Intercompany Solutions is receiving a growing amount of company registration requests from Turkey. During the past weeks, the annual inflation rate in Turkey has risen to a dangerously high level of 36.1 percent. This is the highest rate ever recorded in the past 19 years. This high inflation also exceeds the rates of average savings rates in Turkey, which were around 15 percent last month. As it is, Turkey is in very real danger of falling prey to hyperinflation. The average Turkish consumer finds their daily purchases are even more expensive than economists had predicted, during the last month. The prices that consumers had to pay for goods and services rose exponentially, compared to the same month during previous years.

The Turkish inflation problem

Turkey has already been struggling with ever-increasing inflation for years. The Turkish lira has depreciated considerably in recent months, which is what makes life more expensive for Turks. This doesn’t just concern local goods and products, but imported products also become more expensive as a result. Whilst central banks generally raise interest rates to combat high inflation, the Turkish government and Central Bank seem to do the exact opposite, by cutting interest rates. Economists believe that this led to the Lira dropping massively.

What does this mean for Turkish consumers?

Inflation is an economic process during which money decreases in value, as average prices (the general price level) rise. A strong inflation has a lot of influence on the purchasing power of the citizens of any given country. It also influences the worth of your savings. For example, if the inflation rate is higher than the savings rate, this will mean that your savings can buy less products or services. The money you own will simply be worth less, whilst the prices of all goods and services rise. This can create situations in which people aren’t even able to pay for basic necessities anymore. In the Netherlands the inflation rose as well, but considerably less than in Turkey. The current difference in The Netherlands between the savings and inflation rate is around 3%, whilst in Turkey it’s more than 20%.

Given the very fast increase in inflation, it is a continuous race for residents of Turkey against the increasing devaluation of money. Due to the fact that the value of the Lira is eroding in such a fast tempo, consumers in Turkey have started putting their money in more robust goods and products that can stand the test of time. Gold can always be a sensible investment in such situations. Due to the hyperinflation, consumers in Turkey are looking for purchases that are expected to hold their value better than their own currency.

What does this mean for Turkish entrepreneurs?

Of course, the hyperinflation does not just affect consumers and citizens alone. Business owners are experiencing immense trouble as well, just to keep their heads above water. Since consumers have less money to spend and products have become more expensive, entrepreneurs are looking for alternative ways to save their companies. Due to the decline of the Lira, many companies are near bankruptcy. This is why it might be a safe bet to move your company to another country, where there are less severe inflation problems. The entire world is currently in the grip of inflation issues, but nowhere does it seem to be as severe as in Turkey. If you want your company to survive, moving or expanding to an EU member state might be your best bet.

The European Union is a highly competitive market that offers many benefits to international entrepreneurs. The EU Single Market is one of the main benefits, offering every business owner in the EU to trade goods and products freely within the boundaries of the union. Next to that, the tax rates in the EU are being harmonized. This means that trade between EU member states is becoming more and more easy, without the hassle of having to pass any customs. This will also save you a lot of administrative work.

Choosing the Netherlands as your new location: what are the benefits?

The Netherlands is also an EU member state and, thus, has access to the European Single Market. But Holland offers a wide plethora of other benefits to foreign entrepreneurs. One of the main things the country is famous for, is its trading capabilities. For example, the Netherlands has made the originally Turkish tulip a worldwide known staple. The flower is now famous, due to the fact that the Dutch are shipping the flower all over the world. If you want more exposure for your company, the Netherlands is a very good option. There is a very vibrant community of foreign entrepreneurs, whom you can also meet at various networking events, should you be interested. You also have access to the port of Rotterdam and Schiphol airport, which are two massive logistics hubs any company can profit from. The Dutch are also very welcoming to foreign businessmen.

Company registration in the Netherlands: what you need to know

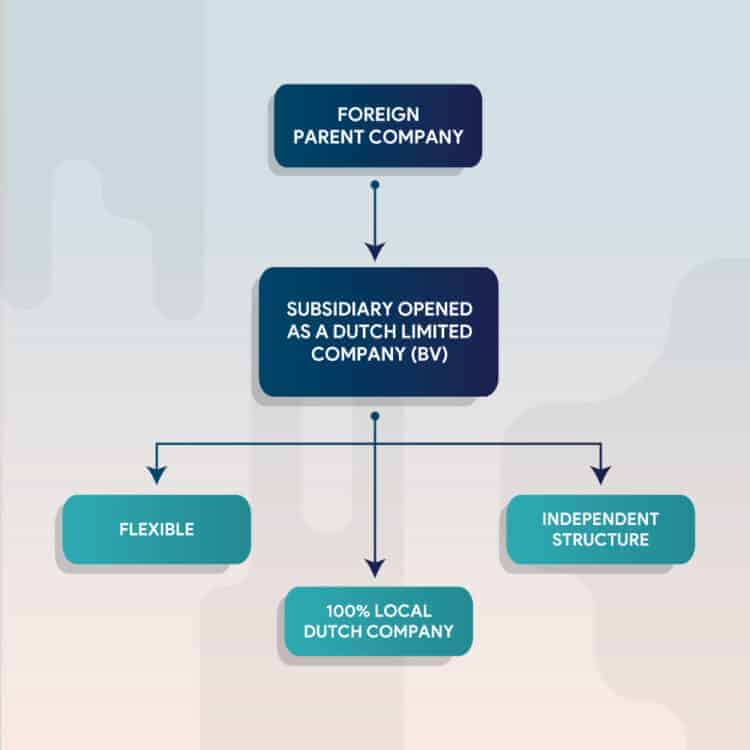

If you choose to establish a Dutch business, you will have to choose a legal entity. By far, the most chosen option is a Dutch subsidiary in the form of a Dutch BV (Besloten Vennootschap), which is a private limited company. You will need to provide information such as your company name, the directors involved and your company activities. If you decide to let Intercompany Solutions help you, we can finish the process for you in just a few business days. We can also assist you with various other activities, such as setting up a Dutch bank account, and finding a suitable location for your business. Want to know more about the possibilities? Feel free to contact us anytime.

During the past decade, we have seen a steady rise of companies establishing a subsidiary in the Netherlands. There are multiple reasons to do this, for example to be able to access the European Single Market. Currently, this is especially profitable for company owners in the United Kingdom, since the UK has been mostly cut off from the European Union after Brexit. Participation in the European Single Market offers a lot of benefits, particularly if you own a company with a logistical component. The EU houses a staggering amount of large (multinational) distribution centers, and not without reason. This enables these companies to trade goods and services without

The European Union currently has 27 Member States that profit from the Single Market. This Single Market was established, in order to guarantee the free movement of capital, goods, people and services within all participating Member States. This is also known as the ‘four freedoms’. If you want to purchase goods within the EU and sell these in a country that isn’t a Member State, opening a Dutch subsidiary might help you enormously, both fiscally and in terms of time-efficiency. The same goes for a reversed situation: when you would like to sell goods produced in the country your company is based in on the European Single Market. We will outline how you can streamline your flow of goods with a Dutch subsidiary in this article, and explain the benefits of establishing a company in the Netherlands.

What exactly is the ‘flow of goods’?

