose rights have been infringed upon can opt for international arbitration rather than sue the defaulting country in its courts.

Holland has developed a large network of such bilateral treaties offering investors the best possible security and protection in foreign contracting countries. It is worth to mention that Holland has entered into BITs with approximately 100 states.

Investors who reside in a country signatory can benefit from the protection of its BITs. Therefore Holland is an attractive jurisdiction for setting up holding companies not only due to its favourable tax regime, but also thanks to the numerous BITs it has concluded.

The double tax avoidance decree

In order to encourage Dutch investments into other, especially developing, countries, the Government has introduced a regulation providing a mechanism to lower Dutch corporate tax on profits obtained from investments in countries that have not concluded tax treaties with Holland. This piece of legislation is the Unilateral Double Tax Avoidance Decree (hereinafter referred to as DTAD). As a result of the DTAD the Dutch taxes levied on investments in countries that have not concluded tax treaties with the Netherlands are usually the same as the taxes levied on investments in tax treaty states.

The Innovation Box (IB) regime

Holland boasts a favourable tax climate under the innovation box regime, with regards to companies working in the field of research & development (R&D). Any company generating income from its own developed and patented intangible fixed assets (excluding trademarks and logos) or from assets derived from R&D activities (verified by an official statement) has the option to report the income using the IB regime. Then its eligible income exceeding the costs for the development of the intangible fixed assets will be subject to only 5 percent tax. Any losses associated with the eligible assets can be deducted against the usual corporate tax rate, i.e. 25 percent. If losses are included in the tax return, then they need to be recaptured using the normal rate. Only then the reduced 5 percent rate will become available again.

No withholding tax with respect to royalty and interest payments

Holland is an attractive jurisdiction for setting up (group) license and finance companies. The greatest advantage of establishing a Dutch license or finance company lies in the tax-effective setup of these entities. In broad terms this efficiency stems from the convenient tax treaties that Holland has concluded, coupled with the lack of withholding tax with respect to outbound royalty and interest payments. If certain requirements are fulfilled, these prerequisites allow for an extremely tax-efficient “flow” of license income and finances through the entity in the Netherlands to the eventual recipient.

The scheme for highly skilled migrants

Foreign employees living and working in Holland can benefit from a concession if they meet particular requirements. This concession is called the 30% ruling. According to it, 30 percent of the wages of the international employee remain untaxed. As a result the overall tax rate on personal income revolves around 36 percent instead of the usual 52 percent.

Legal aspects of establishing a Dutch office

Having a Dutch company in the framework of an international corporation provides both tax and legal benefits. Some important legal benefits are:

1) The legal system in the Netherlands has provisions for various entities to match the characteristics and needs of the planned business operations;

2) The Dutch Commercial Chamber (KvK) is very efficient and cooperative;

3) It only takes a day or two to obtain legalization from a Dutch Latin notary and a court-issued apostille;

4) It is easy to arrange the appointment of a local managing director, for example, to meet the subsistence requirements; and

5) In 2012 the laws on private limited companies (BVs) were thoroughly amended and currently they are a lot more flexible.

The corporate law in the Netherlands has provisions for entities both with and without a legal personality (i.e. both incorporated entities and partnerships/contractual entities).

The more commonly used entities without a legal personality include:

1) sole trader/sole proprietor/a one-man business (Eenmanszaak); (technically, sole proprietorships are not legal entities);

2) general partnership (Vennootschap onder firma or VOF);

3) professional/commercial partnership (Maatschap); and

4) limited partnership (Commanditaire vennootschap or CV.

The more commonly used entities with a legal personality include:

1) private company with limited liability (Besloten vennootschap or BV)

2) public company with limited liability (Naamloze vennootschap or NV)

3) cooperative association (Coöperatie or COOP); and

4) foundation (Stichting).

The choice of a legal entity depends on the type of business to be conducted. Owners of small businesses and freelancers usually establish sole proprietorships, while larger enterprises are incorporated as private companies with limited liability (BVs), public companies with limited liability (NVs) and limited partnerships (CVs).

After you decide to start a business, the first step is to register it at the Commercial Chamber which will include it in the Trade Registry. This procedure must take place during the period starting a week before your business becomes operational to a week after that.

