When you plan to set up a business in a foreign country, one of the choices you will have to make concerns the legal entity type. For some solo entrepreneurs like freelancers or artists the sole trader business might be the appropriate and cheapest option. But in nearly all other cases we advise start-ups as well as already existing businesses looking for a foreign branch or subsidiary, to start a Dutch BV company. The benefits of this business type outweigh most other business types, plus your personal assets are protected. Read on if you like to know more about what limited liability exactly means and how a Dutch BV might be just what you need.

Separating risks and assets with a Dutch BV

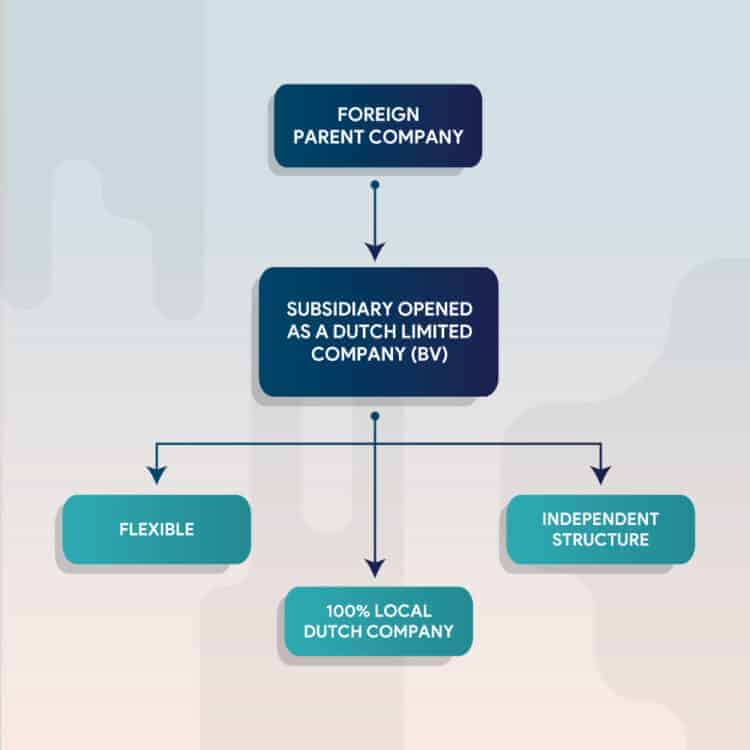

One of the main benefits of a Dutch BV is the fact, that you can set up a so-called holding structure. This means that you have a BV holding company and one or multiple subsidiary companies. By setting up a holding structure (two or more BV’s stacked on top of each other) you separate assets and risks. In addition, a future sale of your shares is untaxed under the participation exemption. We will explain the distinction between these two BV’s shortly below.

The BV as a holding company

A holding BV is a type of BV in which you can “store” your assets or other items that are valuable to your company (such as patents). You can do business with these assets, or you can save them for your pension. In addition to all kinds of valuable assets, you can also hold shares in a holding BV. Next to holding assets, the holding BV is also the company that will pay your salary as the owner of the subsidiary BV’s.

The BV as an subsidiary company

You can establish one or more subsidiary BV’s under your holding BV. These will be the BV’s in which all your daily business activities take place. For example, all invoices are sent from the subsidiary company plus it’s where income is received and costs are paid. Next to that, if the holding company holds 95% of the shares in the subsidiary BV, you can enter into a fiscal group. The tax group means that the Dutch tax authorities see both BV’s for tax purposes as one. As such, you can offset the profits and losses of the different BV’s against each other for tax purposes and save taxes this way. Most larger scale BV’s operate via a holding structure, simply because it makes it easier to reap the largest amount of benefits from your Dutch company.

Personal liability for business debts and commitments: BV versus sole trader company

The separation of risks and assets had another major advantage when looking at a BV, as opposed to a sole trader company. There is a difference in liability for the owner of the company. Owners of a sole trader company are 100% personally liable for debts they might make with their company. This means that these funds can be directly recovered from the personal assets of said owner. In essence, a sole trader company is really person with a VAT number since there is no real distinction between the person and the company.

If you however decide to start a Dutch BV, this is different. The BV is then seen as a legal entity with its own rights and obligations. When the owner of the BV signs a contract, the BV itself is responsible for the fulfillment of that contract and not the person behind it. A BV is represented by its board of directors, but they are not personally bound by the legal acts that the BV enters into. Creditors can recover debts from the assets of the BV, but in general cannot touch the personal assets of the directors or shareholders. Directors can only be held liable in the event of deliberate recklessness.

The Netherlands are further lowering the corporation tax rate

The corporation tax rate in the Netherlands has always been one of the lowest in comparison to many neighboring countries.

- 2024: Up to 200.000 Euro profit equals a rate of 19% and above this sum 25,8% applies.

A previously announced reduction of the top rate to 21.7% will no longer take place right now, but this might be revised once the current situation in the world settles down a bit.

A Dutch BV makes it easy to attract new investors and clients

In general, investors are not eager to invest in a sole trader company. This is due to the fact that by investing, the sole trader company becomes a general partnership. The investors thus become personally liable for debts incurred by another partner. A BV is a so-called capital company. This means that a BV issues shares that represent a value. By issuing these shares, a BV can attract capital from new investors.

Next to that, a Dutch BV has a more professional feel to it. This is mainly because the requirements for establishing a BV are more extensive than for starting a sole trader company, for example. The formation of a BV is effected through a notary. In addition, the BV has an extensive administration obligation. For example, it is legally required to submit annual financial statements to the Chamber of Commerce. An annual account consists of various parts. The larger a company, the more financial information it has to disclose. This gives creditors and other parties a good overview of what is going on in the BV. The stricter incorporation requirements and extensive administrative duty contribute to the professional image of the BV.

A Dutch BV is quick to set up with low capital

Until October 2012 it was mandatory to bring a share capital of 18,000 euros. This threshold has disappeared with the introduction of the Flex-BV. A Flex-BV can be set up with a capital as low as 0.10 eurocent per share. A BV can also be set up in just a few business days, if you partner up with a professional. Intercompany Solutions can help you in every step of the way; feel free to contact us for information or a personal quote.

What you need to know about the flex-bv

Since October 1, 2012, it has been easier to set up a private limited company. Due to the simplification of the rules, a BV is also referred to as a ‘Flex BV’. Here is our overview of what has changed since the introduction of flex-bv and what the benefits could mean for you.

Are you going to start your own company? You can choose different legal forms. In the past, many start-up entrepreneurs were excluded from starting a private limited company (BV) due to the stringent set-up requirements. Fortunately, this is no longer necessary after the amendment of the law of 1 October 2012.

The advantages of a flex-bv

The BV is a legal entity. This means that in the case of debts you are not personally liable for these costs (such as in the case of bankruptcy), but that they remain with the BV unless you acted negligently or fraudulently. Shareholders are only liable for the amount they have invested in the BV. The BV stands on its own: there is continuity. If something happens to you, your company can simply continue to exist. However, a new director must be appointed. If you want to sell your company or retire, you simply sell your shares to the new owner.

If your company has a high profit, the corporation tax that you have to pay if you have a BV is lower than if you pay tax if you have a sole proprietorship or partnership (VOF). A BV has a clear organizational structure.

Applying for a loan:

Note: if you are a director-major shareholder (dga), you often also have to sign for private liability when taking out any loans. As a result, you are still privately liable for the repayment of the loan.

How to convert your company into a bv:

Have you been turning a profit with your sole trader, VOF or partnership for some time? Then it can be beneficial to convert it to a BV. This process has also become simpler since the arrival of Flex BV.

You use the services of a notary for a deed of incorporation. They will draw up your articles of association and let the Chamber of Commerce and the Tax Authorities know that your legal form has changed. It can be that simple. The new year is a good time to do this. You can then close your financial year with, for example, a sole proprietorship and continue with a company. There are no two legal forms mixed up.