The flow of goods is essentially the flow of your available means of production, and the products you offer, within your company. This flow of goods is necessary to transport raw materials, semifinished or finished products from point A to point B. Due to the fact that all means of transportation cost a company time as well as money, an efficient flow of goods is indispensable for any company dealing with distribution activities. In general, the items that are delivered to a store usually do not come directly from the manufacturer, but from a wholesaler or a distribution center.

At every single store, most goods are not directly delivered from the manufacturer, but from a distribution center. A distribution center (DC) is basically a central warehouse. In a distribution center all orders from stores are collected and then shipped. A big advantage of this way of doing business, is that the store only has to communicate with the head office or the DC about deliveries. Within logistics and distribution, people often talk about an internal flow of goods that often follows a fixed pattern:

Incoming goods

- Unloading of freight unit with/without forklift

- Checking of the unloaded cargo

- Updating the information in the company’s WMS

- Storage on location with/without forklift

- Interim or annual balance sheet count or stock control

- Ensuring the conscious objective

Outgoing goods

- Picking parts from order

- Packing and labeling of goods

- Checking the outgoing products

- Preparing the shipment in an outbound area (demarcated area specific to a particular destination or freight unit)

- Loading of freight unit.

The above list is almost always the basis, on top of which are often the movements to supplement the pick locations (for example, rack space for pallets of which only a few pieces are picked at a time). In order to run a tight business, it is very important to keep your warehouse in order. Next to the physical shipping of goods, other administrative tasks are involved when you supply goods to customers overseas. Especially if you live in a country outside the EU zone, and you want to do business within the EU, because this means you will need to create extra customs documents.

If you want to import and/or exports goods, you need to fill out various customs documents and official paperwork. Otherwise, you risk your goods being kept, or claimed, at the border. Within the EU, this problem does not exist due to the European Single Market. But if you own a company outside the EU, the paperwork can become excessive and time-consuming. Hence; if you establish a Dutch subsidiary, you don’t have to deal with the rather large amount of official paperwork anymore.

How to buy or sell goods using a Dutch BV?

If you want to establish a logistical trading company, or if you want to expand your foreign business to the Netherlands, it is necessary for you to create solid connections with sellers and buyers within your market. Especially if you own a webshop and you rely on punctual delivery times. If you already own a business, chances are you have already made such connections. The logistics market is a very dynamic one, with many changes happening in short bursts of time. In order to be able to deliver your goods on time, it is important to set up tight delivery schedules.

The profitable part of owning a Dutch subsidiary, like we mentioned before, is the fact that you get access to the European Single Market. This means you can freely trade your goods with the other 26 Member State as well as the Netherlands, which can help you save a substantial amount of money on customs and shipping costs. For example; if you own a clothing company and you want to enter the Single Market, all you need is a subsidiary. Via this subsidiary, you can ship goods to and from your home based company, without the extra hassle of international shipping. This is due to the fact, that you are transferring goods internally, meaning within your own company.

Which entities are involved with the flow of goods?

When you own an international logistics company, you already know that you have to deal with many different partners and organizations on a daily basis. This means that you best choose your partners wisely, like we mentioned before. But also consider the fact that preparing and creating customs documents requires the proper time and expertise. In most cases, you will be dealing with partners such as wholesalers and different kinds of sellers, as well as a wide array of buyers, of course. Next to that, there will be external parties involved, such as the Tax Authorities of the country your business is situated in.

If you decide to establish a subsidiary in the Netherlands, keep in mind that you will have to adhere to the so-called Dutch substance requirements. These have been put in place, in order to avoid the unintended use of (double) tax treaties by companies established in the Netherlands. The Dutch Tax Authorities monitor such things, so always be concise with your administration and business activities. Next to a country’s Tax Authorities, you will also deal with other organizations such as customs and the Chamber of Commerce. If you want to run a solid business, make sure your administration is always up-to-date.

Which business activities will take places in which country?

Once you decide to establish a Dutch subsidiary, you will have to make a business plan that covers every change you will have to make regarding your current regular business activities. For example; you might have to move your main distribution center, or set up an extra distribution center in the country you establish a subsidiary in. You will also need to figure out where you plan to take care of your administration, since this fact is very important to figure out where the substance of your business is situated. This also includes where you will center your business in general, and where the ‘real’ headquarters of your business will be.

In general, you will need to divide all business activities and see which country would suit which business activity best. If you have a lot of European customers you structurally ship goods to, it would probably be best if you base your (main) distribution center in an EU Member State. You can still do your administration from where you live, since it is not required in the Netherlands that you do this in the country itself. You are also not obligated to live in the Netherlands, which is why it is fairly easy to set up a subsidiary here. If you would like more information about the benefits a Dutch subsidiary can offer your company, feel free to contact us for personal advice.

How can you establish a subsidiary in the Netherlands?

The process of obtaining a Dutch business is fairly straightforward, but it does involve several steps that need to be followed through very precisely. We have a very broad guide regarding the formation of a company in the Netherlands, where you can look up all the information you need on the subject. The procedure itself consists of three steps or phases, which can generally be carried out in 3 to 5 business days. The amount of time the procedure will take greatly depends on the amount and quality of information you can provide, so make sure to acquire all the necessary documents beforehand. Most of the time is spent verifying the documents you provide, so it is beneficial if everything is correct and concise.

For the formation of a subsidiary, which is a Dutch BV (private limited company) in most cases, we follow the next three steps.

Step 1 – Identification

The first step consists of providing us with your identity information, as well as the identity of possible extra shareholders. You will need to send us copies of the applicable passports, next to a completely filled out form regarding the formation of your future Dutch business. We also ask you to send us your preferred company name, since this name will need to be verified in advance to ensure availability. We strongly suggest you don’t start creating a logo, before you know whether you can register this company name.

Step 2 – Signing of various documents

Once you send us the necessary information, we will proceed by preparing the initial documentation for the formation of the business. Once this is done, the shareholders will need to visit the Dutch notary public to sign the formation documents. Alternatively, it is possible for us to prepare the formation documents to be signed in your home country if you are unable to visit here in person. You can then send the original signed documents to our corporate address in Rotterdam. We will tell you exactly what you will need to do.

Step 3 – the registration

When all documents are verified and signed and in our possession, then we can start the actual registration process. This involves filing your company with the Dutch Chamber of Commerce. After this is finished, you will receive your registration number. The Chamber of Commerce will automatically forward your company information to the Dutch Tax Authorities, who will subsequently provide you with a VAT-number. We can also assist with several other necessities, such as opening a Dutch bank account. We also have solutions to apply to certain Dutch banks remotely.

What can Intercompany Solutions do for your company?

If you are interested in expanding your logistics business, the Netherlands offers very exciting opportunities. With one of the best infrastructures in the world, you obtain access to a huge market of potential. Next to that, the IT infrastructure is considered one of the most advanced, with very fast internet speeds. Holland houses a very colorful and wide array of foreign entrepreneurs; from small business owners to large multinationals who have set up subsidiaries or even headquarters here. If you are an ambitious professional, your business is sure to thrive here, provided you put in the necessary work.

If you own an international webshop, you will also find plenty of opportunities in the Netherlands. This rather small country has been world-famous for its international trading capacity and this still shows. If you would like to receive personal advice regarding your company and the possibilities that are open to you, please feel free to contact Intercompany Solutions at any time. We will gladly assist you with any questions you might have, or offer you a clear quote.