Further details about the private company with limited liability (BV)

The private company with limited liability (Besloten Vennootschap or BV) with nominal capital split into shares is the most commonly used entity for business operations in the Netherlands. A BV has one or multiple shareholders and issues only registered shares. It can have one or several “incorporators” or subscribers who can be legal entities and/or natural persons. An entity or an individual, be it resident or foreign, can simultaneously be the sole incorporator and director representing the board of management.

Geographical features: Holland as an international commercial centre

Holland is an ideal strategic destination for businesses thanks to its connectivity. Companies established in the country can easily place their products and services on markets in the EU, Eastern and Central Europe, Africa and the Middle East. Holland is located in the western part of Europe and has common borders with Belgium (south) and Germany (east). To the west and to the north it borders the North Sea and its coastline is 451 km long. Holland is a small country with a territory of 41 526 square kilometres. Its economy is strongly dependent on international trade (more than 50% of the Gross Domestic Product is derived from foreign trade). The country is among the world’s top 10 exporting nations, which is quite an achievement for its size. Approximately 65 percent of all Dutch exports are destined for five countries: USA, the United Kingdom, Belgium, Germany and France.

More than 50% of all export and import in Holland consist of foods, machinery (mainly computers and parts) and chemical products. Many import goods (computers included) are actually destined for other countries and are re-exported largely unprocessed soon after their arrival in Holland. This situation is typical for big transportation and distribution hubs. As a matter of fact many millions of tonnes of North American and Asian goods arrive at Amsterdam or Rotterdam for distribution all over Europe. The role of Holland as an European gateway is also sustained by Schiphol Airport in Amsterdam – the fourth busiest and biggest airport on the continent servicing traffic of both goods and passengers. Most Dutch transportation companies have their bases of operation either in Rotterdam (with Rotterdam The Hague Airport) or close to Schiphol. Other major European airports, namely Düsseldorf and Frankfurt in Germany, Roissy in France and Brussels and Zaventem in Belgium are only several hours away. Furthermore Holland has an exceptional railroad network connecting important European capital cities, including London. The EU capital of Brussels is only a short ride away. Also, Rotterdam’s port is the biggest on the European continent. Until 12 years ago it was also the busiest port in the world, but was overtaken by Shanghai and Singapore. In 2012 it was the sixth busiest port in the world as regards tonnage of cargo per year.

Cost of labour

The living standards in Holland are relatively high and this is reflected by the average salary. In 2015 employers paid 2500 Euro/month to their employees and therefore the average cost of labour was 34.10 Euro/hour. All due taxes are levied at the source of income. The average work week is about 40 h.

The costs of labour in the different members of the EU vary widely. In 2015 the average pay per hour for the whole European Union was 25 Euro, and for the Eurozone the rate was 29.50 Euro. Therefore the costs of labour in the Netherlands are 16 percent higher compared to the average Eurozone value. Still, in 2015, five EU countries had higher labour costs than Holland. The average pay per hour in Denmark (41.30 Euro) and Belgium (39.10 Euro) is approximately 10 times higher compared to the value for Bulgaria (4.10 Euro). The labour in Belgium is more costly than in Luxembourg, the Netherlands, Sweden and France. Yet, the costs of labour in Lithuania and Romania are not much different than the cost in Bulgaria, even though the salaries in these 3 countries are on the rise.

As of 07/2015, the national minimum gross salary in Holland for employees aged 23 and older is 1507.80 Euro/month, i.e. 69.59 Euro/day. Based on 40 working hours per week, this equals 8.70 Euro/hour.

Amsterdam: The new European capital of finance

According to the writer James Stewart, a business columnist working at the NY Times, after Brexit Amsterdam is bound to become the new London thanks to its impressive architecture, top rated schools and exciting night life. Holland has been a global centre of commerce for centuries and so the country is traditionally tolerant to foreigners. Furthermore almost all Dutch residents speak English. The schools in Holland are considered the best on the European continent, with many opportunities for education in English. Amsterdam captivates with its architecture and offers attractive housing options, outstanding restaurants, picturesque views, theatrical and musical performances and an exciting night life. Its citizens have a tolerant, cosmopolitan attitude cultivated for centuries, ever since its emergence as a centre of global trade.

