Memorandum Dutch DGA

Updated on 28 November 2022

1. Introduction

In this memorandum, we aim to provide you with advice about the best way to set up a solid company structure. This also involves making it tax compatible and profitable. We are going to look at factors such as the structure of the company, income taxes and the minimum wage for the director-shareholder (Dutch: DGA). Also, we will outline how to adapt to a DGA living abroad, for example in cross-border situations. For this article, we use a theoretical case with a Dutch BV with a DGA living in Italy. With this information at hand, we did research about the necessary DGA wage, if it is preferable to set up an Italian holding and how dividends will be taxed.

Every DGA has shares in their company and, thus, receives dividend. Dividends that come from a substantial interest are taxed in the Netherlands against 26,9%, while generated income is taxed at a minimum rate of 37,07 % and a maximum rate of 49,5%. The income tax is a lot higher than the tax for dividends from a substantial interest. Because of this difference in percentage, the Dutch government introduced a fictitious employment for the DGA of a company. This essentially means, that a DGA is required to receive salary from his BV. We will discuss this topic next.

2. The salary requirements for a Dutch DGA

The Dutch tax law requires every director-shareholder to pay him/herself a wage from their Dutch BV. Article 12a of the Dutch wage law (‘wet op de loonbelasting’) requires a DGA to have a wage that corresponds to the largest sum of the following three options:

- 75% of the wage in the most comparable employment;

- The highest wage of all employees working for the company;

- €48.000.

This wage is taxed in the income tax as mentioned in the introduction, against a rate of 37,07% or 49,5%, depending on the height of the salary.

2.1 DGA salary in cross-border situations

The above-mentioned wage requirements are for any Dutch DGA, who is also physically living in the Netherlands. In our theoretical case, however, we have a DGA living in Italy. This fact makes our imaginary situation a so-called cross-border situation. The DGA wage is something only the Dutch tax law has introduced, so it is not something other countries also apply and/or know. In cross-border situations, we must always investigate the existing tax treaty between The Netherlands and the country that is applicable, in this case Italy like we said. Because of the uniqueness of the required DGA salary, a country must first accept this Dutch regulation before it is also applicable to their own citizens. If you look at the Tax treaty between The Netherlands and Italy, you will not find such a law or regulation.

This simply means, that a DGA of a Dutch BV who is currently living in Italy, doesn’t have to take the legally required Dutch minimum DGA salary into account. Also, we don’t find anything about a minimum wage for a DGA living abroad in relevant case law about this subject. This means, that a DGA is not obligated to pay him/herself a salary. Furthermore, the fictional DGA salary is not taxable in the Netherlands. So if a Dutch DGA who lives abroad wants to receive a salary, then they are free to choose to do this. Needless to say, this salary will then be taxed in The Netherlands.

2.2 Dividends

A DGA obviously has to receive money for a living. Please note that everything that a DGA receives, which cannot be classified as ‘salary’, is called dividend. Dividend in the case of a substantial interest, which is when you own 5% or more of the total amount of shares of a company, is taxed against a rate of 26,9% according to the Dutch tax law. When we look at the DGA living in Italy, we must again investigate the tax treaty between The Netherlands and Italy in order to find out where the dividend is taxed. In article 10 of the tax treaty, we find that dividend is taxed in the other country, meaning where the DGA lives, in this case Italy. Nonetheless, the Netherlands is also allowed to tax dividend against a rate of 15%. To avoid double taxation, the tax paid in the Netherlands is therefore deductible in Italy.

3. The structure

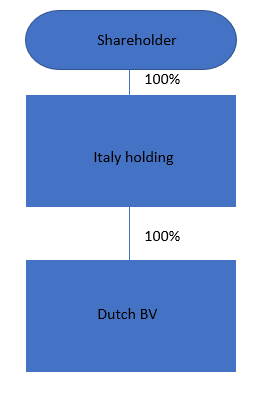

Now that we know how everything is taxed, we can take a deeper look into how to structure the company itself most efficiently. There are two options to choose from in this scenario. The first option is to start a holding company in Italy, and receive the dividend with this holding, before giving yourself this dividend. The second option is to receive the dividend directly without an extra holding. We will outline and explain both options in more detail below.