Extra sources:

A lot of the entrepreneurs we do business with are starting an entirely new company, often from abroad. But in some cases you might already own a company, which you would like to move to a more stable and economically thriving location. Is this possible? And, more importantly; is it possible to move your company to the Netherlands in particular? According to current EU regulations, as well as Dutch national law, this is entirely possible. And we would like to help your with this, if you need assistance. In this article we will outline exactly how you can achieve this, which information you will definitely need and how Intercompany Solutions can assist you during the process, if necessary.

What does it mean to move your entire company to a new country and/or continent?

Often entrepreneurs start a business locally, to find out during a later stage that their direct environment doesn’t provide the best basis for their specific product, service or idea. Next to that, some countries on this planet simply offer more entrepreneurial possibilities than other(s). In such cases, it might be desirable to consider moving your company abroad. For example, if you would like to own a company that deals with resources such as water, it helps if your company is actually situated near water. This is just a crude example, but the fact of the matter is that a lot of companies would benefit from a registration in a foreign country, due to a much larger market potential.

If you want to consider the step of moving your company abroad, this entails some administrative as well as practical decisions and actions. In the long run, it will definitely provide you with enough business opportunities to earn back the investment of moving your company. The choice to decide where your company is situated is entirely yours; in this new day and age, we don’t need to have an office building anymore, nor a permanent residence in a certain country in order to establish a business there. Business is profitable for the entire world, and you as a (potential) business owner should be free to establish yourself in any desired location.

Why would you choose the Netherlands as your company’s home base of operations?

Once you decide to move your company abroad, the very first question you should ask yourself is: where am I going? This is a very valid question, one that deserves the proper time to think about, since you will need to connect your personal business goals with a certain type of inviting national climate. Even though the world is internationalizing at a high rate, all countries still have the benefit of keeping their unique traditions and national customs. This, in the end, is what makes us all unique. Hence, your business can definitely flourish in one of the 193 countries on this planet.

So why is the Netherlands a good decision? One of the main reasons mentioned by both media and reputable business platforms, is the fact that the Netherlands has always been excellent in (international) trade. This tiny country, with currently around 18 million citizens, has achieved a worldwide status as one of the most entrepreneurial countries in the world. The Dutch are famous for their innovative spirit, cross-border cooperation and ability to link multiple interesting yet also contradicting disciplines. If you decide to do business in the Netherlands, you will have plenty of opportunities to elevate your business to your desired status.

Next to the trading history, the Netherlands is also very welcoming towards foreigners and actively stimulates diversity in every way. The Dutch have learned from hundreds of years of travel all over the world, that every single nation has something valuable to offer. This, in turn, provides for a very colorful and lively business climate, with the potential to attract customers from all over the world. You are sure to find a broad clientele for your product or service, provided that it’s good. If you want to know more about the Dutch, you can read some of our blogs about special sectors and characteristics of the Netherlands as a business haven.

Is it legally possible to move your company oversees?

In order to understand how you can move your already existing foreign company, it is crucial to know what the Dutch law says about this. Due to increasing internationalization, there is a larger demand for company relocation. There have been many developments within this area in Europe during recent years. Pursuant to Section 2:18 of the Dutch Civil Code (Burgerlijk Wetboek), a Dutch legal entity can convert into another legal form subject to certain requirements. However, Book 2 of the Dutch Civil Code does not yet contain any rules for the cross-border conversion of companies. There is also no legal regulation at European level at this moment in time. Nonetheless, it is still entirely possible. We will now explain in detail how you can achieve this.

Cross-border conversion of companies

Cross-border conversion means that the legal form and nationality (applicable law) of the company change, but the company continues to exist and retain legal personality. The conversion of a Dutch legal entity into a foreign legal entity is also called an outbound conversion, and the reversed variant (when a foreign company moves to the Netherlands) is named an inbound conversion. The EU/EEA Member States apply different doctrines, when determining the law applicable to a company. Some Member States apply the incorporation doctrine, whilst others apply the real seat doctrine.

The incorporation doctrine means, that a legal entity is always subject to the law of the Member State in which it is incorporated and has its registered office. The Netherlands applies this doctrine; a Dutch legal entity must have its registered office in the Netherlands and must be incorporated in the Netherlands. According to the doctrine of the real seat, a legal entity is subject to the law of the State in which it has its central administration or real seat. As a result of these theories, there may be a lack of clarity as to whether a transfer of seat is possible.

Official EU/EC court rulings explain how cross-border conversion is possible

Questions about this have been put to the Court of Justice of the EC/EU several times during recent years. The EC/EU Court of Justice has issued two important rulings on cross-border conversion of companies. The freedom of establishment as laid down in Articles 49 and 54 of the Treaty on the Functioning of the European Union (TFEU) played a role in this. On December 16, 2008, the Court of Justice of the EC ruled in the Cartesio case (Case C-210/06) that Member States are not in themselves obliged to allow the cross-border transfer of a registered office of a company incorporated under their own law. However, it was noted that the transfer of a registered office must be recognized, if the company can be converted into a local legal form after transfer of its registered office in the new Member State of residence. Provided there are no compelling reasons of public interest to impede this, such as the interests of creditors, minority shareholders, employees or the tax authorities.

Subsequently, on 12 July 2012, the Court of Justice of the EU ruled in the Vale judgment (case C-378/10), that a Member State of the EU/EEA cannot hinder a cross-border inbound conversion. According to the Court, Articles 49 and 54 TFEU mean, that if a Member State has a regulation for internal conversions, this regulation also applies to cross-border situations. A cross-border conversion may therefore not be treated differently from a domestic conversion. Keep in mind that in this case, as with the Cartesio ruling, an exception applies if there are compelling reasons of public interest.

In practice, there may be a need for the possibility of converting a company into a legal entity governed by the law of another country, without it ceasing to exist. Without such a conversion, a company that has transferred its activities to another country may be governed by several legal systems. An example of this is a company incorporated under Dutch law that (completely) transfers its activities to a country that follows the actual seat doctrine. Under this law, the company is governed by the law of the country it is residing in. Seen from a Dutch perspective, however, this company (also) remains governed by Dutch law (incorporation doctrine).

Although the company is in fact no longer active in the Netherlands, Dutch obligations with regard to the preparation and filing of annual accounts, for example, remain in force. If these kinds of company law obligations are overlooked, this can have unpleasant consequences, for example, in the field of directors' liability. Because Dutch law does not provide for cross-border conversion of legal entities, the route of cross-border merger was often chosen in the past. This legal concept is in fact regulated in Dutch law, exclusively for mergers between capital companies established under the law of a member state of the European Union or the European Economic Area.

A new European Union Directive has been adopted

Following these historical rulings, an EU Directive on cross-border conversions, mergers and divisions was adopted by the European Parliament and the Council (Directive (EU) 2019/2121) (Directive). This new Directive, amongst other things, appears to clarify the currently existing rules on cross-border conversions and mergers in the EU. Next to that, it also introduces rules specifically applicable to cross-border conversion and divisions, that are intended for all Member States. A country such as the Netherlands might benefit from this Directive, since we already stated before that the Dutch currently doesn’t have any proper legislation regarding this subject. This would allow for international harmonization, making it much more easy to move your company throughout the EU.