Thanks to the continuous efforts of the nation Holland is currently among the wealthiest states worldwide. The country’s strategic location on the North Sea coast and its rivers, bringing industrial and agricultural benefits have undoubtedly contributed to this success. Thanks to these geographical characteristics and the inherent work enthusiasm of its people, the Netherlands is now a great centre of commerce.

In addition, Holland has a well developed welfare state system ensuring that all the citizens share the prosperity of their homeland. The Dutch take great pride in their high living standards. The expenses associated with living, education, housing and culture are lower compared to most countries in Western Europe. The United Nations Sustainable Development Solutions Network surveys many people residing in various countries worldwide to prepare its annual World Happiness Report. As evident by its name, the report states which countries have the happiest populations. In 2018 Holland took the 6th place.

Cost of living

Similarly to many other countries in Europe, the living cost in Holland has increased with the adoption of the common currency, the Euro. A standard room costs 300 – 600 Euros/month, so it is a lot cheaper to settle in a non-urban area, than to live in a city like Amsterdam or The Hague.

The public transportation is comparatively cheap by EU standards. Most areas work with chip cards (“ov-chipkaart””) that can be used on trams, buses, metros and trains. In the city a single bus ticket costs approximately 2 Euro. A ticket for the train from Schiphol to the Central Station in Amsterdam costs about 4 Euro. A ticket Amsterdam – Utrecht is around 7.50 Euro. In contrast, taxi services are quite expensive. The usual starting cost is 7.50 Euro and the rates reach 2.20 Euro/km.

Please, do not hesitate to call our experts in taxation and incorporation. They will happily assist you with the procedures for starting your own business in Holland.

Brainport Eindhoven is a combination of high tech campuses and businesses. The collaboration between commercial entities and Universities providing theoretical knowledge has proven a fertile ground for innovation. Eindhoven is famous for its Eindhoven University of Technology. Eindhoven is also known for major technology companies based in Eindhoven, such as Philips and ASML.

A complete small-scale high technology infrastructure

Brainport Eindhoven attracts organizations and companies with a wide variety of technologies, top technical universities, popular Original Equipment Manufacturers (OEMs), suppliers undertaking risk-bearing innovations, international knowledge institutions, high expenditure for Research and Development, student teams, start-ups, twenty thousand researchers, shared manufacturing facilities and R&D. This outstanding infrastructure offers all that technology and R&D organizations and companies need to perform to the best of their abilities.

(Article: Netherlands The European Silicon Valley)

Many opportunities to commercialize knowledge

Brainport provides the perfect environment for organizations and companies to commercialize sophisticated products and technologies. The region has developed a comprehensive one-of-a kind technology ecosystem where more than 20 OEMs in the field of high technology work in close collaboration with knowledge institutes and suppliers and has become a lucrative market in its own right. Furthermore, by cooperating with prominent high-quality companies in the development of pilot projects used as showcase, Brainport Eindhoven has become a label of quality leveraging the reputation of businesses. Last but not least, Holland is perceived as a country of pilot projects by the EU, providing various facilities for acquisition of quality labels needed for entry on the market. Brainport can provide independent final verifications of product compliance with global standards in different fields. Thus the region provides the means for companies to establish themselves on international markets.

Cost/risk competitive manufacturing and R&D

Holland, and Brainport in particular, offers businesses and organizations the complete set of tools to perform cost/risk competitive manufacturing of high technologies and R&D. The region makes it possible to work in collaboration with various contract manufacturers of original equipment used to cooperating with giants such as Philips and ASML . They take full responsibility regarding the design and the life cycle of the product. Brainport Eindhoven also offers various R&D facilities as metered services. Thanks to this and the huge diversity of collaborators in prototype design and industrialization, even comparatively small companies have the opportunity to work flexibly on revolutionary technologies and share the involved risks. Furthermore production facilities, services and buildings can be shared flexibly to achieve outstanding cost efficiency.

Eindhoven: A fertile ground for technology and innovation spotting

Brainport has many incubator and accelerator programs and hosts Eindhoven UT, recognized for its partnerships with industry representatives and unparalleled expertise in valorization of knowledge. Therefore the region provides a fertile ground for development of spin-offs, start-ups and scale-ups. These companies make significant contributions to the unique power of innovation of Brainport and its high density of patents. Brainport is also famous with its multidisciplinary initiatives, cross-collaboration and diverse technologies and sectors leading to resourceful crossovers. This combination of factors makes Brainport a perfect region for the purposes of technology spotting.

