Establish a Holding BV Company in The Netherlands

Updated on 19 February 2024

The Dutch holding company has proven to be an ideal structure for many different ventures. The Netherlands’ laissez-faire practices give businesses little to no regulation, minimal taxation, and generally, ease the stress of many entrepreneurs. In this article, we will analyze the main characteristics and benefits of opening a Dutch holding company.

What is a Netherlands holding company?

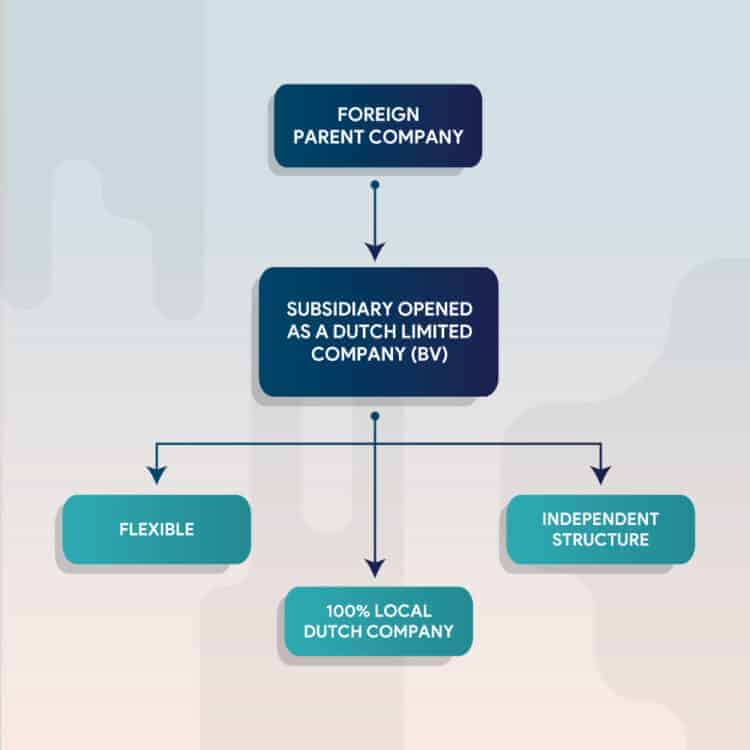

A Netherlands holding company is a type of business with the intention to ‘hold’ the stock of other corporations with the aim of controlling and possibly even absorbing them.

A holding company achieves this by purchasing enough shares of an already existing corporation to gain voting rights, which then enables it to influence the actions of the company, if not control it completely.

What are the benefits of a Dutch holding company?

While there are many benefits to holding companies in general, they are even more uniquely advantaged when located in the Netherlands. The explainer video covers the BV incorporation requirements, as well as advantages of a Dutch holding structure. A Dutch holding structure is where you would incorporate 1 BV and 1 holding BV.

Low Taxation

Thanks to many international treaties, such as the Double Tax Treaty Network, taxes for foreign or local holding enterprises within the Netherlands are significantly reduced. This tax code also promotes equality among investors and entrepreneurs, ensuring that the same regulatory standards given to domestic companies are extended to foreign enterprises as well, including their low tax standards for dividends. Holding companies generally face low taxation, since they are only investing their equity and are not a fully operating business. Moreover, certain companies may be fully exempted from taxation based on their income. Read more on dividend tax in the Netherlands.

Minimal Overhead

Overhead is the monetary cost of running a company. This can include employee salaries, office rents, sales team, and any other expenses devoted to running and organizing the business. Since holding companies rely on the foundations of already established businesses, they have minimal overhead expenses.

Easy Establishment

Establishing a Dutch holding company is a relatively simple process. The Netherlands holding companies can be listed as limited liability companies or limited liability partnerships. The capital minimum for limited liability companies is 1 euro and there is no minimum capital required for the limited liability partnerships. Additionally, no official audits are needed until the holding company has 10 million turnover a year or more. Professional financial management is also not needed, although it may come heavily recommended. The Netherlands remains one of the most favourable places for corporate establishment throughout all of Europe. If you would like to receive more information on how to establish a holding company in the Netherlands, please contact one of our incorporation experts.

Similar Posts:

- Foreign multinational corporations & the Netherlands annual budget

- Tax treaty denounced between the Netherlands and Russia per January the 1st, 2022

- The challenges of starting entrepreneurs

- Want to innovate in the green energy or clean tech sector? Start your business in the Netherlands

- How to set up a business as a young entrepreneur