This Directive already went into effect on the 1st of January 2020, and all Member States have until the 31st of January to implement the Directive as national law. However, this is not mandatory, since Members States can choose for themselves whether they implement the Directive. Due to the fact that this is the first time, ever, that there is a legal framework in the European Union for cross-border conversions and divisions, it makes it directly relevant for limited liability companies such as the Dutch BV. This also complements both the Vale and Cartesio rulings, since both have shown that these legal operations were already entirely possible, based on the right of freedom of establishment.

A cross-border conversion is defined in the Directive as "an operation whereby a company, without being dissolved or wound up or going into liquidation, converts the legal form under which it is registered in a departure Member State into a legal form in a destination Member State, as listed in Annex II, and transfers at least its registered office to the destination Member State, while retaining its legal personality."[1] One of the main advantages of this approach, is that the company will remain its legal personality, assets and liabilities in the newly converted company. This Directive is aimed at limited liability companies, but for cross-border conversion of other legal entities such as cooperatives, you can still invoke the freedom of establishment.

The amount of cross-border conversions keeps rising

Based on these rulings, both outbound and inbound conversions within the Member States of the EU/EEA are therefore possible. Dutch notaries are increasingly confronted with requests for cross-border conversion, due to the fact that more people are considering moving their company to a more economically friendly atmosphere. There is no Dutch statutory regulation regarding this, but that does not have to be an obstacle to notarial execution of the conversion. In the absence of harmonized legal regulations, the procedures that must be followed in the inbound and outbound Member State must be carefully examined. These procedures may differ per Member State, which can make the process a bit complicated if you are not backed by a professional. Of course, Intercompany Solutions can assist you through the entire process of cross-border conversion.

What are the steps involved to move the registered office of your company to the Netherlands?

Starting a company in the Netherlands involves a few less steps than moving an entire company to the Netherlands. Nonetheless, it’s very much possible. If you want to move the seat of your company, you need to take into consideration that there are multiple legal as well as administrative actions involved in this process. We will outline all these actions in detail below, providing you with enough information to consider your move abroad. Of course, you can always contact Intercompany Solutions if you feel like you need more in-depth information, we are always happy to assist you in any way we can.

1. Registration of a branch office and company director(s) in the Netherlands

The first thing you will need to do, is register a branch office in the Netherlands. This entails multiple administrative steps that need to be followed, in order for the process to go smoothly. On our website, you can find plenty of articles that describe the entire procedure, such as this one. If you want to settle your company in the Netherlands, you will need to think about some basic decisions such as the location of your company and the legal entity you prefer. If you already have a limited liability company, you can convert it to a Dutch BV or NV, depending on whether you want your company to be private or public.

We will need information from you, such as valid means of identification, details about your current business and market and the necessary paperwork. We also need to know who the current directors of your company are, and whether all directors want to participate in the new company in the Netherlands. This is necessary in order to register the directors in the Dutch Chamber of Commerce. After we receive this information, we can register your new Dutch company in just a few working days. You will then receive a Dutch Chamber of Commerce number, as well as a VAT number from the Dutch Tax Authorities.

2. Adjusting the foreign notarial deed of incorporation

Once you have registered a company in the Netherlands, you will need to contact a notary public in your own country, in order to adjust the original notarial deed of your company. This means you will have to change all the information that is relevant to your current local company, into the data that you received when you registered a company in the Netherlands. In essence, you are replacing old information with new information, whilst the substantive information explaining your company in detail remains the same. If you don’t know how to do this, you can always contact us for more information and advice. We can also possibly assist you with finding a good notary in your country of residence, and keep in touch with your notary so the cross-border conversion process can be executed smoothly.

3. Validating your new company via a Dutch notary

Once you have adjusted the foreign notarial deed, you will need to contact a Dutch notary to validate and set up your company in the Netherlands officially. This will entail communication between the foreign and Dutch notary, so all company specifics are adopted correctly. Once this has been initiated, the branch office you registered will be transformed into the new headquarters of your company. Regularly, branch offices are registered for companies and multinationals that want to have an extra location in a different country. Since you will want to completely move your company, the branch office will be the new location of your main company. Hence the necessary extra steps, in comparison to solely opening a branch office in the Netherlands.

4. Dissolution of your foreign company

Once you have moved your entire company to the Netherlands, you can basically close down the business in your home country. This means you will have to dissolve the company. Dissolution means you completely disband your foreign company, and it will continue existing in the Netherlands instead. Before you dissolve your company, you should ask yourself some questions:

- Is there any equity?

- Is there a positive share capital?

- Has the final sales tax return been made?

- Are there still bank accounts or insurances?

- Is everything checked by an accountant or lawyer?

- Is there a shareholders' resolution to dissolve?

- Has the form been filed with the Chamber of Commerce?

Overall, dissolving a company generally consists of a few steps, but these can vary a lot per country. If you want to know more about dissolving your company in your native country, we suggest you hire a specialist who will take care of all important matters for you. All assets and liabilities your company has, will then be transferred to your new Dutch company, including shares. If you would like more information on this subject, don’t hesitate to contact us directly.

Intercompany Solutions can help cross borders with your company!

Always wanted to do business oversees? Now is your chance! With ever-increasing internationalization within the business sector, chances are great your company might flourish in a new country. Sometimes, the climate of a certain country can simply suit your business needs better, than your native country. This doesn’t have to be a problem anymore, with the possibility of cross-border conversion. Intercompany Solutions has helped thousands of foreign entrepreneurs to settle their business(es) in Holland with success, ranging from branch offices to headquarters of multinationals. If you have any questions about the entire process, or would simply like to chat about the options for your current business, please do not hesitate to contact us directly. Our experienced team will help you along the way.

[1] https://www.mondaq.com/shareholders/885758/european-directive-on-cross-border-conversions-mergers-and-divisions-has-been-adopted

5 business sectors enabling you to achieve success in the Netherlands

If you are a foreign entrepreneur and you are considering in which country you should set up your business, the Netherlands might just be one of your best bets right now. Even during a global pandemic, the Netherlands have maintained a stable economy with plenty of opportunities business wise. Next to being a stable country, the business climate is extremely open to unique ideas, collaboration proposals and general innovation in every sector imaginable. In this article, we will outline some sectors that are open to foreign investors and entrepreneurs, offering you possibilities for ownership of a Dutch business.

Why choose a certain sector?

If you want to establish a business, you generally have some laid out plans about the sector you want to invest your time in. In some other cases this might be different, for example when you just want to broaden your horizons, but you don’t know exactly how to accomplish that yet. In such situations, it is wise to invest some time in your genuine qualities and experience, and think about what might be the best way to invest those in a company structure. Often, the most successful companies rise up out of a combination of experience, passion and determination. Below we will outline some sectors, that are currently booming in the Netherlands.

E-commerce

One of the most profitable business options nowadays is within the field of e-commerce. This sector has been booming since the very incorporation of the internet, but until a few decades ago has been a playground for only a few lucky ones. Thankfully, the internet started to provide everyone with opportunities for the establishment of an online business and now, in 2021, the number of online business owners is exponentially growing at a stable rate. E-commerce can entail everything: from an online webshop that allows you to offer a variety of products, an online advertisement agency to various artistic professions that can be economized. It is basically a gateway to selling whatever service or product you have to offer. The amount of success highly depends on the quality of your work, as well as your ability to do business with different individuals.