3.1 Italy Holding

When you decide to opt for an Italian holding in our theoretical situation, the Dutch BV then pays corporate tax in the Netherlands. Afterwards, you are left with earnings after taxation, and you can pay dividend to the shareholder; the Italian holding. Normally, the Dutch tax authorities will withhold 15% as tax on the dividend. But in this case, the Dutch tax law offers the possibility to pay the complete 100% as dividend to the Italian holding, without paying taxes in the Netherlands.

This is only possible when the following conditions are met:

- The shares are held without the reason of avoiding taxes;

- The structure is chosen because of a business and/or commercial reason and not because of a tax reason, such as tax avoidance.

This last condition can, in theory, get you into discussions with the Dutch tax authorities, although we have not seen such a case before. Keep in mind that tax evasion can lead to hefty fines in the Netherlands, and, in the worst case scenario, jail time.

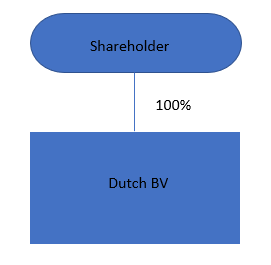

3.2 No holding in between

In case of not choosing for an Italian holding, the picture above shows us the alternative structure for the company. The shareholder will receive the dividend directly from the Dutch BV. In this case, 15% will be taxed in The Netherlands, which is then deductible in Italy, because of existing rules regarding the avoidance of double taxation. The shareholder will obviously also pay taxes on the received dividend in Italy.

4. Conclusion

In short, we can conclude that there is no such thing as a fictional employment and salary for the DGA in the example we just discussed. This means, that the DGA doesn’t have to pay him/herself a salary but can choose to pay dividend instead. Therefore, the DGA can avoid having to pay the Dutch income tax for the salary part. When they, however, choose to pay themselves a salary, this will be taxed in The Netherlands against a tax rate between 37,07% and 49,5%, depending on the height of the salary.

Depending on the structure one chooses, the received dividend will be either taxed in Italy, or in The Netherlands and Italy. When an Italian holding receives the dividend, the Netherlands won’t tax the dividend, but solely under the conditions that the Italian holding doesn’t hold the shares in the Dutch BV to avoid taxes, and secondly that the chosen structure must be chosen because of business or commercial reasons. When the shareholder receives the dividend directly from the Dutch BV, the Netherlands will tax this dividend against a rate of 15%. Because of the tax treaty and due to avoiding double taxation, this will be deductible in Italy and the dividend will be taxed in Italy.

Summary

- Holding company in Italy and a BV in Netherlands

If you have a company in NL and a holding in Italy, then it is possible to pay 0% dividends in the Netherlands. For example: a client named Giovanni, has a company ''Armani Holding'' in Italy, and he also owns a BV ''Armani Netherlands'' in Holland. He makes €100.000 profit. He then pays 15% corporate tax in the Netherlands (€15.000). After taxation, €85.000 of the profit remains. He uses this to pay his Italian holding company €85.000 in dividends. This will not be taxed. This 0% is because of the mother-daughter directive in Europe (if your holding owns the company as a subsidiary, there is no tax). And then the money is received by his Italian holding company. If he wants to pay from his Italian holding company to himself personally, he will have to pay regular taxes in Italy.

- Italian shareholder/director and a BV in Netherlands

In this case, Giovanni owns the Netherlands BV directly, but he lives in Italy. So: Giovanni is 100% shareholder of “Armani Netherlands”. In this scenario, he makes the same amount of profit, and then pays himself €85.000 in dividend. If he does not own a holding, he will pay 15% dividend tax in the Netherlands. This means that he will pay (€85.000 * 15% = €12.750) in tax. And €72250 is received by Giovanni on his Italian personal bank account. He will have to find out what the personal income tax amounts to, in this case, in Italy.

- DGA salary

So, how does it work with the required DGA salary? Due to the fact that Giovanni is not a resident in the Netherlands, there is no minimum salary requirement. However, he is allowed to pay himself a director salary from The Netherlands, and pay tax in The Netherlands, but this is optional. If you have any questions, feel free to contact Intercompany solutions for more detailed information about this topic.