Minimum Salary directors / owners

If you are the owner of a BV, you are most likely also the director of a major shareholder (DGA) (unless one of the other shareholders in the BV is). You are then obliged to give yourself a usual salary of € 45,000 (in 2018). This can be reduced if you can demonstrate as a starter that you do not have the resources to pay such an amount to yourself. Submit this application to the tax authorities. You can often reduce your salary to the minimum wage. In practice, it often comes down to taking a wage for a certain amount of the profits.

This rule is only applicable to persons who are both a shareholder, of relatives of a major shareholder in combination with being a director.

What do you need for a flex-bv?

A notarial deed of incorporation;

Registration of the BV in the Trade Register of the Chamber of Commerce (KvK).

The main changes

- The required starting capital of at least €18.000 is no longer required. A company capital of 1 euro is enough. (Although, it might be recommended to put a bit more).

- You no longer need a mandatory bank and accountant statement for the establishment.

- You have more freedom to organize the statutes. What must be included in the articles of association: the company name, place of business, purpose of the BV, the share capital and an arrangement for the directors and/or supervisory directors who suddenly disappear (for example due to illness or suspension). You should not deviate from this.

- You may issue shares without voting rights or without the right to a profit distribution (dividend). This can be useful, for example, when issuing shares to employees, family members or financiers.

- You may take decisions outside the general meeting. This allows the BV to act faster. Especially if there is only one director-major shareholder (DGA).

- You may decide to limit the transfer of shares. Previously, if one of the shareholders left the BV, the shares had to be offered to the other shareholders before you could sell them to someone else. That statutory blocking scheme has been abolished.

- You can change your statutes more easily; even if the BV has been established before.

The rules for a flex-bv

The flex-bv deletes several measures that were intended to protect creditors, including the minimum starting capital of eighteen thousand euros. It has been replaced by provisions that still protect creditors.

If you threaten to no longer be able to pay your due debts, you may not pay a dividend.

If you act carelessly, you can be held personally liable for the debts incurred. In addition, the laws to combat bankruptcy fraud are being tightened.

Read here for more information on incorporating a Dutch BV.

Would you like to start a business as an expat? The Netherlands is an ideal place for entrepreneurs. There are numerous market opportunities and a healthy economy with plenty of potential investors open to new ideas.

However, the Netherlands is also known for the a number of administrative procedures that you have to consider when starting your own company. To set up a business in the Netherlands, for example, one of the first things you need to decide is if you want to register and operate the company remotely. Or if you want to work and reside in the country.

If you are from a country not from the EU, EEA, Visa free travel country, you might need to apply for a business visa to come by. For long term residency you might need to apply for an Authorization for Provisional Residence, and possibly even a work permit or TWV. When completing the application, keep in mind that your proposed business must benefit the Netherlands in some way.

Legal forms

The next step is to decide which legal form is right for your company. It is essential to choose a structure with the appropriate legal form as this determines liability for tax purposes. ICS can help you with this process. Generally foreign entrepreneurs are best suited to start a Dutch BV company.

BV or Sole Trader (eenmanszaak)

Freelancers living in the Netherlands, often choose the sole trader structure. However, the most frequent option for professional small and middle sized businesses is a the BV, which is a limited liability company. The advantages of the Dutch BV for foreign entrepreneurs are:

- You can open a BV remotely with our services

- You can operate a BV from anywhere in the world

- You can request a bank account remotely with our services

- It is a very common structure for foreign entrepreneurs in the Netherlands

- You do not need an address in the Netherlands

- You do not have to be a resident to open the BV

- You do not need a residence permit or visa

- You do not have a minimum requirement of time you need to spend in the Netherlands

- You can open it before you live in the Netherlands (and run it remotely)

For the Sole Trader (Eenmanszaak)

- You need to live in the Netherlands

- You cannot run it completely remotely, as you are required to stay in the Netherlands more than 50% of the year

- You need to have a Dutch fiscal identification number and Dutch residence address

- You cannot open it before you live in the Netherlands

Registering your company at the Chamber of Commerce

Once you have decided the kind of business you wish to set up, the next thing you need to do is to register the company with the Chamber of Commerce, which is mandatory. Registration must occur from one week before the start of business to one week after work has commenced.

Very soon after your business is registered with the Chamber of Commerce, you will be issued with a unique company number or the Chamber of Commerce number. It is a statutory requirement to include this number on all company invoices and mail.

Dutch Corporate Tax

As well as registering with the Chamber of Commerce, your fledgling business must additionally be registered with the Tax Authorities. We recommend registering as soon as you can in order to claim a VAT deduction. ICS is specialized in tax registration for foreign business owners.

What about Dutch VAT?

When customers are invoiced for your services or when they pay you for your products, you will need to add an extra 21% VAT tax to your rate.

The VAT return must be calculated every quarter and paid directly to the tax authorities. However, VAT may be deducted from VAT spent. VAT is not a cost for the entrepreneur, it is only a cost for the end consumer.

Vat is not the only tax.

Entrepreneurs in the Netherlands will at least encounter some of the following taxes.

- Corporate tax, this tax is paid upon the company profit after all company costs.

- Income tax, this is tax on salary that an individual pays when receiving income. Income tax includes tax on dividends, wages and bonuses.

- Payroll tax, this is the tax that company owners pay on top of the salary to the government.

Why does the Netherlands have Payroll tax?

With the payroll tax, costs such as health insurance and unemployment benefits for every resident is covered. Every tax paying resident of the Netherlands has the right to these benefits.

Business Administration

In the Netherlands, businesses must keep business records. Every business owner is legally obliged to keep them for at least 7 years. If you close your company, your accountant or bookkeeper is required to hold the documents for you. The bookkeeper will be legally appointed as the custodian for your records.

The business Administration includes:

- Contracts and agreements

- Costs of business activities

- Invoices sent and received

- Your balances and bank statements

- Annual accounts

- VAT and tax filings

Dormant company accounting

The Netherlands does not have a type of dormant company. If your firm is inactive (little or no invoices), you can request your accountant for the VAT filings and Payroll tax to be halted. However, you are still legally required to file the end-of-year corporate tax filing, the board to sign off on the numbers in an official declaration and depositing of the annual statement in the Chamber of Commerce. ICS does offer special accounting prices for firms with no activities. Please ask one of our accounting specialists for more information.

Insurance and pensions

As an entrepreneur, you are prepared to take risks and you may have plenty of responsibilities.

It is advisable to take out insurance to protect you against risks and to guarantee an income if you are unable to work in the future.

In the Netherlands, entrepreneurs are liable for personal injury and material damage that you, your employees or your product cause on your behalf. Business liability insurance is, therefore in some more risky type of business categories (construction and so on), essential to reimburse the damage that your company may cause to others. Another frequently used insurance is disability insurance which assures you of an income if you are unable to work because of ill-health.

Health insurance is mandatory for everyone in the Netherlands. As an entrepreneur, your contributions are based on your taxable income. Legal assistance insurance is also recommended as conflicts may occur, whether with clients, employees or suppliers. This type of insurance guarantees help and advice on legal issues.

If you wish to set up a company in the Netherlands, you can opt for "private limited liability company", also known as a BV. This legal entity is comparable to the Belgian BVBA. You can have a number of motives for establishing a BV.

Why should I use a Dutch BV?

Although you can also do business with your Belgian BVBA across the border, a Dutch BV, which has a business address in the Netherlands, can give your local customers, business partners and employees just a little more confidence in your organization. And once you operate in the Netherlands, you will soon have to deal with Dutch regulations.

The advantage of a BV is that it is a legal entity so that it can participate in legal transactions under its own name and can thus conclude a purchase agreement itself.

At a BV continuity is guaranteed because death or bankruptcy of a director or shareholder has no consequences for the survival of the company. The shares in a BV can also be transferred relatively easily.

And vice versa: the director and shareholder are - in principle - not liable with their private assets for the debts of the BV or, for example, in the event of bankruptcy of the company. A BV has equity from which creditors can recover. However, please note that under Dutch law a director can in certain cases be held liable for debts of the company.