Another option is to become an affiliate, for example with a stable e-commerce business like Bol.com. Bol.com is the Dutch equivalent of Amazon, and as such is very often visited. Bol.com accounts for almost 15% of all online shopping actions performed by Dutch citizens, as you can see here for example. When you become a franchisee, you don’t have to worry about factors such as keeping an inventory, as the franchiser will sort out all these details for you. Online business in the Netherlands is a very active and profitable market, provided you run a solid business and have unique ideas. If you want to know more about Bol.com, you can look at this in-depth article about becoming an official partner.

IT and engineering

Another very interesting sector in the Netherlands is IT, especially when combined with engineering. With robotics as a newly upcoming immense industry, this field will change and possibly enhance our society like never before. If you have ambitions related to this sector, the Netherlands will definitely provide you with a very fertile ground for growth and success. Many technical universities in the Netherlands are internationally renowned, such as in Delft, Eindhoven (the city of Philips) and Breda. If you would like to cross bridges between regular mechanical engineering and Artificial Intelligence, this might be the opportunity of a lifetime.

Next to highly skilled and experienced employees, you can find a vast array of interesting freelancers within these fields. This will make it easy to expand your company in due time, because of the very vast amount of well-educated, multilingual and qualified personnel. IT is a very dynamic business that changes almost constantly, which makes it a good sector for anyone who likes constant change within their field of work. Both sectors are also very profitable, mainly due to this constantly evolution. You can jump into the market at any time, provided you have innovative and sustainable ideas.

Freelance opportunities

If you would like to do business in a country with many self-employed people, the Netherlands is one of the safest bets worldwide. With a very colorful array of different universities, excellently reachable cities and plenty of opportunities to co-work, the Dutch have made a habit out of experiencing all life has to offer. This results in many small business owners, who often provide fantastic services for very reasonable prices. If you want to compete with the Dutch as a freelancer yourself, you best make sure you are up for the challenge.

The small business market is highly competitive in the Netherlands, and in general the most highly skilled and unique freelancers flourish. For larger companies this provides a good business opportunity in terms of flexible employment. Due to the high internet accessibility and nearly perfect infrastructure in the Netherlands, most employees will be able to work from home. This makes it easier to establish flexible contracts, plus you will also not have to pay any wage tax or insurance premiums.

Logistics

The Netherlands profits from a logistically very strategical position. This is due to the port of Rotterdam, and the largest national airport, Schiphol, being only approximately one hour away form each other. Hence, there are many multinational logistics companies settled near these areas, as well as many other businesses that profit from a good infrastructure. If you plan to start a business with a warehouse or suspect to own plenty of stock, the Netherlands (at the very least) offers you excellent transport possibilities, making import and export extremely easy. You also benefit from the European Union and its Single Market, which allows for free transport of goods and services throughout the entire EU, as the Dutch have been a member state since the beginning. Especially for e-commerce businesses, this is a great opportunity to trade swiftly and without too many legally necessary documents.

Life sciences sector

The life sciences sector has been in the spotlight for quite some time, especially since the start of the Covid-19 outbreak. The whole world is watching whilst plural companies try to come up with the best vaccine against it, which has resulted in a greater attention for healthcare in general. If you would like to add your expertise within this field, the Netherlands offers a very competitive and also innovative life sciences sector. The country houses many renowned pharmaceutical companies, which are often backed by research institutions and (local) universities. This offers an ample amount of possibilities in terms of groundbreaking research and solutions for existing problems. Just two days ago, researchers in Rotterdam might have possibly found a cure for arthrosis. The life science sector is all about improving life in any way possible, so if this is your niche, you will have plenty of resources in the Netherlands to accomplish your goal.

Intercompany Solutions can set up your Dutch business in just a few working days

If you would like to know more about the various sectors in the Netherlands, or how you can involve yourself with our country, you can always contact our team directly. With many years of experience assisting foreign investors and entrepreneurs with establishing a business in the Netherlands, we know exactly how to tackle all necessary actions and possible problems. Feel free to send us your questions, and we will get back to you as soon as possible.

One of the most flourishing and successful sectors in the Netherlands is the hospitality and tourism sector. On a yearly basis, approximately 45 million people go on vacation in the country. Around 20 million of these people are foreigners, making this a booming sector that is always vibrant. There are more than 4,000 hotels in the Netherlands, offering almost 150,000 rooms per night. The restaurant sector is also very lively: the country houses more than 17,000 different restaurants.

So even though there is much competition, there is also a lot of space for new ideas and innovative (interdisciplinary) possibilities. Hospitality in general is a very profitable sector to operate in, and thus, many foreign investors create horeca companies that often offer different services under the umbrella of one main company or venture. We will provide you with more information about the horeca sector in this article, as well as details about the registration and establishment procedure for any company that falls under this category.

What is the Dutch ‘horeca’ sector?

The industry that is related to tourism and the food and beverage industry is named the horeca sector in the Netherlands. The word horeca is actually an abbreviation for hotel, restaurant and café. If you have a solid business plan and know this sector a bit, you can earn a significant profit from a business in a well-known Dutch city. All horeca companies are governed by the same laws and regulations, that regulate the entire food and accommodation industry in the Netherlands. If you would like to know more about the general regulations, and, whether you can adhere to these, you can always contact Intercompany Solutions directly for a personal consultation.

Why would you choose to open a horeca company in the Netherlands?

One of the first reasons we can name to start a horeca company is the popularity of the entire market. The tourism, food and beverage industry has always been popular, since it allows people to unwind from their daily responsibilities. During the past years, this specific sector has also seen a rise in general profits, since the number of Dutch citizens that chooses to go out to eat has grown exponentially. Due to the down-to-earth Dutch nature, eating out used to be more of a luxury for most families in the past. Since a few decades, however, it’s become much more of a regular activity for citizens in the Netherlands.

It’s a sector that also changes fast, due to the continually varying preferences of the customer. If you want to invest in something sustainable, which is still open to innovation and change, the horeca sector is just the thing for you. The Dutch restaurant industry especially has been expanding during the last five years. There are two general factors contributing to this trend, according to Euromonitor. The first one is the overall steady economic stability and growth in the Netherlands, which has been at a steady pace for decades. The second reason is the previously mentioned higher customer confidence in the horeca sector, which is evident due to the higher amount of customers eating out on a daily basis.

If you want to start a restaurant or another type of horeca business in the Netherlands, you will have to keep in mind that you need to respect the Dutch legislation regarding horeca companies. You will need to adhere to a variety of rules that are aimed at consumer safety mostly. For example, there are multiple necessary licenses for some specific undertakings. If you want to know whether your company can comply to these rules, you can always ask Intercompany Solutions for advice. Below, we will outline the necessary permits that you might need as a Dutch horeca business owner.

The licenses you might need to operate a Dutch horeca company

Due to the sensitive nature of the sector, there are multiple licenses that need to be acquired before someone starts a horeca company. This is aimed mainly at consumer safety, such as guidelines regarding the way food is prepared, safety guidelines as well as hygiene regulations concerning your company. The licensing requirements when opening a horeca company in the Netherlands are quite extensive, as such establishments are created to offer a wide array of services and sell various types of products. Amongst these licenses, the most important ones are:

- The general food and drink license, which is issued by the Netherlands Food and Consumer Product Safety Authority

- If you want to serve alcoholic beverages, a beverage license is also mandatory

- If you want to start a business with a terrace adjacent to it, you will need a terrace permit for serving food and beverages

- For optimum consumer satisfaction, you can choose to play music on your premises as well. This requires a music performance license

- If you want to install a few gaming machines, you will also need a separate license to be able to do this

- If you would like to sell tobacco in your establishment, this will require a separate tobacco license as well

Next to the required permits, all horeca company owners need to comply to all existing employment regulations concerning this type of Dutch business. These regulations can vary, for example in the case of food handlers. If you would like to receive in-depth information about all the necessary regulations to adhere to, Intercompany Solutions can inform you about all legal obligations that go along with establishing a Dutch horeca company.