Cooperation in technology development decreases the period to market

Holland’s technology-minded government and Brainport’s open platforms for research, supply chains, campuses, clusters, and multidisciplinary approach to work allow companies to take advantage from sharing of knowledge, mutual strengthening of core competences, efficient use of Research and Development budgets, risk sharing and product development and testing with potential customers in public areas. The path is open for development of revolutionary technologies at reduced costs that can be quickly released on the market.

Availability of brilliant IT and tech specialists

The outstanding reputation of companies established in Brainport and the knowledge and educational institutions in the region attract talents from around the globe. These acknowledged professionals are willing to contribute to the development of sophisticated top-class technologies. Therefore companies benefit from a large talent pool, including scientists, researchers, physicists, engineers, designers and developers excelling in their fields. Attractive campuses and properties like Strijp-S (a village concept) and the local High Technology Campus offer specialists a sustainable, dynamic working environment. The options for accommodation contribute to a great extent to the attractiveness of the region.

Active support in starting new High Tech businesses

In Brainport, Research and Development companies find everything necessary for a successful business: close collaboration, easily accessible platforms for research, joint innovation programs, open supply chains and attractive campuses. On these campuses, knowledge institutions and companies work together on particular technologies, high-technology clusters and networks, as well as on various events dedicated to technology. The campuses facilitate business development and help newcomers find their way in the region. Furthermore they offer international businesses special partnerships to let them try out the benefits and become a part of the high technology ecosystem. The development agency of the region, Brainport Development, provides full support in setting up a new business locally or finding suppliers and partners.

A creative symbiosis between citizens, industries and governments

Brainport Eindhoven has a technology-minded government, adaptive and innovative citizens, cooperating industry partners, pilot opportunities and living laboratories offering organizations and companies plenty of room for experimentation. The region presents opportunities to test new services and products in real life situations, thus adding value to the goods and ensuring that they meet the end-users’s needs. Brainport is ideal for development and implementation of smart services and products in close collaboration with potential customers in realistic settings. With such background, it is not surprising that the region is leading in the area of smart mobility and city concepts.

Partners and expertise for creation of unimaginable technologies

Brainport Eindhoven is a melting pot of high technology organizations and companies specializing in diverse fields. To them collaboration is a major instrument for development. The region hosts partners who have the abilities to develop, evaluate, prototype and manufacture systems beyond imagination with unparalleled efficiency. There are also private and public partners contributing to the development of a unique platform facilitating an efficient and broad technology roll out. Therefore in Brainport the process from the initial development of products to their introduction on the market is incredibly fast.

Stability, prosperity and international orientation

Holland is a prosperous and stable country that welcomes international business entrepreneurs: a veritable European gateway. Brainport Eindhoven has a strategic location, the largest Dutch airport after Schiphol, a multilingual well-educated workforce, outstanding digital infrastructure, and a growing and thriving international community. The region offers everything needed for a great quality of life.

Do you intend to establish a business in the field of high technology in Brainport open a company? Our local office can assist you in registering your company in the region.

Foreigners residing in the Netherlands can either work for local businesses or establish their own companies. For the past few years people increasingly choose the second option, relying on the governmental support for start-ups.

One of the profitable businesses foreigners can establish in the Netherlands is shops. There are not many requirements to be fulfilled or licenses to be obtained. One significant advantage is the possibility to stock shops with quality products delivered from local manufacturers and producers. This is particularly convenient for low-cost consumer goods that are sold quickly.

Our local agents in company formation can assist you with the procedure for company registration with the aim to open a shop.

Registration of a shop in Holland

In order to open a shop, first you need to register your company at the Commercial Register. The procedure for company formation in the Netherlands requires:

- choosing a company name;

- selecting a form of business;

- registering the selected entity;

- registering with the Tax Administration;

- obtaining a social security registration;

- applying for a company account in a local bank, an additional merchant account is optional;

- obtaining the licenses necessary for operation.

As regards the licenses needed for opening a Dutch shop, the requirements vary depending on the offered products.

Licenses necessary for operating a Dutch shop

Of the permits necessary to open a shop in Holland, perhaps the most significant is called a market license. It allows both sole traders and companies to sell products on the Dutch market. This license is provided by the municipality of the area where the business operates.