How do I set up a Dutch BV?

A BV is only possible with a notary and this cannot be deviated from. A notary draws up a deed of incorporation of which the articles of association of the BV to be part of. The articles of association are the basic rules and in any case contain information about the name, purpose, seat and shares (including who will receive shares and the price of the shares).

In Dutch law, many provisions state that the main rule can be deviated from in the articles of association. You can use a BV as you wish within the limits of the law.

From the moment that the notary public passes the deed of incorporation, the BV must be registered in the Trade Register of the Chamber of Commerce. In general, the notary takes care of that registration.

The Shareholder Agreement

If you have more shareholders, you can draw up a shareholders' agreement, preferably prior to the establishment of the BV. Here you can lay down agreements that are not included in the deed of incorporation (the articles of association) or that require further elaboration, such as that shareholders may not compete with each other, regarding the exercise of voting rights, when the shares may be transferred to a third party (or must be offered to the other shareholders) and the board decisions that must first be submitted to the shareholders for approval.

You can make the shareholders' agreement as extensive as possible if you wish, but this must be in line with the deed of incorporation.

The management agreement

It is often recommended that the rights and obligations of the director(s) vis-à-vis the company be laid down in a management agreement. This may include arrangements regarding, among other things, the management and expense reimbursement of the director, the decisions that the director must first submit to the shareholders for approval, non-confidentiality and non-competition agreements, the core duties of the director and the way in which the director must carry out work.

If the director is a natural person, he or she may be qualified as an employee under Dutch employment law. If that is the case, it has employment law and tax consequences. A management agreement often stipulates that the director is not regarded as an employee, but as a contractor. But whether there is a pure contract or an employment contract, that is determined by Dutch law; the name of the contract is inconclusive. More information about Dutch employment law can be found here.

Is a minimum capital required?

When establishing a BV you do not have to pay a mandatory minimum capital. You can set up a BV with a capital of one euro cent.

The Netherlands is one of the ten largest exporters in the world. The food industry is one of the largest industries in the country, while other vast industries are: energy, chemistry, negotiation, machinery, metallurgy, electrical commodities plus sign services, plus sign foreigners.

1. Agriculture

The Netherlands is one of the world's largest exporters of food products plus agricultural products, thanks to the highly mechanized agricultural sector plus innovative agro-food technology, the promising geographical location in the heart of Europe, the mild weather plus the flat fertile floor.

The Dutch agro-industry focuses on international export is laundry before almost 21% of the country's total export value. The Netherlands is in the first position in the European Union (EU), provided that it is in second place in the world, after the United States (US), due to the export of agricultural products.

The agricultural industry provides employment to 4% of the Dutch workforce plus produces vast remnants before the food plus processing industry. One part of the food plus agricultural products exported from the Netherlands includes tomatoes, peppers, cucumbers, apples, flowers, and flower bulbs.

Open a food or agricultural company in The Netherlands

2. Energy

The energy industry in the Netherlands is one of the main export products of the country plus sign, provided that the source of employment is plus sign patriotic income.

As estimated, 25% of natural gas reserves in the European Union (EU) are located in the Netherlands. Expansive natural gas supplies were discovered in the Netherlands in 1959 and have generated significant revenues for decades. The Netherlands has had no other mining resources since the closure of the coal industry in 1974.

The Groningen Gasveld, situated during Slochteren, is one of the largest natural gas fields in the country.

More information on opening an energy company in The Netherlands.

3. Chemicals

The chemical industry in the Netherlands is one of the most important economic sectors in the country.

- The country is home to the headquarters of 19 of the world's foremost multinational chemical companies, including Royal Dutch Shell, DSM, AkzoNobel and BASF.

- The Netherlands is home to research institutions such as the Netherlands Organization before Applied Natural Sciences Research (TNO) plus numerous universities.

- The country is also one of Europe's leading suppliers of chemical products and services. The extensive transport network in the Netherlands makes raw materials easily accessible.

- The chemical industry focuses on developing smart materials and solutions in five areas: health care, energy, food security, and many more.

It's clear that with an advanced and healthy economy across a range of sectors, the Netherlands is an inviting prospect for foreign entrepreneurs. Contact ICS who can help guide you through the inevitable red tape that surrounds starting up a new company in the Netherlands.

Read here on starting a chemical company in the Netherlands

In the last years, researchers and startups in The Netherlands started innovating in cryptocurrency, Quantum Computing, Artificial Intelligence and alternative energies.

In recent years, the construction sector has been the fastest-growing sector for independent entrepreneurs. In 2018, there was a growth of over 7%, and the following year saw a growth of 5.3%, according to the senior sector analysts.

At the same time, there is a shortage of construction workers, a gap that self-employed entrepreneurs are currently diving into. After the crisis of 2008, many construction workers lost their jobs, but now they have the job of sorting them out as self-employed people.

The Netherlands is now widely regarded as one of the healthiest economies in Europe, according to recent surveys despite the impact of the coronavirus pandemic. Amsterdam is now perhaps the most popular European city for establishing a new company, as well as large corporations keen to set up regional headquarters serving the entire European area means that the construction industry has been transformed into one of the most extensively developed parts of the Netherlands' economy. It is also a welcoming country for international investors in the construction sector in other regions of the country.

At ICS, we have registration agents who can provide up-to-date information and advice on all you need to know to establish a construction company.

The Civil Code - The Environmental Licensing Law

The Construction Law regulations fall under the remit of the Netherlands' Civil Code, although there is also additional legislation with which construction companies are required to comply. One of the most relevant is the Environmental Licensing Law. This sets out the rules for a construction company in the Netherlands to comply with on building sites. The law encompasses the following:

The actual building of the property;

Any exemptions for the area planning;

Demolition of current sites;

Building on green spaces.

Dutch law is complex so contact ICS to help you navigate your way through the Environmental Licensing Law and the registration process of your construction company.

Registering your construction company in the Netherlands

You will need to register your company with the Dutch Companies Registrar. You might need to apply for certain licenses which will permit you to carry out construction works. For large construction projects this is highly recommended. For independent contractors, most construction workers do not need a license but simply a safety certificate. This is a 1-day course proving you understand safety at the construction site.

Organisations and businesses in the Dutch construction sector can apply for the all-in-one license for material features which may include:

The construction license;

The environmental license;

The exemption for zone planning;

The nature conservation permit;

The renovation license.

You should be aware that extra licenses and permits may be required depending on the nature of the work involved.

Contractors and independent workers generally do not need to apply for any licenses.

For help in establishing a company in the construction sector, please feel free to contact our ICS representatives in the Netherlands.

The Netherlands offers different type of foundations, the ANBI foundation is the foundation (Dutch: Stichting) most commonly used for non profit organisations. ANBI stands for: 'Algemeen Nut beogende instelling', an entity serving a general purpose. Non profit organisations are also referred to as 'NGO' or Non Governmental Organisation.

What is an ANBI?

ANBI stands for algemeen nut beogende instelling, in English a charitable institution. But in The Netherlands not every charitable institution can call its self an ANBI. An institution can only be an ANBI if it is almost entirely committed to the public benefit (algemeen nut). Associations (such as sports, personnel, singing, harmony or drama associations) and hobby clubs are usually not ANBI.

The tax-inspector grants the ANBI-status to a charity if it applies for that status and the charity meets these requirements.

Why an ANBI?

An ANBI fiscal advantages compared to charitable institution that does not possess that status. An ANBI has tax benefits, such as:

- An ANBI does not pay any inheritance tax or gift tax for inheritances and gifts that the institution uses for the public interest.

- If an ANBI makes donations in the public interest, the recipient does not have to pay gift tax.

- Donors of an ANBI may deduct their donations from income or corporation tax.

- In order to be eligible for the deduction of periodic gifts, the donor and the ANBI must record the gift in an agreement.

- An ANBI is eligible for a refund of energy tax.

