Benefits Dutch Holding Company

Updated on 19 February 2024

What are the benefits of establishing a Dutch holding BV company?

If you are thinking about establishing a multinational in the Netherlands, a holding structure is probably exactly what you need. Starting a business oversees can be a tedious task, especially if you are not well-acquainted with the laws and regulations of a specific country. This also entails choosing a legal entity for your business, which can be tricky if you have no prior knowledge about this subject. The legal entity is basically the ‘form’ your business will have. Some legal entities also have legal personalities, whilst others do not. Such details are important, because it regulates factors such as liability and the amount of taxes you will have to pay.

The Netherlands has a vast array of legal entities available, making it possible to tailor your business form to your personal needs and preferences. The best choice for your business depends on a few factors, but in general the Dutch BV is the one of the most chosen company forms in the Netherlands. This legal entity makes it possible to issue shares, and dissolves personal liability for any debts the company makes. In most cases, a Dutch BV with a holding structure could be the most beneficial option. This is especially true for multinational and/or large organizations, since this structure makes it possible to divide various parts of your business.

Forming a holding business requires a professional approach

If you are interested in setting up a holding structure, we advise you to inform yourself about all Dutch legal entities and decide for yourself, what the best choice might be for you. Intercompany Solutions is also ready to assist you with any questions you might have. We understand that a large corporation would prefer professional advice regarding the best location for their European headquarters, since this combines our professional expertise with logical and timely planning – which saves you both money and time. You can potentially set up a holding structure in just a few business days, provided you have all the necessary information at hand.

What exactly can be defined as a holding structure?

When you establish a business with a holding structure, this comprises a Dutch holding BV and one or multiple entrepreneurial BV’s, which are sometimes also referred to as subsidiaries. The role of the holding BV is administrative in nature, as it involves controlling and monitoring the activities of the underlying BV’s. It also deals with all external stakeholders. The entrepreneurial BV’s are aimed at the daily business activities of the company, i.e. gaining and creating profit and extra sources of value. You can thus separate your assets and keep a broad overview of your entire company and its structure.

Benefits of owning a holding company in the Netherlands

One of the main benefits of a Dutch holding is that this legal entity is very advantageous from a tax point of view. This is only true, of course, if you want to generate profits with your business endeavor. Due to the so-called participation exemption, the profit, on which you have already paid tax in the entrepreneurial BV, is not taxed again in the holding company. As a result, you can easily get your profit from your entrepreneurial BV without paying any tax, via a dividend payment to your holding company. You can then also use this profit in your holding company for reinvestment(s), or to provide a mortgage loan to yourself. If you do not have a holding company, however, you must pay tax via box 2 if you distribute the profit to yourself.

You can also cover your risks when you own a holding structure, because this ensures that you separate your activities from your assets. This can be anything, such as your profits of course, but also your website and trademark rights. By placing these assets in your holding company, you cannot ‘lose’ them if the entrepreneurial BV should go bankrupt. When the bankruptcy is being settled, the insolvency administrator cannot access the assets in the holding company. But when the assets are in the entrepreneurial BV, on the other hand, he can access these assets. The same applies to third parties who have claims on the entrepreneurial BV. If valuable items are housed in the holding company, it is not possible for third parties to claim these.

5 reasons why you should definitely establish a (holding) company in the Netherlands

If you are thinking about setting up an oversees business, there are probably many options you are considering. This might involve the location of your business, the approximate size and details such as whether you want to hire staff. But there are other elements that have an impact on the possible success of your company, such as the general economic climate in the country you wish to establish your business. The Netherlands is consistently ranked high in many top lists concerning countries, that are rated excellent for business opportunities, economic wealth and stability as well as innovation in every sector. The Netherlands also has a very welcoming climate for multinationals and holding companies, which is why some of the world’s biggest names are settled here like Netflix, Tesla, Nike, Discovery, Panasonic and now also the EMA (European Medicine Agency).

One of the main benefits of a Dutch company, is the multitude of interesting tax incentives and the relatively low corporate tax rate. The Netherlands actually has quite a history as a well-known jurisdiction regarding company structures, especially when it comes to asset protection and tax planning. If you are serious about your business and invest time in a correct administration, the Netherlands can offer you many benefits for your international business. The Dutch business climate is highly competitive, and thus, you are expected to actively invest in Dutch expansion and innovation. If you want to benefit from something, it’s always good to offer something else in return. This also makes it nearly impossible to establish an artificial presence in the Netherlands, whilst still expecting to take advantage of all the tax benefits the country has to offer.