In addition to the abovementioned market license, opening a Dutch shop implies certain measures for safety that must be considered by the business owners. The sold products need to be insured, and different contracts with the suppliers need to be signed. In particular cases, when selling imported products, the shop owners will have to obtain import permits.

If you need further information on registering a Dutch company, do not hesitate to get in touch with us. Our local consultants in company registration will assist you with the procedure for business incorporation. You can also check our guide on opening a Restaurant, Cafe or Hotel business in the Netherlands.

If you intend to start a business on the European continent, you have to choose a suitable country to begin with. Europe includes 44 countries (28 members of the EU) of various sizes, languages and levels of economic development. You might consider the Netherlands as a good place to establish your European business. The five main reasons why you should are listed below.

-

English will do everywhere

Regardless of the part of Holland you are in, the locals will speak basic English as a minimum. Your beginner’s attempts to speak Dutch will most likely result in replies in English. The widespread knowledge of the English language has multiple advantages, among which:

- Drafting agreements in English is common practice. You don’t have to translate your contracts in Dutch for them to be legally binding.

- If you employ local personnel or use the services of Dutch vendors, you will not encounter serious communication problems.

- You will not need to adapt your manuals or product packaging;

- The marketing slogans of your company can remain in English, though it may be appropriate to translate your other advertisements.

-

Short distances for travel

The big cities like the capital of Amsterdam, Utrecht, Den Hague and Rotterdam are an hour away from one another by car, at the most. The Randstad megalopolis hosts seven of the fifteen million people living in the country. Even the far-off regions or towns are no more than 3 hours away by car. Therefore you will be able to operate on the whole territory of the country from a single location.

-

Considerable spending power

Statistics show that in Holland the gross domestic product per capita rates among the highest worldwide. And, unlike in other top scoring countries, the distribution of income is relatively even. Therefore most Dutch residents have quite a bit of spending money.

-

Good opportunities online

The broadband penetration in the Netherlands rates among the highest worldwide due to the coaxial and phone networks covering the entire country. Dutch people shop readily online, while it is cheap and easy to arrange payments for the services and goods you offer. Consumers are not biased and more inclined to buy Dutch products: good deals always attract customers.

-

Setting up a company is easy

The last competitiveness ranking prepared by the International Institute for Management and Development rates the Netherlands 1st on the European continent and 4th in the world with respect to competitiveness. With the help of Intercompany Solutions, you can register your company within a few days. Small businesses need to meet few requirements and it is not obligatory to appoint an accountant or a local director. The rate of corporate income tax is twenty percent. You will also need to pay a fifteen percent withholding tax, but this could be settled with taxes on dividends covered by you elsewhere.

If you need further information on company establishment in Holland, please, get in touch with our qualified agents. If you are interested in starting a business in the Netherlands, you might also like our article with 5 ideas for opening a small Dutch business.

In the Netherlands, you have the option to discuss the tax position of your company with the Tax Administration and reach together an agreement regarding the consequences tax-wise. This agreement is binding for the taxpayer and the authorities. It needs to reflect the qualification and interpretation of facts and to conform to the national tax legislation, i.e. it should not contradict it. As of 2004 the policy on rulings is split in two general parts: for advance pricing agreements (APA) and advance tax rulings (ATR), respectively.

Advanced pricing agreements (APA) in the Netherlands

APAs cover the aspects of the arm’s length principle of remuneration and the methodology for transfer pricing. APAs are based on transfer pricing studies. The national tax authorities agree with the taxpayer that the income used for corporate taxation will be determined by such a study.

Advance tax rulings (ATR) in the Netherlands

ATRs cover the tax treatment related to specific circumstances and facts. Usually, ATRs are related to:

- the participation exemption regime (a one-page overview is available);

- the tax consequences with respect to hybrid financing;

- the tax consequences with respect to hybrid entities;

- the presence of permanent establishments in the country;

- the implementation of rules for foreign taxpayers.

When signing an ATR you should carefully go over and confirm the circumstances and facts forming the base of this agreement. If the circumstances and facts change it may be useful to check whether and to what degree the concluded ATR will continue to serve its purpose. Our extensive experience in ATR- and APA-related negotiations guarantees that our clients always get reliable agreements minimizing the probability of surprises.