- Volunteers who work for an ANBI make a donation to an ANBI under certain conditions.

- An extra donation deduction applies to donors of cultural ANBIs.

In short an ANBI is exempted from inheritance and gift taxes. Donors may deduct their donations to an ANBI from income or corporation tax. In order for an institution to get the status as an ANBI it needs to meet a number of conditions.

What conditions must an ANBI meet in general?

In order to be designated as an ANBI, the institution must meet all of the following conditions:

- The institution must be fully focused on the public benefit. This must be apparent from, among other things, the statutory objective and the intended activities.

- The institution must serve the public interest with almost all of its activities. This is the 90% requirement.

- The institution is not for profit with all of its activities that serve the public interest.

- The institution and the people directly involved with the institution meet the integrity requirements.

- No natural or legal person may dispose of the institution's assets as if they were its own assets. Directors and policymakers may not have a majority of control over the assets of the institution.

- The institution may not hold more capital than is reasonably necessary for the work of the institution. Therefore, equity must be limited.

- The remuneration for policymakers is limited to an expense allowances or attendance fees.

- The institution has an up-to-date policy plan.

- The institution has a reasonable ratio between management costs and expenditure.

- Money that remains after the institution has closed down is spent on an ANBI, or on a foreign institution that focuses for at least 90% on the public benefit.

- The institution complies with the administrative obligations.

- The institution publishes specific data on its own or joint website.

What conditions must an ANBI meet? in detail

- 90% requirement: In order to be designated as an ANBI, an institution must meet the 90% requirement. In addition, the activities that pursue the objective of the institution must serve a general interest almost entirely. An ANBI must spend at least 90% of its expenses usefully in general. In some cases, generally useful activities that did not cost money can also be included in this 90% test.

- No profit motive: An ANBI may not make a profit with all of its activities that serve the public interest. An ANBI must make a profit from commercial fundraising activities. The condition is that the profits benefit the main activities of the ANBI.

- Integrity requirements: An institution can only be an ANBI if the institution and the people directly involved with it meet the integrity requirements. If the tax inspector has reason to doubt the integrity of an institution or a person involved in it, he can ask for a Certificate of Good Conduct (VOG). If the VOG is not submitted, the institution will not receive the ANBI status or it will be withdrawn. The tax inspector no longer sees an institution as a public benefit institution if a director, a manager, or a person who determines the image of the institution has been convicted of a crime and:

- the crime was committed in the capacity of the person concerned

- the conviction took place less than 4 years ago

- the offense constitutes a serious breach of the legal order

A face-determining person is a person who is seen as a representative of the ANBI. He or she does not need to have legal ties to the institution, such as employment. Think, for example, of an ambassador of an institution.

- Control over the assets: A number of guidelines are attached to the management and spending of the assets of an ANBI. For example, a natural or legal person may not dispose of the institution's assets as if they were its own assets. Directors and policymakers may not have a majority of control over the assets of the institution. It is also not allowed for one of the board members to have a casting vote or veto. For example, if a board or policy-determining body consists of 3 persons with the same voting rights, then it satisfies the condition. It is recommended to record these subjects in the statutes of the institution.

- Limited equity: An ANBI may not hold more capital than is necessary for the activities of the institution. This is called the 'spending criterion'. An ANBI may, however, hold assets if there is:

- assets received as a bequest (through an inheritance) or a gift

The condition is that the deceased or donor has determined that the donated or bequeathed capital must be maintained, or that it has been determined that only the return from that capital is used to pursue the purpose of the ANBI. This is also referred to as 'stem power'. Often the donor or deceased stipulates in a will that the estate must retain its value due to inflation by means of an annual adjustment. The ANBI must take this into account when spending the available returns.

- capital arising from the purpose of the ANBI: For example, it concerns a nature reserve or place of worship to be maintained by an ANBI.

- capital that is needed as a means to realize the purpose of the ANBI

For example, the business premises or the wn storage facility for relief supplies.

- a reasonable capital necessary to ensure the continuity of the work

- Remuneration policy makers: The policymakers of an ANBI (for example members of the supervisory board) may only receive compensation for expenses incurred. Policymakers may also receive attendance fees that are not excessive. An example of attendance fees is a fee for preparing and attending meetings.

- Ratio between management costs and expenditure: The management costs of the ANBI must be in reasonable proportion to the expenditure. What is 'reasonable' depends (among other things) on the nature of the ANBI. For example, an institution that raises funds often has different costs than an institution that manages assets. Management costs are costs for the management of the institution, such as costs associated with conducting administrative management (eg costs for an accountant).

- Liquidation: It must be clear from the statutes of an ANBI that money that remains after the ANBI has been dissolved (positive liquidation balance) is fully spent on an ANBI. If the articles of association state that the positive liquidation balance will be spent 'as much as possible' on an ANBI or a foreign institution that focuses for at least 90% on the public benefit, the tax inspector will reject the application.

- Administrative obligations for an ANBI: An ANBI is obliged to keep an administration. This administration must at least show:

- which amounts have been paid per policymaker for expense allowances, attendance fees and other payments. This enables the tax inspector to assess whether the members of the policy-making body (such as members of the supervisory board) do not receive excessive expense allowances or attendance fees.

- what costs the institution has incurred: Consider, for example, the management costs of the institution. This allows us to assess whether there is a reasonable relationship between costs and expenditure.

- the nature and size of the institution's income and assets: In this way the tax inspector can assess the spending of the ANBI on the spending criterion.

- what the expenditures and expenditures of the institution are: In this way the tax inspector can assess the spending of the ANBI on the spending criterion.

- Policy plan: An ANBI must have an up-to-date policy plan. This plan provides insight into the way in which the ANBI wants to achieve its objective. The plan may be a multi-year policy plan, but it must in any case provide insight into the coming year.

It is mostly advised to publish the policy plan on the website of the ANBI. In this way one informs sympathizers and donors and one immediately complies with the publication obligation that applies to ANBIs. Publishing the policy plan is not mandatory. One does need to highlight a number of information from the policy plan on the website.

Transparency of an ANBI via the internet

An ANBI is obliged to publish data on its own website, or on a joint website. Since January 1, 2021, large ANBIs are obliged to use standard forms for the publication of the data. Large ANBIs are:

- ANBIs that actively raise money or goods from third parties (fundraising institutions) and whose total income in the relevant financial year exceeds € 50,000.

- Non-fundraising ANBIs if the total expenses in the relevant financial year exceed € 100,000

If the institution not a large ANBI, then one can use the standard form, but there is no obligation to do so. Usage of the standard form can be an easy way out.

If one chooses not use the form, the following information must published:

- the name of the institution

- the RSIN (Legal Entities and Partnerships Information Number) or the tax number

- the contact details of the institution

- a clear description of the objective of the ANBI

- the main points of the policy plan

- the function of the directors: such as: 'chairman', 'treasurer' and 'secretary'.

- the names of the directors

- the remuneration policy

- Publish the remuneration policy for the statutory board and the policymakers.

- an up-to-date report of the activities performed

- a financial statement must be published on the website. This has to be done within 6 months after the end of the financial year. The statement covers a balance, a statement of income and expenses and an explanation

Content of a policy plan of your ANBI?

The backbone of your ANBI is its policy plan. An ANBI is obliged to have a policy plan. One is also obliged to include and explain the following information in the policy plan:

- the institution's objective and activities to be performed

- the method of acquiring income

- the management and use of the institution's assets

The institution's objective and work to be performed:

Describe in the policy plan as specifically as possible what the institution wants to achieve, in the form of a clear objective.

In addition, indicate how you will implement the objective, such as which activities the institution carries out and will carry out in order to achieve the stated objective. An example could be providing emergency aid during disasters or establishing schools in developing countries.

Is your institution committed to the interests of a specific target group? Describe this target group as clearly as possible.

The method of acquiring income

Describe in the policy plan how your ANBI will raise income.