- The Netherlands provides a gateway to Europe and the entire international market

One of the largest attractions in the Netherlands business wise, is the access to two internationally renowned logistic hubs: Schiphol airport and the port of Rotterdam. One of the main reasons for establishing a holding company at a certain location, is the access to gateways to international trade and markets. If you want your business to succeed in a relatively competitive situation, it’s essential that you have access to a wide plethora of markets in a short amount of time. Around 95% of the most lucrative markets in Europe are reachable within just 24 hours from the Netherlands, and Amsterdam and Rotterdam are only 1 hour apart from each other. Both the port and the airport are directly connected to one of the best rail networks in Europe, which also offers high-speed connections to large cities Such as Paris, London, Frankfurt and Brussels.

Next to that, the Netherlands’ position along the North Sea also offers many possibilities and benefits. The port of Rotterdam was home to no less than 436.8 million tons of cargo in 2020 alone, even during the pandemic. If you would like to read some interesting facts about the port of Rotterdam, you can look at this leaflet. The sea is connected to an extensive river delta in the country itself., including three deepwater ports, which means you can easily transport goods into and out of Europe via this route. The Netherlands also benefits from a world-class infrastructure, backed by the latest technology and continuous innovation.

- Access to highly advanced technology

The Netherlands is very well known for its innovative and unique technological solutions, which are also backed by multiple universities that constantly invest in the future of the country, and the whole world. If you want your multinational company to grow quickly, you will need access to high-quality infrastructure, technology and human resources. This especially involves trustable and professional service providers, who can help you source for intellectual property and new technologies. The Netherlands has everything you need!

Furthermore, the Amsterdam Internet Exchange (AMS-IX) is the largest data traffic hub worldwide, which is quite an example. This concerns both the total traffic, as well as the total number of members. The Netherlands is also ranked 7th place in the world for technological readiness on the World Economic Forum list. On average, you can expect one of the fastest internet speeds in the Netherlands when compared to Europe entirely. This above par digital infrastructure is what makes the Netherlands so attractive for foreign multinationals.

- The Netherlands houses exceptional and multilingual talent

Due to the small size of the Netherlands, you can find an extremely high concentration of expertise, knowledge and skills within a very compact area. In contrast to many bigger countries, where resources are further apart and scattered. The Netherlands also houses renowned research institutes, as well as very interesting partnerships between the private and the public sector. This interdisciplinary approach involves universities and knowledge centers, the entire business industry as well as the Dutch government. The Netherlands also has a very old tradition of involving foreign investors and entrepreneurs, in order to advance and accelerate growth in nearly all imaginable sectors. These include huge sectors such as IT, life sciences, high-tech systems, agri-food, the chemical sector and of course the health sector.

Regarding personnel, you can rest assured that the Netherlands is one of the best countries in the world to find highly skilled, well-educated and experienced employees and professionals. Due to the large amount of excellent universities and masters programs, the Dutch workforce is known worldwide for its expertise. Next to being well-educated, almost all Dutch natives are bilingual. If you look for highly qualified personnel, you can even expect employees to be trilingual. The gross salary in the Netherlands is relatively high compared to some other countries in The south and east of Europe, but there are little to no labor disputes. This makes the cost of Dutch labor highly competitive and worthwhile.

- The Netherlands provides much in terms of efficiency gains

As a multinational and/or holding, establishing efficiency in the way you do business is crucial. A very well-known motive to start a holding company in Europe, or to expand your already existing multinational, is access to the European Single Market. This allows you to freely trade goods and services in all Member States, without the hassle of extensive customs regulations and border agreements. As such, it is very easy to streamline your European activities such as sales, manufacturing, research & development and distribution from solely one headquarters. This significantly reduces your overhead costs.

The Netherlands provides one of the best bases for a multinational operation, since its access to Europe and the international market is almost unparalleled. The Netherlands has always been on the forefront of worldwide trade, and this is still visible in the current culture and business climate. In the latest World Bank’s Logistics Performance Index, the Netherlands was ranked 6th in 2018. The country especially scores high in terms of the efficiency of its customs and border procedures, but also regarding the high quality logistics and IT infrastructure, the very high level of professionalism in the entire sector and the many easy and affordable shipping options. According to the DHL Global Connectedness Index, The Netherlands is still the world’s most globally connected country in 2020. This has been consistently so for years.

