Incorporate a Dutch BV

Updated on 19 February 2024

How to incorporate a Dutch BV: a step to step guide

If you want to jumpstart your business, perhaps you should think to incorporate a Dutch BV. Not only will moving to the Netherlands provide you with a lot of interesting business opportunities; but you can also benefit from lower tax rates and a whole new area with millions of new potential customers. If you want to make a smart decision then a country based in the EU is your best option. The EU gives you the opportunity to benefit from the single market, meaning that all goods and services can be exchanged freely within the borders of the European Union. One of the most stable and competitive member states of the EU is the Netherlands. This small country has proven its worth throughout the centuries: from the infamous 17th ‘golden’ century until today, this country stayed ahead of many others in business as well as other entrepreneurial achievements. Read on for more information about the Netherlands, why registering a business in Holland is a wise decision and why incorporating a Dutch BV will immensely aid you in attaining your business goals.

Why register a company abroad?

One of the main reasons for starting a foreign business is the adventure of it all. You will not only get the chance to tap into a completely new market, but you can benefit from several different opportunities too. For instance; tax rates and regulations might be much less severe than in your native country. Next to that, countries like the Netherlands are famous for their positive economic climate and stability. It’s pretty obvious that your business can only profit from such benefits. Some entrepreneurs shy away from taking such chances, because they wrongly believe it’s difficult and far-fetched to be able to register a business in another country. The truth is quite the contrary: opening a Dutch BV is a very straightforward and quick process, that does not even require you to be in the Netherlands physically. If you want to expand your business or are simply looking for opportunities abroad, starting a Dutch BV will provide you with ample amounts of options and opportunities.

Looking for a good tax rate?

When entrepreneurs want to start a business, one of the first things they consider is the lowest possible tax rate. After all; no one really likes to give away their hard-earned cash to the local government. In the Netherlands you are in luck, as you can find one of the most competitive tax rates in the entire EU.

From 2024 the corporate income tax rates will be 19% for all profits that do not exceed 200.000 euro and 25,8% taxes for all profits above 200.000 euro. Which inevitably makes Holland a very interesting tax jurisdiction for many investors and entrepreneurs.

Corporate Income tax Netherlands

2024: 19% below €200.000, 25,8% above

Corporate Income Tax Rates

Germany: 30%

France: 25,8%

Luxembourg: 25%

Belgium: 25%

Netherlands: 19-25,8%

The various business types in the Netherlands:

One of the most important questions you need to ask yourself when starting a business overseas is the type of legal entity you prefer. This mainly depends on your specific business goals and ambitions, such as the size of your company, the amount of profit you assume to be generating in the future and the amount of personal liability you feel comfortable with. In our experience an incorporated business structure works best, since you limit your personal liability this way. This means that any business loans or debts will never be recovered by depleting your personal assets. In the summary below you can find a brief description of every available Dutch business type.

1. Unincorporated business structures:

A Single Person Business – ‘Eenmanszaak’:

A General Partnership – ‘Vennootschap Onder Firma Or VOF’:

A Limited Partnership – ‘Commanditaire Vennootschap Or CV’:

A Commercial Or Professional Partnership – ‘Maatschap’:

2. Incorporated business structures:

A Private Limited Company – ‘Besloten Vennootschap Or BV’:

A Public Limited Company – ‘Naamloze Vennootschap Or NV’:

Cooperative And Mutual Insurance Society – ‘Coöperatie En Onderlinge Waarborgmaatschappij’:

A Foundation – ‘Stichting’:

An Association – ‘Vereniging’:

Why incorporate a Dutch BV?

There are several benefits to incorporating a Dutch BV. And we do not just mean the benefits of having a Dutch business, but the fact that a Dutch BV offers many opportunities and gives you plenty amount of freedom in deciding how you want to structure your business. One of the main benefits is, of course, the limited liability. Not a single shareholder carries any personal liability for debts the company made.

Also there is the lowered minimum share capital since the introduction of the Flex-BV. Before this date, everyone needed a minimum of 18.000 euros just to be able to incorporate a Dutch BV. Nowadays this amount is lowered to a single euro. This means that solid start-ups and innovative entrepreneurs with little savings can also get their chance to do business on a professional level. Next to these two obvious benefits, you also have access to many subsidies if your idea is interesting enough. Furthermore, with a Dutch BV you can benefit from several reduced tax rates regarding the withholding of taxes on royalties, interest and dividends. There is also a minimum taxation of gains coming from share sales in the country of establishment.