Opening a horeca company in Holland: general information about the food and beverage industry

Usually, every country in the world has its own unique cuisine. A very traditional Dutch meal generally consists of vegetables and potatoes with meat or fish, although the vegetarian and vegan market is greatly expanding in the Netherlands since the past decade. Next to that, due to a large amount of immigrants and expats and the former Dutch colonies, the Dutch cuisine has been influenced immensely by foreign food and dishes. If you choose to eat out in Holland, you will be able to eat anything from anywhere around the world because of this little fact. Which is exactly what makes the Dutch horeca sector so versatile.

The same applies to other businesses such as hotels, bed & breakfasts, pubs and bars. As such, the horeca industry is very broad and offers plenty of possibilities for creative entrepreneurs who feel passionate about the food and beverage sector. Opening a small hotel or hostel can also prove to be profitable, since the Netherlands is a very popular destination for all sorts of travelers: from families to backpackers and plenty of people taking short business trips. This enables you to choose almost any kind of establishment, provided you do solid research concerning your target audience. If you are interested in opening a fusion restaurant, then Holland is also a fantastic place to do business due to the extensive amount of foreign influences in the country. All in all, there are many possibilities you can explore. We strongly advise getting assistance from a third party, in order to create a good business plan, and know your strengths and possible pitfalls before you start.

What types of establishments can you set up?

There is a vast array of possible horeca companies you can choose to establish in the Netherlands. All these companies need to comply to the corresponding regulations, and consist of businesses that are categorized into a few subgroups. These subgroups are necessary in order to foresee the strain the company might have on its direct environment. For example, it would be rather difficult to open a nightclub in a residential area with many children, as this would cause a massive nuisance for the people living in that neighborhood. You can find all the categories and establishments below.

Category I: light horeca companies

These consist of businesses that, in principle, only need to be open during the day and possibly in the (early) evening. These businesses are mainly focused on the provision of food and meals, and therefore cause only limited nuisance to local residents. Within this category, the following subcategories are distinguished:

Ia - Hospitality related to the retail sector, such as:

- Automatic food supply

- Sandwich shop

- Cafeteria

- Coffee bar

- Lunchroom

- Ice cream parlor

- Dutch ‘snackbar’

- Tearoom

- Caterer

Ib - Other light catering, such as:

- Bistro

- Restaurant

- Hotel

Ic - Companies that attract relatively large traffic, such as:

- Companies referred to under 1a and 1b with a business surface of more than 250 m2

- Takeaway and delivery restaurants

Category II: medium horeca companies

The next level are businesses that are normally also open at night and can therefore cause significant nuisance to local residents, such as:

- Bar

- Beer house

- Billiard Center

- Café

- Tasting room

- Room rental (without a regular use for parties and music/dance events)

Category III: heavy horeca companies

These are all companies that are also open at night, in order to function properly. These companies generally also attract numerous visitors and can therefore cause major nuisance to the direct environment, such as:

- Discotheque

- Nightclub

- Party center (regular use for parties and music/dance events)

Sometimes there is an overlap in business type, such as hotels that own a bar, or have a restaurant on the premises. In such cases, you will need to research well which permits you will need. Our company formation experts can assist you in registering and opening any of the food establishments that are mentioned above.

Requirements to start a food and beverage establishment in the Netherlands

If you want to open a restaurant, hotel or bar, you will need to obtain certain approvals from the Dutch government and several other authorities. This includes all the necessary permits, but also factors such as adherence to the hygiene code as described by the Netherlands Food and Consumer Product Safety Authority. All regulations and laws are based on applicable EU legislation, such as regulations regarding the transportation, preparation and processing of food and beverages. Next to that, any horeca company in the Netherlands dealing with food and beverages needs to observe and comply to the statutory regulations of the Hazard Analysis and Critical Control Points system (HACCP). This system provides plenty of invaluable information, such as the way you should handle and produce food in order for it to be safely consumed.

The steps involved to establish a Dutch horeca company

The steps for setting up a Dutch horeca company are the same as for any other type of business, but there are some extra actions to be carried out. This entails, for example, obtaining all the necessary permits. The first step is always the business plan, which should contain all the information that you need to establish a company. Once you have a broad outline regarding your preferences, you will need to register your company at the Dutch Chamber of Commerce. Once this is done, you will also automatically receive a VAT number from the Dutch Tax Authorities.

But this is definitely not all you need to do! As explained earlier, at this point it’s important to obtain all the necessary licenses and permits. If you are a foreign investor, you will also need a residence permit for your company, or the company you will be investing in. Once you have all the licenses and permits, then you can proceed with the incorporation process. After receiving your registration numbers and information, you can think further about the location of your new business. If you intend to build an entirely new establishment, you will have to obtain a construction permit. Most entrepreneurs prefer to buy or rent an already existing building, which can be remodeled and renovated to your exact preferences.

Once you have all credentials and a location, you will need to inform yourself about all the hygiene and food safety regulations that you need to comply with. Once you decide to hire staff, you will also have to prepare an evaluation plan and a risk inventory. Intercompany Solutions can assist you during all steps of this process, so you can rest assured that all regulations and responsibilities are met.

Special design requirements for food and beverage establishments

One factor to keep in mind when you choose an appropriate building for your horeca establishment, is the layout of your future company. This is neatly written down in the Dutch Establishments Layout Requirements Act, which needs to be adhered to. This specific law prescribes how the spaces in the building need to be designed, especially the spaces where you cook, store, process and serve food. Some of the most important requirements are as follows:

- At all times, the kitchen needs to be separate from the space where you serve food and beverages

- The building needs to contain at least two separate toilets with adequate facilities to wash your hands

- You need to install a ventilation system, which definitely needs to be connected to the kitchen

- The entire building needs to be connected to a modern electrical system

- The building also needs to be connected to a clean and proper water supply line

- You need to have at least one telephone in the building

Another important regulation concerns noise levels. These need to be respected at all times, otherwise you can expect the Dutch police on your doorstep. Please keep in mind that all these laws and regulations are very tightly controlled and often inspected. If an inspector comes, and you don’t comply with one or more law or regulation, your company can be shut down almost immediately, until you resolve the problem. This could cost you a significant amount of profit, so make sure you comply to all laws at all times.

Staffing requirements for horeca companies in the Netherlands

If you open a horeca company, you will inevitably need to hire staff to take care of all daily business activities. The general regulations regarding hiring staff in the Netherlands apply, with some possible additions. For example, if you want to open an establishment that serves alcoholic beverages, you will need to make sure that your entire staff is at least 16 years of age. Next to that, your staff also needs to complete some mandatory courses about the sector, in order for them to be able to prove that they are informed about all food safety and hygiene regulations imposed in the Netherlands. This can be proven by certain declarations of personal hygiene, as well as their professional competence. The (general) manager of the company must be at least 21 years of age. If the business is an association, or in the case that there are multiple managers, then all business partners need to adhere to this requirement.