The management and use of the institution's assets

Finally, describe in the policy plan how the assets are managed. This differs per institution. Explain not only the management of the assets, but also the use of the collected funds and goods. If money is reserved for spending in future years, this must be explained in the policy plan.

Optional data

In addition to processing the aforementioned data, a policy plan is free of form. You are free to include further information in the policy plan that will increase your transparency towards sympathizers and donors, such as:

- the name the RSIN or tax number

- the postal or business address

- a phone number or email address

- possibly the number of the Chamber of Commerce

- possibly the details of the bank account

- board composition and the names of the directors and policymakers

- an overview of income, expenditure and assets your ANBI can add a forecast for the coming years.

- the remuneration policy for the board or the policymakers

(FAQ) ANBI Stichting

- What is the difference between an ANBI foundation and a regular foundation?

The difference between an ANBI foundation and a regular foundation is the ANBI status. The ANBI status is an extra step that needs to be performed after forming the ANBI. The ANBI also has certain tax exemptions, but also certain restrictions that a regular foundation does not have. - What are the benefits of an ANBI foundation?

Donators to the foundation may receive tax exemptions for their donations. The ANBI foundation also has certain tax exemptions that stimulates the charitable aspect. There is no tax to pay on donations received, there is also no tax to pay on founders donating to the foundation. - Can an ANBI foundation make profits?

Yes it can, as long as the profits are used to fund it's main charitable cause. - What can the ANBI spend funds on?

In short: Anything that benefits the goal of the charitable cause. This can include fundraisers, promotions, giveaways and so forth. And all activities that are related to that.

A foundation may involve other companies for assistance with it's services. Imagine the World Nature Fund hires an event planner company to plan a fundraiser, or a digital marketing company to fix their website. - What are the restrictions of an ANBI foundation?

In short: For obtaining the NGO status, the founders declare that the goal should not be to make the board members wealthy, or for board members to receive disproportionate amounts. - May an ANBI foundation compensate board members?

Yes, but there are limits to board member compensation. For preparing and filing a meeting, a board member can receive a maximum of €356. For larger NGO's there are different criteria. - May an ANBI Foundation compensate it's staff and volunteers?

Yes, volunteers may receive up to €170 per month or €1900 per year tax free.Above this amount the foundation would need to pay the salary through a payroll accountant and pay the employer taxes. The employee in this case has to include this in his income tax filings. - Can an ANBI foundation pay out cost declarations to it's members?

Yes, any declared costs (which has to be substantiated in the accounting with a proper document), may be paid out to members. There are no limits on such declarations. Of course the relevancy to the organisation and it's activities should be clear.

Registering a company in the Netherlands

Registering a company in the Netherlands is now more convenient than ever. The exact amount of time it takes to form a company abroad also depends on the country you want to establish your company in. Most entrepreneurs don’t even consider registering a Netherlands company, but they might be missing out on new opportunities. And having a company incorporation agent to assist you will definitely make the step easier. But with so many countries in the world, where will it be best for your firm?

Did you know, for example, that there are huge differences in tax rates in most European countries? There are also some countries that offer quite extensive tax deduction possibilities and the Netherlands is one of those countries.

If you are looking for a stable, competitive, international and prospering environment; then Holland is definitely the place to start your new company. With many well-developed sectors to choose from, a pool of bilingual (Dutch and English), specialized employees and many business opportunities nationally as well as internationally, you are ready to go once your business is set up. And we can take care of this whole process for you in just a few business days. How? Read on for tips and information about company registration Netherlands.

You can learn a lot from the Dutch

The Dutch are very successful in many different sectors. Due to constant innovation and the will to propel themselves forward in various business areas, you can count on some healthy competition and interesting investment opportunities. Especially the creative sector, the health industry, logistics sector, the agricultural sector and e-commerce have been high on the world’s list of most advanced sectors.

Holland keeps being ranked amongst the top 5 most competitive and stable countries for business registration, so rest assured your Dutch business will attract all the possible opportunities to grow and become prosperous.

Characteristics of the Netherlands as a business opportunity

- Next to innovative sectors and a multitude of different business options, Holland has much more to offer. Some highlights:

- When you form a company in the Netherlands, you are also joining the European Union. This might prove to be beneficial for various reasons; currently a lot of Brits might have a good shot of continuing their business by opening a branch office in the Netherlands to stay within the borders of the EU

- Being in the EU, you profit form the European Single Market. This means you can freely export and import goods and services in the entire zone

- The Dutch workforce is highly skilled and mostly bilingual, making it very easy for you to find the best employees for your business

- The Dutch are one of the largest economies in the world, whilst being one of the smallest countries at the same time. You will have access to a highly developed and huge worldwide infrastructure, with the port of Rotterdam and Schiphol airport at your disposal

- The total costs for registering a company in the Netherlands are very low compared to other (neighboring) countries

- The Netherlands has a large amount of skilled and knowledgeable freelancers, which you can easily hire via various freelance initiatives or platforms

The various business types in the Netherlands

Once you know if you need a permit and which one, you can research your options further by exploring all the various business types in the Netherlands. There is a large amount of legal entities to choose from, depending on the size of your business and your specific plans. You can choose from unincorporated and incorporated business structures. If you choose an unincorporated structure, you need to keep in mind that you will personally be held accountable for any debts your company makes. This is why most entrepreneurs choose an incorporated business structure; in order to limit the amount of personal risk. Nonetheless, we have summarized all business types so you can do some research before picking a certain legal entity.

1. Types of unincorporated business structures:

Eenmanszaak

Sole trader/single person business

Maatschap

Vennootschap onder firma or VOF

Commanditaire vennootschap or CV

2. Types of incorporated business structures:

Besloten vennootschap or BV

Private limited company (ltd. and Inc.)

Coöperatie en onderlinge waarborgmaatschappij

Naamloze vennootschap or NV

Vereniging

Stichting

Dutch incorporated business structures types explained

As you can see in the summary above, there are a total of 5 different incorporated business structures. We will not elaborate further on the unincorporated company structures, as we have seen from experience that most foreign investors and start-ups tend towards choosing a Dutch BV or another incorporated structure due to the limited personal liability involved. This is by far the safest option to choose, though you can read some detailed information about four other legal entities below as well.

The Dutch BV: The Dutch version of a private limited company is the most chosen business type by foreign entrepreneurs. In the past, you needed 18.000 euro to even register a Dutch BV. Nowadays the criteria are more forgiving, since you only need 1 euro to form a Dutch ‘flex-BV’. By lowering the minimum share capital necessary to start a Dutch BV, the country opened up many possibilities for smaller firms and businesses. If you start a Dutch BV, you can have corporate shareholders and directors. Please keep in mind that all corporate shareholders need to be verified during the process of the registering company Netherlands. They also need to have the appropriate authority to sign the deed of formation. It is also an idea to register a branch office as a Dutch BV, especially for companies that are experiencing difficulties in their native country. For instance Brexit weighs heavily on many English corporations and businesses. As such, many English businesses have already opened a branch office in the Netherlands.

The Dutch NV: Next to a private limited company, you can also choose to register a public liability company in the Netherlands. The Dutch NV is most suitable for large corporations and businesses, although you need to take into account that you will need a minimum share capital of 45.000 euro in order to start an NV. A Dutch NV also has a board of directors, who can be appointed during the annual meeting of shareholders.

The Dutch Foundation: You can also choose to start a Dutch foundation, which you can use as a holding or commercial entity or for family funds. Foundations can own shares as well as real estate in the Netherlands, plus you are allowed to obtain profits too. Under very strict and severe conditions, you can be exempt from taxes whilst owning a Dutch foundation. If you would like to know more about the possibilities, we can always provide you with general advice.

The Dutch General partnership: If you want to start a company with colleagues or other entrepreneurs, a general partnership might be an option for you. This business type is specifically for partners who use a single company name to obtain a common goal. This business type, however, comes with private liability like all unincorporated business types. So if you want to stay safe personally, a BV might prove to be a much better choice.