- Excellent business climate and tax conditions

Due to the very stable political and economic climate, the Netherlands houses many internationally known multinationals. If you would like to profit from a more attractive business climate, for example one that is better than the country you currently reside in, this country will suit you well. The Netherlands is a perfect base for optimizing your current tax situation, as well as for the protection of your assets and investments. The Netherlands is somewhat considered as a safe haven and also a tax haven, although the last depends on the legitimacy of your business. Criminal activities will not be tolerated.

Nonetheless, the country offers a welcoming and safe climate for entrepreneurs, who otherwise suffer from a rather poor business climate in their native or home country. The country’s economy is naturally very open and also internationally oriented, since it is one of the main goals of the Dutch government to make the international flow of goods, services and capital completely possible without any obstacles whatsoever. One of the main benefits of the Netherlands is also the legal system. The system has plenty of checks and balances, making the legal framework very trustworthy, professional and flexible as well.

How to establish a holding company in the Netherlands, and what should you definitely consider?

When you want to set up a completely new holding company (meaning you don’t already own a multinational company), there are some choices to make and factors to consider. One of the first questions you should ask yourself, is whether you want to start the company alone, or with other people. It is strongly advisable to set up your own holding company, without any other shareholders. This is also named a ‘personal holding company’. If you set up a personal holding company, you can prevent, amongst other things, problems with making certain decisions. This can involve decisions such as profit distribution, or your salary. With a personal holding company, you can make all these decisions yourself. In addition, you no longer have many of the advantages of the holding company when the holding company is not a ‘personal holding company’. For example, you are unable to set up other BV’s yourself, due to the fact that you don’t own the holding company by yourself.

It’s best to establish your holding company in one go

In some cases, new entrepreneurs establish only a Dutch BV, and afterwards find out they would have been much better off with a holding structure from the beginning. For example, it can cost you much more money if you first start your entrepreneurial BV, and only later your holding company. In such cases, you will have to transfer or sell your shares in the entrepreneurial BV to the holding company. You also have to pay income tax on the exact purchase price. The problem with this is, that your entrepreneurial BV often becomes more valuable over time. And the higher the purchase price, the higher the tax you will have to pay to the Dutch government. Avoid this higher tax by setting up your holding structure in one go. If you already own a work BV, it is still possible to set up a holding structure. In that case, keep in mind that a share transfer must take place, whereby the shares of the entrepreneurial BV are transferred to the personal holding company.

What about taxation of a holding company?

A huge benefit of the Dutch tax system is its very low tax rates, compared worldwide. The corporate tax rate is 19% for a profit up to 200,000 euros in 2024. Above that sum, you pay 25.8% in corporate tax. Next to that, the Dutch extensive network of tax treaties as well as the participation exemption regime work to avoid double taxation for all (foreign) companies, that might have to deal with taxation in multiple countries. A nice detail, is that the Dutch Tax Authorities have a very cooperative attitude, and aim to help any entrepreneur along the way in every possible situation.

There are also certain tax incentives available for new and existing entrepreneurs, often to encourage investing in the research & development department. As we stated many times in this article, the Dutch are very interested in innovation and progress. So basically every entrepreneur who enters the Dutch market with such ambitions, will be very welcomed here. These incentives involve the Innovation Box, for example, taxing the income you have derived from IP at a lower tax rate. Furthermore, you can acquire the so-called ‘WBSO-status’, which allows subsidies on certain salary taxes. This mainly involves employees involved in research and development.

One very important factor to consider are the Dutch substance requirements, in order to even be able to benefit from certain Dutch tax incentives. These requirements state, that the management of your holding company must be situated in the Netherlands. Nonetheless, there is no direct requirement to appoint Dutch board members. There is also no necessity to own a physical location in the Netherlands, or have a Dutch bank account. Once your company starts to become engaged in business activities, however, and you start making profit, these factors should be reconsidered for further benefits.

How to establish a holding company in the Netherlands?

