Set up Dutch BV Company | Netherlands Incorporation Services

Updated on 19 February 2024

How to set up a Dutch BV company

Foreign entrepreneurs and international companies starting new activities in the Netherlands, often set up a Dutch BV company. To incorporate limited liability companies (LLC), in Dutch ‘’Besloten Vennootschap’’ (B.V.)

The Netherlands BV company is similar to the English Ltd. or The German UG company. The Netherlands BV is also the most common type of company structure for establishing a holding company in the Netherlands.v neth

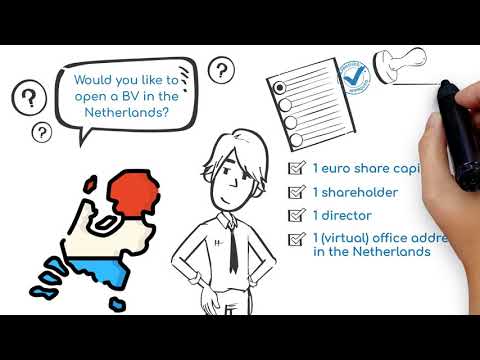

Main traits of the Dutch BV:

- A minimum share capital of €1

- The shareholder is liable only for the amount paid as share capital

- The issuing or transferring of shares requires permission from the shareholder(s)

- The shareholders are registered in the Dutch company register

- A foreign company, local company or natural person may be the shareholder or director of the Dutch BV

- Amendments to the Dutch Company Law have made it much simpler to incorporate a Netherlands BV, reducing the cost of a company formation in Holland greatly.

Requirements to set up Dutch BV

For Opening a BV in the Netherlands, The Dutch BV may have founding members which are (foreign) companies or individuals. The Dutch Company Law allows the newly set up Netherlands BV to be formed with one or more director(s) who may be the shareholder(s) as well. The main advantage of a Dutch BV company, as opposed to the Dutch NV company, is the minimum share capital of €1. Most entrepreneurs however, opt for a share capital of €100. (100 shares of €1)

The first financial year of the company may be an extended year, for example: If you start a business on 10-10-2023, your first fiscal year may be from 10-10-2023 until 31-12-2024.

The main requirement to set up a Netherlands BV or Dutch limited liability company is to have a local Netherlands business address. How to form a company in the Netherlands.

The main steps of registering a Dutch BV

A public notary will draft the articles of association. The official documents in Dutch should contain information on the management board, shareholders, the companies business activity, the share capital and registration address. After drafting the articles of association and the formation deed, the procedure for registration will start. The main steps include:

- Verifying the availability of the company name, and reserving the name

- Collecting due diligence documentation to sent to the incorporation agent

- Submitting the notarized statutory documents and deed of incorporation

- Registering in the commercial registry of the Netherlands

- Registering with the tax authorities

- Open a bank account and deposit the company capital

- Commence of business operations

Bank account opening for Dutch BV

It is necessary for a BV in The Netherlands to have a corporate bank account. The bank account may be set up after the company is formed. After the bank is incorporated, the company capital may be transferred. The bank account is necessary to perform day to day business activities and for the share capital deposit. It is recommended to set up a Netherlands BV company to obtain a Dutch bank account. In many cases, the company bank account can be opened remotely.

VAT Registration

It is highly recommended for most businesses to perform a VAT registration. With an active VAT number, the company does not need to charge any VAT for transactions between European member states. As well as the VAT paid in the costs of the businesses (rent, purchases of stock and inventory) may be claimed back by the company.

Dutch BV business permits

Certain company activities need permits or licenses granted by the government or supervising authority. In most cases the licenses can be arranged easily, the most difficult licenses are in the financial services or payment industry.

- Financial licenses for payment processing companies, investment firms or financial services

- Employment agencies need to be licensed with a branch organisation

- Crypto platforms may not require licensing, depending on the exact business activity

- Import and export companies will require an EORI registration, this can be accomplished within 1-2 weeks

- Local bars and hotels require a local municipality license to perform the business activity

- Certain type of shops are regulated, such as night stores

- Food and cosmetics businesses may be subject to licensing to comply with the health codes and consumer protection

- Transport companies

The Netherlands ”Flex BV”

Because of the popularity in other countries with limited companies, the Dutch government in 2012 decided to simplify the regulations on the Dutch BV. The current BV Netherlands companies are known by law as ”Flex BV”, standing for flexible. The flex BV has the same status and traits as an older regular BV company, however, it is more easy to form a Flex BV. For example, the required capital for the Flex BV is €1. Before the regulations were reformed, the required capital was €18.000.

Advantages of a Netherlands BV company

The Netherlands BV is a very flexible and competitive entity. It has many advantages and can be used for different purposes. The most popular uses are:

- BV companies are able to function as a director and shareholder of other companies

- The BV company may be held as a subsidiary by a foreign company. It is allowed to have a foreign company as a director

- The BV company is very reputable in international trade.