The Dutch Professional Partnership: The last option is the so-called professional partnership. This is a business type specifically for self-employed professionals or freelancers, like consultants, accountants, therapists and comparable professions. In this case you will also be privately held accountable if you make any debts with the business. So the only three business types that are exempt from personal liability are a Dutch BV, NV and foundation.

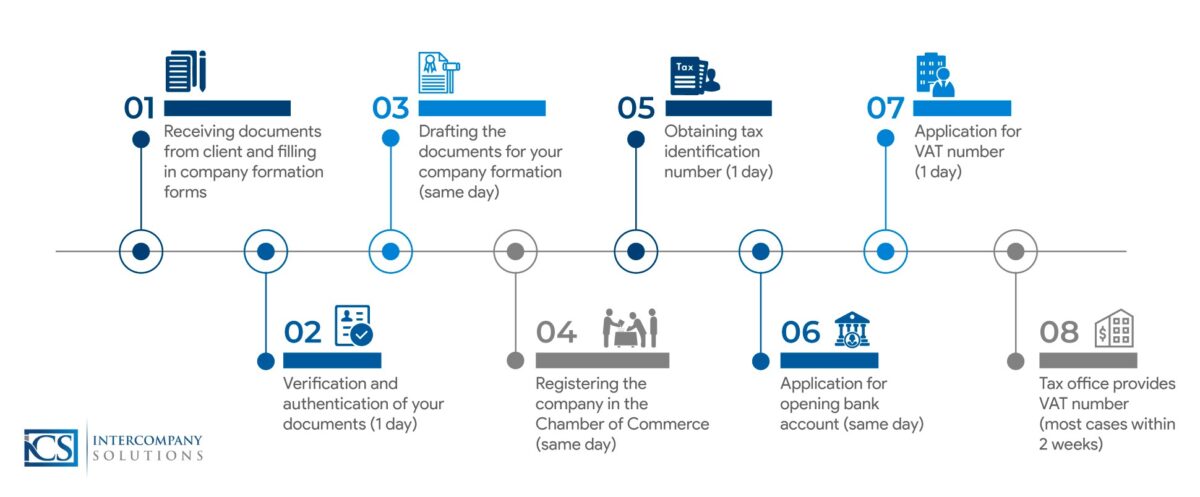

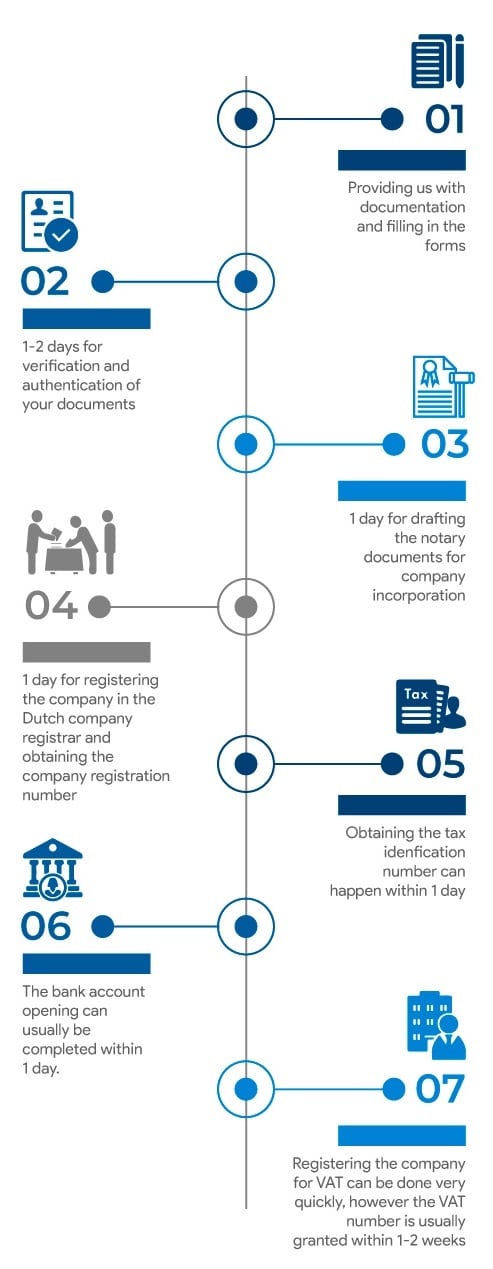

The step-by-step process of company registration Netherlands

Once you have chosen your preferred business type, it’s basically time to start taking action towards company registration in the Netherlands. The good news is that you don’t have to come all the way to the Netherlands to register your company: this is now also possible remotely. Some other necessary actions like opening a bank account can also be done from afar. The whole process can be done in little more than five business days. Of course, this is only achievable if we have all the required information and documentation. So please be very precise with the application forms and important documents like your business plan. The steps of the process of company registration in the Netherlands are as follows:

Step 1

Step 2 – 5

Step 6

Step 7 – 8

Practical information: required permits

If you are enthusiastic about the Netherlands, there are some details you will need to take care of first. Having all documentation ready is a necessity and this might include certain permits, depending on where you currently live. If you are an EU citizen, you can start a company immediately. As a non-EU citizen, you need a permit according to Dutch immigration law.

1. The start-up permit:

If you are interested in registering a business in the Netherlands and you are currently living outside of the EU zone, you will need a start-up permit. If you want to get this permit, your business and business idea need to contribute something to the Netherlands. This means providing proof that your business will be able to sustain itself, as well as showing that you are in a stable financial situation yourself. Also, you will need to find yourself a facilitator who will help you with various issues regarding the promotion and well-being of your business.

2. The self-employed permit:

Another permit is the self-employed permit. This is intended for people who want to move here with an already existing business or want to become self-employed in the Netherlands. If you want to acquire this permit, you will need to prove that your company will benefit the Dutch business market somehow. A good business plan as well as references and financial prospects from clients and investors will generally do well. You will need to get a certain amount of points before you are granted this permit. The point system does not apply, however, to both the United States as well as Japan.

How to apply for a permit?

As you will need to meet several criteria and conditions to obtain these permits, there is an agency in the Netherlands that will judge your application. The Netherlands Enterprise Agency (RVO) will score your business and determine whether you will be granted a permit. The scoring is subjected to certain factors, like your own experience and your goals for this specific company. The main goal is to achieve a win-win situation; so both the Dutch and your company can benefit from registering a company in Netherlands.

Intercompany Solutions

You will also receive a corporate extract, a VAT number and all other information that you will need. If you need further assistance at this point, for example to open a corresponding bank account or find a good accountant to take care of financial matters, we can help you with many other things. An accountant is necessary for your tax filings and also the annual statement of your BV, which needs to be published every year. Once this is all sorted, you are ready to go and can start doing business in the Netherlands.

All local companies performing customs-related operations in Holland and other members of the EU must have a unique EORI number. If you need further information about the EORI registration procedure or other accounting matters, our Dutch specialists are ready to assist you.

Dutch format of the EORI number

The Dutch EORI number consists of:

- country code: the Netherlands is designated with NL;

- a unique number or code: the company’s fiscal number; in case this number is shorter than 9 digits, e.g. 7 or 8 digits, the EORI number will begin with “0” or “00”, respectively; Dutch EORI numbers always follow the format NL + nine digits.

Assignment of EORI numbers in Holland

Only legal entities can have EORI numbers. Therefore branches of international companies cannot register for individual Dutch EORI numbers and have to use the ones issued to the respective head offices.

EORI numbers are assigned by the MS where companies are resident. In Holland businesses holding excise tax licenses are also assigned EORI numbers. The purpose is to avoid using more than one ID number for companies dealing with the Customs.

Applying for a Dutch EORI number

Businesses established in Holland have two ways of obtaining EORI numbers:

- for Dutch companies holding fiscal numbers no official EORI application is required, since the EORI number is derived from the tax number; all Dutch businesses that have performed customs-related operations in the country before the beginning of July, 2009, were issued EORI numbers.