The process of establishing a holding company is actually the same as setting up a Dutch BV, with the difference that you are setting up multiple BV’s at the same time. A holding is also considered a Dutch BV, after all, but with a different purpose than an entrepreneurial BV. So the steps involved are exactly the same, just with more companies involved. The first step in establishing a holding company, is deciding the legal entity. As said, a BV will be the best option in 90% of all cases but other legal entities are also able to act as a holding company, such as the foundation.

If you decide to set up a BV as a holding, then this is generally possible in just a few business days. The registration of any Dutch business needs a personal approach, since there is not one singular road to achieve this. If you have all the necessary documents at the ready though, and can provide us with all the information we need, it’s a fairly straightforward and swift process. The one thing that is important to know, is that the shares of all subsidiaries established will be transferred to the also established holding company. That’s one reason why it is named a holding: the holding company holds all the shares of all entrepreneurial BV’s involved.

In general, you can simply see a holding as the center of a spiderweb, which holds all involved entrepreneurial BV’s. In Dutch, it’s also described as a head office. People in the Netherlands find it actually very common to implement a holding structure, especially if you have plans or ambitions to expand in the future. This way you can build around a central core business, that enables the several underlying companies to flourish out of one main hub. The operational activities of practically any business can involve a lot of potential liabilities, so from a safety point of view, it makes sense to limit the risk and put your hard-earned money where it’s most safe. A holding company enables any entrepreneur to pay dividends to the holding BV, which in turn protects these dividends from any external claim. Also, the holding is not taxed for this incoming dividend, and neither is the entrepreneurial BV taxed for the outgoing dividend. This is all based on the participation exemption, you can read more about this here.

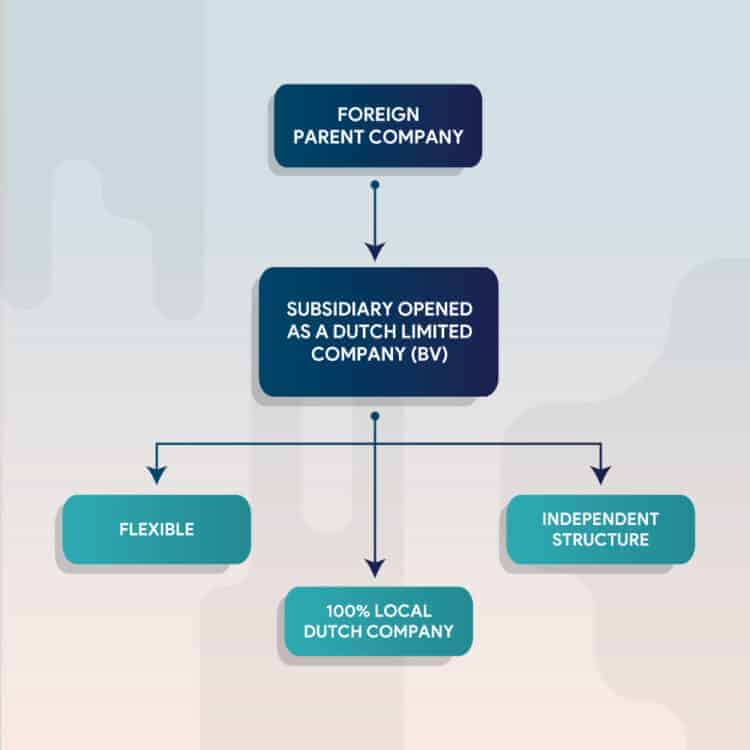

Starting a Dutch company as an already existing multinational?

If you want to start a brand-new holding company in the Netherlands, you can simply contact us for more information and, of course, a personal quote. In some cases, you might also be part of a large multinational organization wanting to expand to the Netherlands. There are plural ways to achieve this, which are mainly based on the legal entity you choose and your personal preferences regarding your business. Please feel free to contact us for personal advice any time.

Sources:

https://lpi.worldbank.org/international/global

https://worldpopulationreview.com/country-rankings/internet-speeds-by-country

Similar Posts:

- Foreign multinational corporations & the Netherlands annual budget

- Want to innovate in the green energy or clean tech sector? Start your business in the Netherlands

- How to set up a business as a young entrepreneur

- Tax treaty denounced between the Netherlands and Russia per January the 1st, 2022

- The Netherlands in favor of eliminating tax havens