- The Dutch BV has one of the lowest tax rates in Western Europe

- It gives access to the European markets

- A BV may be formed within a few days, with little to no restrictions

- A BV may be formed and operated by non-resident persons

Dutch BV taxation

The Netherlands has over a 100 international tax treaties, this is more than any other nation in the world. The BV is deemed as a resident in the Netherlands by law, however, a local business address is needed. Companies which are registered for taxation have to pay corporate tax on the profits, the corporate tax rates range from 19% up to €200.000 profit, and 25,8% for the amounts above that. In the coming years, the Netherlands is planning to lower the corporate tax rates to appeal to more foreign companies.

Profits taxation

2024: 19% below €200.000, 25,8% above

The VAT rates are 9% for the lower rate and 21% for the upper VAT rate. The rates depend on the activities on which the VAT is charged. (9% VAT for the lower VAT rate is valid since 01-01-2019). Netherlands based companies need to pay tax on their worldwide income, nonresident companies only need to pay tax on certain incomes.

Legal obligations for setting up a Dutch limited company

Publication of the annual statements of the Dutch LLC is limited to a few requirements. Such as: The notary incorporation deed, the share capital and details on the directors and board members. The incorporation deed has information on internal processes and decision-making. Such as, the responsibilities of the directors, the rights and obligations of the shareholders. The shareholders may vote to appoint the director(s) of the company. Larger corporations may have board members. The majority shareholder(s) and directors are registered to be affiliated to the company, in the Chamber of Commerce.

Assisting entrepreneurs with compliance

Intercompany Solutions has specialized in assisting and setting up BV Netherlands for foreign entrepreneurs. Possible services are: Appointing a corporate secretary who manages activities such as acquiring a local bank account, apply for an EORI number or maintaining the company documents. The director(s) and/or board of the company are responsible for fulfilling the tax obligations and maintaining of proper accounting. The Netherlands BV company needs to file VAT tax returns, either quarterly or monthly.

Annual reporting requirements for Dutch BV’s

The Dutch B.V. is obligated to prepare annual financial statements for the shareholders. The annual statements have to be prepared according to the rules written in the civil code of the Dutch company law. Annually the company is required to publish a limited balance sheet, this is usually done by your account. Strict auditing requirements are necessary for companies who have over 12.000.000 EUR turnover per year, a balance sheet of over 6.000.000 EUR or more than 50 employees. The publication of the annual statement needs to be made at the Dutch Company Register. This publication needs to be made within 13 months after the end of the year. The director(s) can be held liable in case of late publication. Every year, the shareholders should hold a general meeting. The purpose of the meeting is to discuss the annual report and review the management’s performance. The meeting between privately owned companies is generally an informal event, as shareholders are quite familiar with each other and do not see a need to keep official notes of the meeting.

About Intercompany Solutions

Operating since 2017, our company has helped thousands of clients from 50+ countries to set up their businesses in the Netherlands. Our clients range from small business owners opening their first company, to multinationals opening a subsidiary in the Netherlands. Our experience with international entrepreneurs has allowed us to perfectly adjust our processes in order to ensure the successful establishment of your company. Customer satisfaction is guaranteed for all the services we offer. Our scope of expertise:

Associations and memberships

We are constantly improving our standards of quality to deliver impeccable services.

Media

Intercompany Solutions CEO Bjorn Wagemakers and client Brian Mckenzie are featured in a report for The National (CBC News) ‘Dutch Economy braces for the worst with Brexit’, in a visit to our notary public on 12 February 2019.

BV Incorporation FAQ

Can I incorporate a BV remotely?

Yes. Foreign entrepreneurs may incorporate a Dutch limited company without having to visit The Netherlands, this can be done by granting a power of attorney to our staff. A slightly different procedure is conducted in this case. Setting up a Dutch BV company is one of the many advantages of the Netherlands

Can anyone establish a Dutch company no matter where they are located?

Yes. The Netherlands is a country open to foreign investors. Any person of any nationality may become a shareholder of a Dutch Limited Company and set up a Dutch BV.

Can I open Dutch Bank Account?

Certainly, our company will guide you in opening a Dutch bank account. In many cases the bank account can be opened even remotely!

What is the cost of opening a BV in The Netherlands?

An incorporation is possible from €1.000, depending on your requirements. If you are looking to open a bank account or if you want to have assistance with VAT application and accounting services.

Do I need to speak the language?

No, our incorporation agents will make sure you can go through all procedures in English, Italian or Spanish. Dutch officials will be able to communicate in English, and often in German and French as well.

Can I apply for residency in the Netherlands?

The first step in applying for residency as a Non-EU entrepreneur is to set up a company in the Netherlands, afterwards an application may be made with the Dutch immigration services. Our consultants will be glad to introduce you to our immigration partners.

Do you assist in ongoing company management?

Yes, our a company can assist with our secretarial services, providing assistance for ongoing activity of your newly set up Dutch BV company. Such as tax compliance, accounting and secretarial services.

Our Dutch incorporation agents can help you start a business in the Netherlands.

Similar Posts:

- Foreign multinational corporations & the Netherlands annual budget

- Tax treaty denounced between the Netherlands and Russia per January the 1st, 2022

- How to set up a business as a young entrepreneur

- Want to innovate in the green energy or clean tech sector? Start your business in the Netherlands

- The challenges of starting entrepreneurs