Accounting services in the Netherlands

Whether you operate a Dutch BV, holding company, or international branch, we simplify accounting and VAT administration so you can focus on growing your business.

Our Core Accounting Services

1. Corporate Accounting (Dutch BV and Holding)

We provide full-service bookkeeping and corporate accounting for Dutch entities, including:

- Complete financial administration for the fiscal year

- Preparation and submission of the annual corporate income tax return (VPB)

- Drafting and filing of annual financial statements with the Dutch Chamber of Commerce (KvK)

- Management of shareholder agreements and annual reports

- Periodic financial reviews and compliance checks

2. Netherlands VAT Filings

We manage all aspects of Dutch VAT (BTW) compliance, including:

- Quarterly VAT filings

- Annual VAT returns and adjustments

- VAT registration and deregistration

- Article 23 license applications (for import/export VAT deferral)

- Intra-Community (ICP) declarations and European OSS filings

3. European OSS and ICP Filings

For companies selling goods or services across EU borders, we handle:

- OSS (One Stop Shop) filings for EU B2C sales

- ICP declarations for intra-EU B2B transactions

- Cross-border compliance and reconciliation support

4. Annual Statements and Corporate Tax

Every Dutch BV must file an annual statement and corporate income tax return (VPB).

We prepare, review, and submit your reports according to Dutch accounting standards, ensuring all legal requirements are met — even for low-transaction or inactive companies.

Our Continuous Administration Services

Administrative, tax-related and financial services we offer

Intercompany Solutions has already assisted thousands of companies with the entire process of doing business in the Netherlands. This includes a wide array of administrative and financial services from A to Z. We have a clear understanding of all the various industries in the country, including all relevant fiscal and tax requirements to adhere to. We can also assist with the following matters:

- Application of VAT & EORI Number

- Checking a VAT Number

- Dutch Substance Requirements

- How you can claim back paid VAT

- The requirements for Dutch invoices

- Finding out whether your Dutch company is a tax resident

- Processing EU Transactions in VAT Return

- ABC Transactions

- Providing information about administrative and audit requirements

- Tax Liabilities For Residents & Non-Residents

- Inform you about all deductible expenses

- We can prepare financial statements for you

- We can also assist you with other matters

Tax and Fiscal Consultancy

If you are planning to start a Dutch company or already own a business in the Netherlands, it is important to think about a solid tax strategy and manage your finances well. Intercompany Solutions can assist you with information about the Dutch tax regulations and answer your questions in this regard.

Payroll Services

Our financial specialists have experience in payroll services, especially for foreign business owners who potentially want to hire personnel and expats. We can assist you during the process of hiring staff, for example, by applying for the Wage Tax ID.

Some Of Our Recent Clients

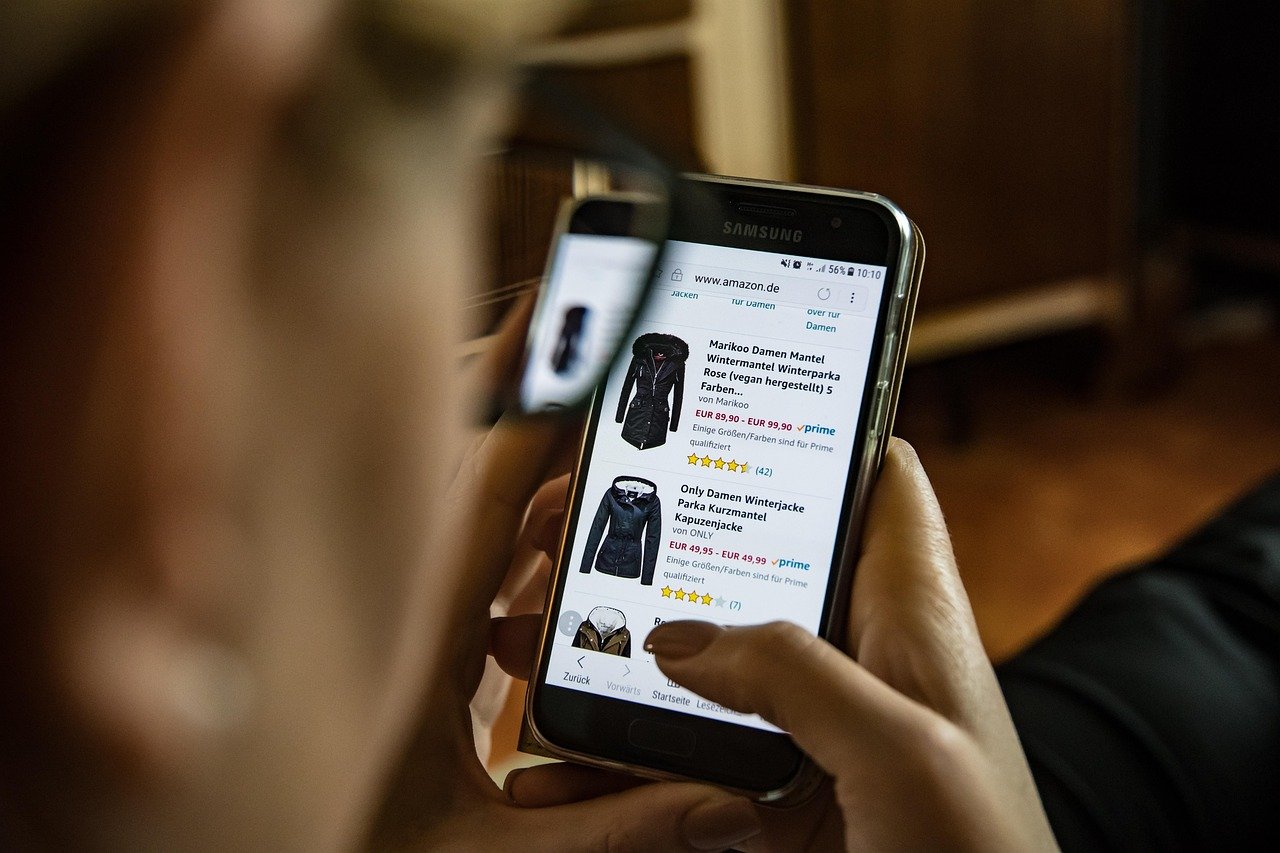

Accounting for E-commerce and Webshops

We offer:

- Integration with your webshop via Premarc software

- Automated transaction processing and reconciliation

- VAT and OSS filings for EU sales

- Real-time financial reporting and guidance

Our accountants directly assist with implementation to ensure seamless operation between your webshop and accounting system.

Find here more information on E-commerce accounting.

Frequently Asked Questions

On Accounting

Do I need to have a Dutch director for my Netherlands company’s tax status?

If I don’t have any transactions, why would I need to have accounting services?

What is the added value for me to have a Dutch accountant?

Am I, as foreign entrepreneur required to know all accounting and tax requirements in the Netherlands?

What other services do you offer?

What is the benefit of having ICS request a VAT number for my firm?

Why Choose Intercompany Solutions?

Integrated solutions

Fast, reliable support

with fixed annual pricing