According to the legislation on the types of investment vehicles that can be registered in Holland, these structures may be established as investment companies or funds. Investors intending to go through the procedure for starting a fund can register their vehicles as closed- or open-ended forms of business.

Legal entities applicable for investment funds in the Netherlands

The Dutch legislation relating to investment funds includes various acts concerning the different regulated vehicles. To give an example, funds with a closed end are subject to Directive 2003/71/EC on the prospectus to be published when securities are offered to the public or admitted to trading, and are implemented in accordance with the EU legislation. Regardless of whether a fund has been established in a closed- or open-ended form or as a related vehicle, e.g. a start-up hedge fund, the Dutch laws prescribe the following five legal entities:

- private limited company (BV);

- public limited company (NV);

- cooperative;

- limited partnership;

- mutual fund (FGR).

Businessmen willing to open a Dutch fund also have the option to establish a variable capital investment company (BMVK). This entity acts as a fund for investments because its investors can set up umbrella funds in its structure. Still, in contrast to investment funds, a BMVK is not obliged to offer its stocks on the national market.

Corporate and non-corporate Dutch entities

The Dutch legal entities that can be used for investments belong to two general categories: corporate and non-corporate. The first group includes the BV, NV, cooperative and MBVK. The second features mutual funds and limited partnerships.

All these structures are taxed differently, in accordance with the system for taxation that covers them. The tax system in Holland allows legal entities open for investment funding to be established either as opaque or transparent. For opaque entities, the tax administration levies corporate tax with respect to capital gains and income.

Our company in the Netherlands can provide you with further information regarding the taxation of the structures listed above. Please, get in touch with our agents to receive detailed information on the legislation governing investment funds.

The procedures for appointment and dismissal of staff are partially covered by the Civil Code of the Netherlands and partially clarified by the judicial system. It is relatively easy to employ staff, but it may prove tricky to dismiss employees.

Employment contracts under Dutch law

The Dutch law on employment does not require a contract in written form. However, it is advisable to conclude written contracts with your employees to avoid discussions about the arrangements. It is good to start your employment contract with definitions of the most significant conditions for work.

The written employment contract also allows both the employer and the employee to include particular clauses, for example regarding non-competition, trial period, company secrecy, working hours, salary, bonus regulation, holidays, pension scheme, terms of termination, etc.

The contract for employment can be prepared in a language other than Dutch or English, but in such case, there is a risk of misinterpretation. Therefore a contract in one of those two languages is preferable.

If the hired employee is living and working in Holland, then the applicable law would be the Dutch one. In special cases, however, where the individual works in two or more countries, the provisions may be different. The particular circumstances will be determined by the governing law. The parties may need to consider the legislation of different countries.

In the Netherlands, it is advisable for employers to draft their contracts according to the local Dutch laws. Otherwise, some conditions or arrangements may prove to be invalid.

Agreements for employment in the country can be concluded for a particular or indefinite time period. However, fixed-term and open-ended contracts are subject to specific legislative provisions. Furthermore, the law is continually changing and therefore the agreement for employment needs to be revised regularly.

Dismissal of staff in the Netherlands

It may prove difficult to fire an employee by reason of various legal provisions related to dismissal.

First of all, you should have reasonable arguments in support of your decision to end the employment agreement. The law in the Netherlands mentions eight possible reasons, including economic circumstances, underperformance, serious misconduct, sick leave with a duration of more than 2 years and frequent illnesses.

The employment contract can be terminated via different routes. The easiest approach is to conclude a termination agreement ending the employment with mutual consent. During this process, the two parties often enter negotiations. You can also terminate the employment agreement by asking the Agency for Insurance of Employees (or UWV) to issue a permit for dismissal. This is a possible solution only in case the employee has been on a sick leave for 2 years or more or the job has become redundant because of technical, economic or organizational reasons. The third possibility is to seek contract dissolution in court due to shortcomings such as underperformance.

The UWV and the Court would not permit termination of an employment agreement if there is a prohibition for dismissal (e.g. during sick leave or pregnancy).

In the Netherlands, the dismissal procedure is heavily regulated. We are prepared to assist you in understanding the rules and applying them in your best interest.

In case you have questions on the mentioned topics, our Dutch office will be happy to give you answers and provide you with the ins- and outs of the Dutch workforce.