Blog

Establishing a Dutch BV with multiple shareholders: what are the pros and cons?

When you start a company, there are some details to consider beforehand. Such as the market you want to operate in, the name of your company, the location of your company and, also, the amount of people that will be involved with the company. This last part can be tricky, since not everyone wishes to […]

5 services Intercompany Solutions can assist your company with

Whether you want to open a new business in the Netherlands, or branch out your current business, there are many ways in which our company can assist you along the way. We have been active in the company establishment sector for many years, working alongside starting as well as already existing entrepreneurs from many different […]

EBIT and EBITDA: everything you need to know

If you would like more insight into the actual profitability of your company, then the term EBIT definitely deserves your attention. This abbreviation is often confused with EBITDA, but those two are not quite the same. We will discuss the difference between both extensively in this article. In essence, there are several ways to analyze […]

What is the ABC-delivery within the EU, and how does it relate to chain transactions?

The Netherlands is considered a highly competitive country worldwide, when it comes to doing business. With the port of Rotterdam and the airport Schiphol just 2 hours away from each other, it is considered profitable to open a logistical or drop-ship business here. The immediate access to high-quality infrastructure ensures, that you can import and […]

Dividend payments between multiple Dutch BV’s: how does this work?

We often provide starting business owners with specific advice regarding the legal entity they can choose, once they decide to establish a Dutch business. We generally advise opting for a private limited company: in the Netherlands, this is known as a Dutch BV. Owning a BV has multiple benefits, one of the most important being […]

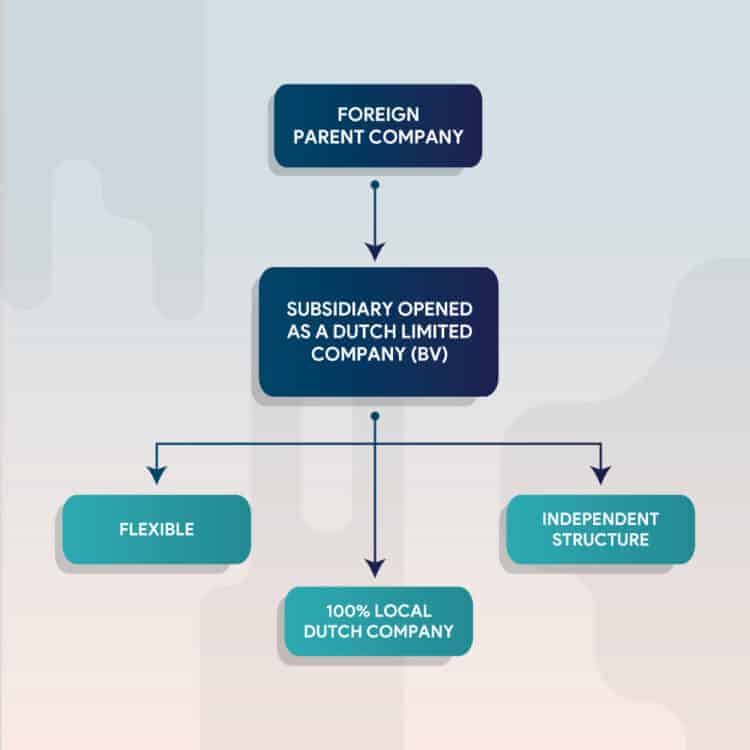

Expertise - Corporate Structuring

If you are thinking about setting up a new Dutch business or corporation, then it is wise to consider the way in which you would like to organize your company. Every business has a few main components, such as a director and shareholders. But corporate structuring is about more than just the fulfillment of certain […]

How to determine good rates for your business? A practical guide

One of the most difficult things to consider when you just started a business, is setting the rate you want to charge your (future) clients. Many starting entrepreneurs are unsure what to do, since there is a very fine line between undercharging and overcharging. You don't want to pull yourself out of the market with […]

Service - Corporate compliance

If you aspire to establish a Dutch business, you will need to inform yourself about certain compliance obligations. Every business or corporation that will conduct business in the Netherlands, needs to register itself officially at the Dutch Chamber of Commerce, and subsequently also at the Dutch Tax Authorities. This is due to national tax purposes […]

What happens with a Dutch BV when a director passes away?

Some questions are better left unasked, especially when the subject is rather bleak. The passing away of any person or a company succession is never a positive conversational topic, nonetheless it deserves attention, especially in the context of business matters. For example, if you are the owner of a Dutch BV and you pass away: […]

How to establish a foundation or NGO in the Netherlands?

Have you ever considered setting up a foundation? Most businesses are mainly focused on generating profit, whilst foundations generally serve a higher and more idealistic purpose. A foundation is a completely different legal entity, than, for example, a sole proprietorship or Dutch BV. The establishment of a foundation therefore also involves a different set of […]

Launching an ICO for your crypto company in the Netherlands: information and advice

If you are currently the owner of a crypto company, or plan to establish one in the near future, then launching an ICO can be an interesting way for you to raise funds for your business. It can also allow you to create a new coin, service or app. An ICO is essentially a profitable […]

Tax treaty denounced between the Netherlands and Russia per January the 1st, 2022

On the 7th of June last year, the Dutch government informed the cabinet about the fact, that the Russian government has officially agreed to the termination of the double taxation treaty between the Netherlands and Russia. Therefore, as of January 1, 2022, there is no longer a double taxation treaty between the Netherlands and Russia. […]