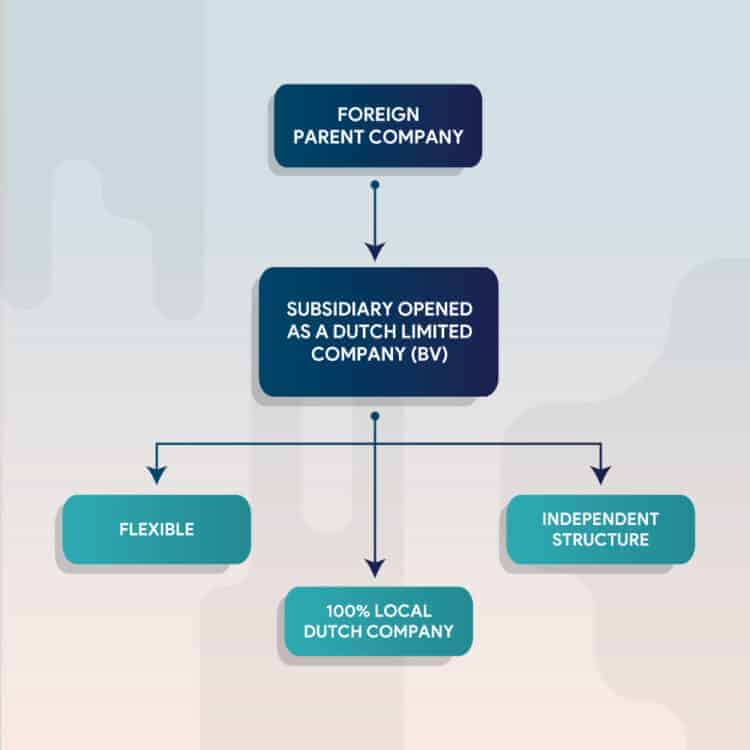

The Dutch BV holding structure in a nutshell

If you want to start a Dutch BV, you might want to consider a holding structure. This is not only a very logical and secure way to incorporate your business, but it also is cost-effective in the long run. A holding is nothing more than a legal entity that can only hold assets. This means that a holding company does not carry any risks nor liabilities associated with the general activities and operations of its subsidiaries. A subsidiary, in turn, is a legal entity that is involved in trade or services. As such, with a subsidiary you can perform all your normal business activities. The subsidiary will indeed be liable for its operations, but the overarching holding will not be. Thus, suppliers and creditors may file claims against the subsidiary but not against the holding. This greatly limits the risks for your core business, as the holding will always be safe from such liabilities. The Dutch BV holding structure has some main characteristics:

- Every holding structure includes at least two separate private limited companies (BV’s)

- One of all BV’s is a holding without any business activities

- The other BV(‘s) are all subsidiaries that engage in daily business activities

- The holding’s shares are owned by the investor/business starter

- The holding company is the owner of all the shares of all subsidiaries

Some good reasons to choose a Dutch BV holding structure

There are a few main reasons for entrepreneurs choosing to incorporate a Dutch BV holding structure. The first one is the obvious avoidance of various risks. With a BV holding structure you do not have any personal liability, plus the capital of the active company can be protected. Assets such as profits and pension provisions are safe from any business risks. There is a second large benefit, namely several possible tax advantages. There are structures in place that aid you in profiting from having a Dutch BV. One of these opportunities is the participation exemption, which allows the owner of any Dutch BV to sell their company and transfer profits to the holding BV without paying any taxes over the profit itself. If you are interested in all the benefits that come with incorporating a Dutch BV holding structure, never hesitate to contact us for advice. There are a few surefire reasons that make a Dutch BV holding structure the perfect fit for your company, if:

- It is reasonably imaginable that you will sell your company one day. This brings the previously mentioned tax advantage into play: it will allow you to transfer the profit of the sale to the holding BV free of taxation.

- You would like an extra layer of risk protection for your business capita

- You are interested in a flexible business structure that also has fiscal benefits in the Netherlands

How to incorporate a Dutch BV?

After you have chosen a specific business type, it’s time to start the procedure that will actually establish your business. This basically entails of filling out the necessary paperwork, providing us with correct information and waiting two days. You do not even need to come to the Netherlands, like we previously mentioned. For a clear overview of the steps involved we have summarized these for you:

Step 1

We first need to check a few things, such as:

Step 2

Step 3

How long does it take to incorporate a Dutch BV?

- We have created an overview of the time it takes to finish the aforementioned steps from A to Z:

- Preparing, signing and sending the necessary documentation: max. 5 hours

- Verification and authentication of all received documents: max. 2 business days

- Drafting the notary documents for company incorporation, registering the company in the Dutch company registrar and obtaining the company registration number, obtaining the tax identification number, opening of a Dutch bank account: max. 1 day

- Registering the company for VAT: max. 2 weeks

What are the costs of starting a business in Netherlands?

We would love to provide you with a fixed price for the incorporation of a Dutch BV, but the reality is that every single business requires a personal approach. It depends on different factors such as the business type, certain permits needed and the amount of time in which you can provide us with all necessary documents. There are a few general fees however, that you can take into consideration:

- The preparation of all documents

- The fee for registering a Dutch company at the Dutch Chamber of Commerce

- The fee for registration at the Dutch tax authorities

- Incorporation fees that cover the formation of the company and extra services like opening a bank account

- The fees for assistance with obtaining the VAT number and (optional) EORI number

If you would like a personal quote, please contact us at any given moment. We are always happy to discuss your business ideals and give you a chance to implement them in the Netherlands.

Similar Posts:

- Foreign multinational corporations & the Netherlands annual budget

- How to set up a business as a young entrepreneur

- Want to innovate in the green energy or clean tech sector? Start your business in the Netherlands

- Tax treaty denounced between the Netherlands and Russia per January the 1st, 2022

- The challenges of starting entrepreneurs