- businesses intending to apply officially can fill in the EORI application template and choose whether to have the number publicly available on the EU EORI website.

Dutch companies willing to obtain EORI numbers do not have to submit any additional documents. The local Customs can access the necessary information.

Businesses established in countries outside the EU can file EORI applications in a Member State where they perform activities. The issued number will be valid in the entire EU.

Businesses active in third countries are asked to submit a Trade Registry document issued no more than six months ago. The EU has established a common database containing the EORI numbers accessible by the customs in all Member States.

For more information on starting a Dutch company, see this page. If you need further details regarding the registration for an EORI number, feel free to call our accounting company in Holland.

How to incorporate a Dutch BV: a step to step guide

If you want to jumpstart your business, perhaps you should think to incorporate a Dutch BV. Not only will moving to the Netherlands provide you with a lot of interesting business opportunities; but you can also benefit from lower tax rates and a whole new area with millions of new potential customers. If you want to make a smart decision then a country based in the EU is your best option. The EU gives you the opportunity to benefit from the single market, meaning that all goods and services can be exchanged freely within the borders of the European Union. One of the most stable and competitive member states of the EU is the Netherlands. This small country has proven its worth throughout the centuries: from the infamous 17th ‘golden’ century until today, this country stayed ahead of many others in business as well as other entrepreneurial achievements. Read on for more information about the Netherlands, why registering a business in Holland is a wise decision and why incorporating a Dutch BV will immensely aid you in attaining your business goals.

Why register a company abroad?

One of the main reasons for starting a foreign business is the adventure of it all. You will not only get the chance to tap into a completely new market, but you can benefit from several different opportunities too. For instance; tax rates and regulations might be much less severe than in your native country. Next to that, countries like the Netherlands are famous for their positive economic climate and stability. It’s pretty obvious that your business can only profit from such benefits. Some entrepreneurs shy away from taking such chances, because they wrongly believe it’s difficult and far-fetched to be able to register a business in another country. The truth is quite the contrary: opening a Dutch BV is a very straightforward and quick process, that does not even require you to be in the Netherlands physically. If you want to expand your business or are simply looking for opportunities abroad, starting a Dutch BV will provide you with ample amounts of options and opportunities.

Looking for a good tax rate?

When entrepreneurs want to start a business, one of the first things they consider is the lowest possible tax rate. After all; no one really likes to give away their hard-earned cash to the local government. In the Netherlands you are in luck, as you can find one of the most competitive tax rates in the entire EU.

From 2024 the corporate income tax rates will be 19% for all profits that do not exceed 200.000 euro and 25,8% taxes for all profits above 200.000 euro. Which inevitably makes Holland a very interesting tax jurisdiction for many investors and entrepreneurs.

Corporate Income tax Netherlands

2024: 19% below €200.000, 25,8% above

Corporate Income Tax Rates

Germany: 30%

France: 25,8%

Luxembourg: 25%

Belgium: 25%

Netherlands: 19-25,8%

The various business types in the Netherlands:

One of the most important questions you need to ask yourself when starting a business overseas is the type of legal entity you prefer. This mainly depends on your specific business goals and ambitions, such as the size of your company, the amount of profit you assume to be generating in the future and the amount of personal liability you feel comfortable with. In our experience an incorporated business structure works best, since you limit your personal liability this way. This means that any business loans or debts will never be recovered by depleting your personal assets. In the summary below you can find a brief description of every available Dutch business type.

1. Unincorporated business structures:

A Single Person Business – ‘Eenmanszaak’:

A General Partnership – ‘Vennootschap Onder Firma Or VOF’:

A Limited Partnership – ‘Commanditaire Vennootschap Or CV’:

A Commercial Or Professional Partnership – ‘Maatschap’:

2. Incorporated business structures:

A Private Limited Company – ‘Besloten Vennootschap Or BV’:

A Public Limited Company – ‘Naamloze Vennootschap Or NV’:

Cooperative And Mutual Insurance Society – ‘Coöperatie En Onderlinge Waarborgmaatschappij’:

A Foundation – ‘Stichting’:

An Association – ‘Vereniging’:

Why incorporate a Dutch BV?

There are several benefits to incorporating a Dutch BV. And we do not just mean the benefits of having a Dutch business, but the fact that a Dutch BV offers many opportunities and gives you plenty amount of freedom in deciding how you want to structure your business. One of the main benefits is, of course, the limited liability. Not a single shareholder carries any personal liability for debts the company made.

Also there is the lowered minimum share capital since the introduction of the Flex-BV. Before this date, everyone needed a minimum of 18.000 euros just to be able to incorporate a Dutch BV. Nowadays this amount is lowered to a single euro. This means that solid start-ups and innovative entrepreneurs with little savings can also get their chance to do business on a professional level. Next to these two obvious benefits, you also have access to many subsidies if your idea is interesting enough. Furthermore, with a Dutch BV you can benefit from several reduced tax rates regarding the withholding of taxes on royalties, interest and dividends. There is also a minimum taxation of gains coming from share sales in the country of establishment.

The Dutch BV holding structure in a nutshell

If you want to start a Dutch BV, you might want to consider a holding structure. This is not only a very logical and secure way to incorporate your business, but it also is cost-effective in the long run. A holding is nothing more than a legal entity that can only hold assets. This means that a holding company does not carry any risks nor liabilities associated with the general activities and operations of its subsidiaries. A subsidiary, in turn, is a legal entity that is involved in trade or services. As such, with a subsidiary you can perform all your normal business activities. The subsidiary will indeed be liable for its operations, but the overarching holding will not be. Thus, suppliers and creditors may file claims against the subsidiary but not against the holding. This greatly limits the risks for your core business, as the holding will always be safe from such liabilities. The Dutch BV holding structure has some main characteristics:

- Every holding structure includes at least two separate private limited companies (BV’s)

- One of all BV’s is a holding without any business activities

- The other BV(‘s) are all subsidiaries that engage in daily business activities

- The holding’s shares are owned by the investor/business starter

- The holding company is the owner of all the shares of all subsidiaries

Some good reasons to choose a Dutch BV holding structure

There are a few main reasons for entrepreneurs choosing to incorporate a Dutch BV holding structure. The first one is the obvious avoidance of various risks. With a BV holding structure you do not have any personal liability, plus the capital of the active company can be protected. Assets such as profits and pension provisions are safe from any business risks. There is a second large benefit, namely several possible tax advantages. There are structures in place that aid you in profiting from having a Dutch BV. One of these opportunities is the participation exemption, which allows the owner of any Dutch BV to sell their company and transfer profits to the holding BV without paying any taxes over the profit itself. If you are interested in all the benefits that come with incorporating a Dutch BV holding structure, never hesitate to contact us for advice. There are a few surefire reasons that make a Dutch BV holding structure the perfect fit for your company, if:

- It is reasonably imaginable that you will sell your company one day. This brings the previously mentioned tax advantage into play: it will allow you to transfer the profit of the sale to the holding BV free of taxation.

- You would like an extra layer of risk protection for your business capita

- You are interested in a flexible business structure that also has fiscal benefits in the Netherlands

How to incorporate a Dutch BV?

After you have chosen a specific business type, it’s time to start the procedure that will actually establish your business. This basically entails of filling out the necessary paperwork, providing us with correct information and waiting two days. You do not even need to come to the Netherlands, like we previously mentioned. For a clear overview of the steps involved we have summarized these for you:

Step 1

We first need to check a few things, such as:

Step 2

Step 3

How long does it take to incorporate a Dutch BV?

- We have created an overview of the time it takes to finish the aforementioned steps from A to Z:

- Preparing, signing and sending the necessary documentation: max. 5 hours

- Verification and authentication of all received documents: max. 2 business days

- Drafting the notary documents for company incorporation, registering the company in the Dutch company registrar and obtaining the company registration number, obtaining the tax identification number, opening of a Dutch bank account: max. 1 day

- Registering the company for VAT: max. 2 weeks

What are the costs of starting a business in Netherlands?