Are there any other factors to consider?

If you are a foreigner who is interested in starting a Dutch horeca business, or an investor within this sector, then the above-mentioned information provides you with a broad outline regarding all the laws and regulations that govern this sector. Next to all the necessary licenses and permits, there are other factors to consider. For example, the fire safety of the building is an important matter to tend to. The local police department in the region you establish your company will inspect your premises before you open, in order to make sure that you comply to all important rules. You will then be issued a fire safety certificate, if you comply to all necessary laws.

Another important subject is the existence of environmental regulations regarding the disposal of waste. As such, materials such as cooking oil and other substances that can impact the environment negatively, need to be collected in special recipients and deposited in these, before you dispose of the waste. You also need to register any restaurant with the Dutch Food and Consumer Product Safety Authority, this is mandatory for all establishments in the Netherlands that sell food and beverages. This authority will approve your company’s hygiene plan.

Intercompany Solutions can register your horeca company in just a few business days

As you can see, establishing a horeca company in the Netherlands requires a lot of administrative actions and paperwork. As a (starting) foreign entrepreneur, we understand that this can seem like an impossible task to carry out by yourself. Intercompany Solutions has many years of experience within the field of Dutch company registration. We can take care of the entire process for you, enabling you to focus solely on your business endeavor. Want to know more about our services? Feel free to contact us for more information, or if you would like to receive a personal quote.

Sources:

https://www.cbs.nl/nl-nl/cijfers/detail/84040NED

What are the benefits of establishing a Dutch holding BV company?

If you are thinking about establishing a multinational in the Netherlands, a holding structure is probably exactly what you need. Starting a business oversees can be a tedious task, especially if you are not well-acquainted with the laws and regulations of a specific country. This also entails choosing a legal entity for your business, which can be tricky if you have no prior knowledge about this subject. The legal entity is basically the ‘form’ your business will have. Some legal entities also have legal personalities, whilst others do not. Such details are important, because it regulates factors such as liability and the amount of taxes you will have to pay.

The Netherlands has a vast array of legal entities available, making it possible to tailor your business form to your personal needs and preferences. The best choice for your business depends on a few factors, but in general the Dutch BV is the one of the most chosen company forms in the Netherlands. This legal entity makes it possible to issue shares, and dissolves personal liability for any debts the company makes. In most cases, a Dutch BV with a holding structure could be the most beneficial option. This is especially true for multinational and/or large organizations, since this structure makes it possible to divide various parts of your business.

Forming a holding business requires a professional approach

If you are interested in setting up a holding structure, we advise you to inform yourself about all Dutch legal entities and decide for yourself, what the best choice might be for you. Intercompany Solutions is also ready to assist you with any questions you might have. We understand that a large corporation would prefer professional advice regarding the best location for their European headquarters, since this combines our professional expertise with logical and timely planning – which saves you both money and time. You can potentially set up a holding structure in just a few business days, provided you have all the necessary information at hand.

What exactly can be defined as a holding structure?

When you establish a business with a holding structure, this comprises a Dutch holding BV and one or multiple entrepreneurial BV’s, which are sometimes also referred to as subsidiaries. The role of the holding BV is administrative in nature, as it involves controlling and monitoring the activities of the underlying BV’s. It also deals with all external stakeholders. The entrepreneurial BV’s are aimed at the daily business activities of the company, i.e. gaining and creating profit and extra sources of value. You can thus separate your assets and keep a broad overview of your entire company and its structure.

Benefits of owning a holding company in the Netherlands

One of the main benefits of a Dutch holding is that this legal entity is very advantageous from a tax point of view. This is only true, of course, if you want to generate profits with your business endeavor. Due to the so-called participation exemption, the profit, on which you have already paid tax in the entrepreneurial BV, is not taxed again in the holding company. As a result, you can easily get your profit from your entrepreneurial BV without paying any tax, via a dividend payment to your holding company. You can then also use this profit in your holding company for reinvestment(s), or to provide a mortgage loan to yourself. If you do not have a holding company, however, you must pay tax via box 2 if you distribute the profit to yourself.

You can also cover your risks when you own a holding structure, because this ensures that you separate your activities from your assets. This can be anything, such as your profits of course, but also your website and trademark rights. By placing these assets in your holding company, you cannot ‘lose’ them if the entrepreneurial BV should go bankrupt. When the bankruptcy is being settled, the insolvency administrator cannot access the assets in the holding company. But when the assets are in the entrepreneurial BV, on the other hand, he can access these assets. The same applies to third parties who have claims on the entrepreneurial BV. If valuable items are housed in the holding company, it is not possible for third parties to claim these.

5 reasons why you should definitely establish a (holding) company in the Netherlands

If you are thinking about setting up an oversees business, there are probably many options you are considering. This might involve the location of your business, the approximate size and details such as whether you want to hire staff. But there are other elements that have an impact on the possible success of your company, such as the general economic climate in the country you wish to establish your business. The Netherlands is consistently ranked high in many top lists concerning countries, that are rated excellent for business opportunities, economic wealth and stability as well as innovation in every sector. The Netherlands also has a very welcoming climate for multinationals and holding companies, which is why some of the world’s biggest names are settled here like Netflix, Tesla, Nike, Discovery, Panasonic and now also the EMA (European Medicine Agency).

One of the main benefits of a Dutch company, is the multitude of interesting tax incentives and the relatively low corporate tax rate. The Netherlands actually has quite a history as a well-known jurisdiction regarding company structures, especially when it comes to asset protection and tax planning. If you are serious about your business and invest time in a correct administration, the Netherlands can offer you many benefits for your international business. The Dutch business climate is highly competitive, and thus, you are expected to actively invest in Dutch expansion and innovation. If you want to benefit from something, it’s always good to offer something else in return. This also makes it nearly impossible to establish an artificial presence in the Netherlands, whilst still expecting to take advantage of all the tax benefits the country has to offer.

- The Netherlands provides a gateway to Europe and the entire international market

One of the largest attractions in the Netherlands business wise, is the access to two internationally renowned logistic hubs: Schiphol airport and the port of Rotterdam. One of the main reasons for establishing a holding company at a certain location, is the access to gateways to international trade and markets. If you want your business to succeed in a relatively competitive situation, it’s essential that you have access to a wide plethora of markets in a short amount of time. Around 95% of the most lucrative markets in Europe are reachable within just 24 hours from the Netherlands, and Amsterdam and Rotterdam are only 1 hour apart from each other. Both the port and the airport are directly connected to one of the best rail networks in Europe, which also offers high-speed connections to large cities Such as Paris, London, Frankfurt and Brussels.

Next to that, the Netherlands’ position along the North Sea also offers many possibilities and benefits. The port of Rotterdam was home to no less than 436.8 million tons of cargo in 2020 alone, even during the pandemic. If you would like to read some interesting facts about the port of Rotterdam, you can look at this leaflet. The sea is connected to an extensive river delta in the country itself., including three deepwater ports, which means you can easily transport goods into and out of Europe via this route. The Netherlands also benefits from a world-class infrastructure, backed by the latest technology and continuous innovation.