We would love to provide you with a fixed price for the incorporation of a Dutch BV, but the reality is that every single business requires a personal approach. It depends on different factors such as the business type, certain permits needed and the amount of time in which you can provide us with all necessary documents. There are a few general fees however, that you can take into consideration:

- The preparation of all documents

- The fee for registering a Dutch company at the Dutch Chamber of Commerce

- The fee for registration at the Dutch tax authorities

- Incorporation fees that cover the formation of the company and extra services like opening a bank account

- The fees for assistance with obtaining the VAT number and (optional) EORI number

If you would like a personal quote, please contact us at any given moment. We are always happy to discuss your business ideals and give you a chance to implement them in the Netherlands.

Note: It is not a ''crypto license'', but a ''registration requirement''.

Exchanges are all virtual currency trading companies, brokerages and intermediaries that buy- and/or sell cryptocurrency to clients. Such as Bitstamp, Kraken, Bitonic and other similar exchanges.

Regulatory situation in the Netherlands before 21st November 2020

Before the new rule came into effect on 21st November 2020, crypto exchanges and wallet providers in the Netherlands did not require any registration or licensing from the central bank.

Although it was still highly recommended, and necessary to follow well-structured know-your-customer and anti money laundering practices as broker, buy or sell cryptocurrency. Only recently it became an official requirement in The Netherlands.

What do the regulation mean for the practical onboarding process?

Wallet custodians and virtual currency trading companies need to identify their clients and manage the risk of money laundering by monitoring and reporting suspicious transactions.

The client identification process will be comparable to what some regulated Western crypto exchanges currently already ask from their clients, a copy of passport, a passport selfie, a proof of address, some declarations or proof as to the source of your income, and to declare what type of transactions you will have and for what reason. Depending on the limits you want to unlock. A practical guideline for this can be crafted.

Some exchanges solve this by using new digital onboarding solutions to be able to quickly accept the clients. Clients can be identified by a live video conference in which the passport is checked by a compliance employee and compared to the person holding it. And so the identify of the client is confirmed. For higher limits of trade, additional documents may be requested.

Some exchanges require the client to upload documents until they are inspected by a compliance staff member. During certain busy periods in the crypto market, the onboarding time may take up to 2 weeks for some exchanges.

Quick summary of requirements proposed for registration with the Dutch Central Bank:

- Fill in a notification form of your activity

- Send all company legal documents, identification and resumes of owners

- Send a business plan and compliance manual

- To have managers / directors of demonstrable integrity and suitability

- To have a transparent company structure

- The regulator will monitor and test the integrity and may suspend the registration

For the full list please consult this document, page 19-20 for a shortlist.

Compliance requirements (at least):

- To have a compliance procedure for identification and monitoring of clients

- To report unusual transactions

- To have compliance staff follow an annual training

- To make a industry based risk profile to identify higher-risk clients and transactions

- To identify clients and ensure their funds are of legal origin

The process is relatively straight forward and should have a high succes rate in case all documents and files will be supplied properly.

The Dutch Central Bank has shared an application form for registration, as well as an indication of the registration fees, €5000 for a new company.

The Central Bank will charge the total costs of supervision to the entire applicable crypto industry in the Netherlands. This means an estimated cost of €29.850 per year per crypto licensed company. The actual cost will be based on a percentage on your turnover. The Central Bank in this case can be likened to a Financial Regulator such as the Security and Exchange Commission.

The greatest criticism from the crypto industry is that the current proposal would likely work in favor of larger exchanges, and in the disfavor of smaller exchanges. The smaller exchanges might not be able to cope with all additional registration and compliance costs.

FAQ about the Crypto registration

- What if I open a crypto company that is not a trading or exchange firm?

If you do not trade, exchange crypto for (fiat) money or hold customer funds, you are likely not regulated. - What is the timeline of a registration with the Dutch Central bank if I want to start an exchange or crypto broker in The Netherlands?

We cannot predict the processing time by the government body. But generally the whole process can take between 6 and 12 months. - If I have a company like Shapeshift or a Decentralized exchange, do I need to be regulated?

Currently there is no requirement for regulation if you only trade virtual currencies for virtual currencies. (Dutch Central Bank Link) - Do you have experience with these requests?

Because Intercompany Solutions specializes in corporate law, we collaborate with a specialized law firm for the crypto license applications. Our firm can assist with all matters up to the point of application, such as: incorporation of the firm, advise on the documentation and assistance with the compliance and accounting requirements.

How can Intercompany Solutions assist your crypto company?

We have years of experience in the cryptocurrency industry and we have advised and assisted (large) foreign crypto firms in setting up a cryptocurrency company in the Netherlands. We can assist you with all practical procedures and regulatory information to make your crypto business in the Netherlands successful.

We can also assist you with:

1. Formation of the company and all requirements

2. The application for the crypto license (This part is handled by a specialized Financial law partner firm).

3. Assistance in drafting a compliance and AML policy as is required for the crypto license

4. Assistance with drafting and organizing the internal documentation, business plan and registration requirements

5. Provide you with a consultation from one of our financial lawyers

Other sources:

1. Virtual currency and fifth anti money laundering directive Link

2. Law came into effect on 10 November 2020 Link

3. MICA came into effect on June 2023 Link

As the Brexit date in October is closing in, more and more British entrepreneurs and companies are chosing to move their headquarters or backup subsidiaries to the Netherlands. The future is still very unclear. No one really knows how reality will look once Brexit takes effect, but the benefits of owning a company in Holland remain plentiful. So which companies are we talking about? And what exactly are the benefits of moving your company? In this article we present you with some pretty logical reasons others deemed important enough, to register a company in the Netherlands.

Intercompany Solutions CEO Bjorn Wagemakers and client Brian Mckenzie are featured by CBC News - Dutch Economy braces for the worst with Brexit, in a visit to our notary public on 12 February 2019.

Many multinationals have already preceded you

The Netherlands Foreign Investment Agency (NFIA) has released information that 98 companies have already settled in the Netherlands. An additional whopping 300+ companies are seriously considering doing the same. These are huge multinationals such as Discovery and Bloomberg, adding a nice variety of newly settled businesses in the Netherlands. It’s especially the financial sector, media and communications and IT and technology that have seen a substantial rise in newly established foreign companies.

Why all the sudden moves?

Obviously Brexit has a large amount of complicated consequences, especially for businesses operating within the European Union. For example; financial institutions are obligated to have European subsidiaries to do business with Europeans and European companies. This is not obligatory for most other companies, though British entrepreneurs will have to deal with both British as well as European clients. Having a subsidiary in the Netherlands will make your daily business activities a lot easier to handle.

The biggest reasons British companies are choosing Holland

The reasons for a company or company subsidiary in Holland are pretty clear. As already stated above; reason number one is definitely the fact that some companies might be lawfully obligated to do so. Other companies might go bankrupt if they don’t tend to their European clients’ needs in the same current timeframe. The connection with Europe stays firm that way, making it possible to continue their business as usual.

A second important reason is the ample amount of subsidies for new businesses and innovations currently offered by the EU. With Brexit these subsidies become unattainable, or at the very least harder to get. This might create stagnation in overall innovative concepts, or new startups. The third reason for a company to move or open a branch office in the Netherlands, is the fact that lengthy border procedures will be completely avoided.

Other reasons worth mentioning are specifically aimed at Holland being a very smart choice for your company. Holland has an extensive and well-operating infrastructure; physically as well as digitally. The different ports and airports are well within a maximum two hour driving distance. Also, there is a reason so many expats have happily chosen the Netherlands in the past. There is a large amount of bilingual personnel, the services Holland offers to foreigners are excellent and the Dutch business market is very stable and secure.

If you want to know more about the whole process of establishing a company in the Netherlands, or would like to hear more about all the benefits, feel free to contact our team anytime. We can answer all your questions and provide you with the necessary information to make a well thought-out decision.