- Access to highly advanced technology

The Netherlands is very well known for its innovative and unique technological solutions, which are also backed by multiple universities that constantly invest in the future of the country, and the whole world. If you want your multinational company to grow quickly, you will need access to high-quality infrastructure, technology and human resources. This especially involves trustable and professional service providers, who can help you source for intellectual property and new technologies. The Netherlands has everything you need!

Furthermore, the Amsterdam Internet Exchange (AMS-IX) is the largest data traffic hub worldwide, which is quite an example. This concerns both the total traffic, as well as the total number of members. The Netherlands is also ranked 7th place in the world for technological readiness on the World Economic Forum list. On average, you can expect one of the fastest internet speeds in the Netherlands when compared to Europe entirely. This above par digital infrastructure is what makes the Netherlands so attractive for foreign multinationals.

- The Netherlands houses exceptional and multilingual talent

Due to the small size of the Netherlands, you can find an extremely high concentration of expertise, knowledge and skills within a very compact area. In contrast to many bigger countries, where resources are further apart and scattered. The Netherlands also houses renowned research institutes, as well as very interesting partnerships between the private and the public sector. This interdisciplinary approach involves universities and knowledge centers, the entire business industry as well as the Dutch government. The Netherlands also has a very old tradition of involving foreign investors and entrepreneurs, in order to advance and accelerate growth in nearly all imaginable sectors. These include huge sectors such as IT, life sciences, high-tech systems, agri-food, the chemical sector and of course the health sector.

Regarding personnel, you can rest assured that the Netherlands is one of the best countries in the world to find highly skilled, well-educated and experienced employees and professionals. Due to the large amount of excellent universities and masters programs, the Dutch workforce is known worldwide for its expertise. Next to being well-educated, almost all Dutch natives are bilingual. If you look for highly qualified personnel, you can even expect employees to be trilingual. The gross salary in the Netherlands is relatively high compared to some other countries in The south and east of Europe, but there are little to no labor disputes. This makes the cost of Dutch labor highly competitive and worthwhile.

- The Netherlands provides much in terms of efficiency gains

As a multinational and/or holding, establishing efficiency in the way you do business is crucial. A very well-known motive to start a holding company in Europe, or to expand your already existing multinational, is access to the European Single Market. This allows you to freely trade goods and services in all Member States, without the hassle of extensive customs regulations and border agreements. As such, it is very easy to streamline your European activities such as sales, manufacturing, research & development and distribution from solely one headquarters. This significantly reduces your overhead costs.

The Netherlands provides one of the best bases for a multinational operation, since its access to Europe and the international market is almost unparalleled. The Netherlands has always been on the forefront of worldwide trade, and this is still visible in the current culture and business climate. In the latest World Bank’s Logistics Performance Index, the Netherlands was ranked 6th in 2018. The country especially scores high in terms of the efficiency of its customs and border procedures, but also regarding the high quality logistics and IT infrastructure, the very high level of professionalism in the entire sector and the many easy and affordable shipping options. According to the DHL Global Connectedness Index, The Netherlands is still the world’s most globally connected country in 2020. This has been consistently so for years.

- Excellent business climate and tax conditions

Due to the very stable political and economic climate, the Netherlands houses many internationally known multinationals. If you would like to profit from a more attractive business climate, for example one that is better than the country you currently reside in, this country will suit you well. The Netherlands is a perfect base for optimizing your current tax situation, as well as for the protection of your assets and investments. The Netherlands is somewhat considered as a safe haven and also a tax haven, although the last depends on the legitimacy of your business. Criminal activities will not be tolerated.

Nonetheless, the country offers a welcoming and safe climate for entrepreneurs, who otherwise suffer from a rather poor business climate in their native or home country. The country’s economy is naturally very open and also internationally oriented, since it is one of the main goals of the Dutch government to make the international flow of goods, services and capital completely possible without any obstacles whatsoever. One of the main benefits of the Netherlands is also the legal system. The system has plenty of checks and balances, making the legal framework very trustworthy, professional and flexible as well.

How to establish a holding company in the Netherlands, and what should you definitely consider?

When you want to set up a completely new holding company (meaning you don’t already own a multinational company), there are some choices to make and factors to consider. One of the first questions you should ask yourself, is whether you want to start the company alone, or with other people. It is strongly advisable to set up your own holding company, without any other shareholders. This is also named a ‘personal holding company’. If you set up a personal holding company, you can prevent, amongst other things, problems with making certain decisions. This can involve decisions such as profit distribution, or your salary. With a personal holding company, you can make all these decisions yourself. In addition, you no longer have many of the advantages of the holding company when the holding company is not a ‘personal holding company’. For example, you are unable to set up other BV’s yourself, due to the fact that you don’t own the holding company by yourself.

It’s best to establish your holding company in one go

In some cases, new entrepreneurs establish only a Dutch BV, and afterwards find out they would have been much better off with a holding structure from the beginning. For example, it can cost you much more money if you first start your entrepreneurial BV, and only later your holding company. In such cases, you will have to transfer or sell your shares in the entrepreneurial BV to the holding company. You also have to pay income tax on the exact purchase price. The problem with this is, that your entrepreneurial BV often becomes more valuable over time. And the higher the purchase price, the higher the tax you will have to pay to the Dutch government. Avoid this higher tax by setting up your holding structure in one go. If you already own a work BV, it is still possible to set up a holding structure. In that case, keep in mind that a share transfer must take place, whereby the shares of the entrepreneurial BV are transferred to the personal holding company.

What about taxation of a holding company?

A huge benefit of the Dutch tax system is its very low tax rates, compared worldwide. The corporate tax rate is 19% for a profit up to 200,000 euros in 2024. Above that sum, you pay 25.8% in corporate tax. Next to that, the Dutch extensive network of tax treaties as well as the participation exemption regime work to avoid double taxation for all (foreign) companies, that might have to deal with taxation in multiple countries. A nice detail, is that the Dutch Tax Authorities have a very cooperative attitude, and aim to help any entrepreneur along the way in every possible situation.

There are also certain tax incentives available for new and existing entrepreneurs, often to encourage investing in the research & development department. As we stated many times in this article, the Dutch are very interested in innovation and progress. So basically every entrepreneur who enters the Dutch market with such ambitions, will be very welcomed here. These incentives involve the Innovation Box, for example, taxing the income you have derived from IP at a lower tax rate. Furthermore, you can acquire the so-called ‘WBSO-status’, which allows subsidies on certain salary taxes. This mainly involves employees involved in research and development.

One very important factor to consider are the Dutch substance requirements, in order to even be able to benefit from certain Dutch tax incentives. These requirements state, that the management of your holding company must be situated in the Netherlands. Nonetheless, there is no direct requirement to appoint Dutch board members. There is also no necessity to own a physical location in the Netherlands, or have a Dutch bank account. Once your company starts to become engaged in business activities, however, and you start making profit, these factors should be reconsidered for further benefits.

How to establish a holding company in the Netherlands?

The process of establishing a holding company is actually the same as setting up a Dutch BV, with the difference that you are setting up multiple BV’s at the same time. A holding is also considered a Dutch BV, after all, but with a different purpose than an entrepreneurial BV. So the steps involved are exactly the same, just with more companies involved. The first step in establishing a holding company, is deciding the legal entity. As said, a BV will be the best option in 90% of all cases but other legal entities are also able to act as a holding company, such as the foundation.