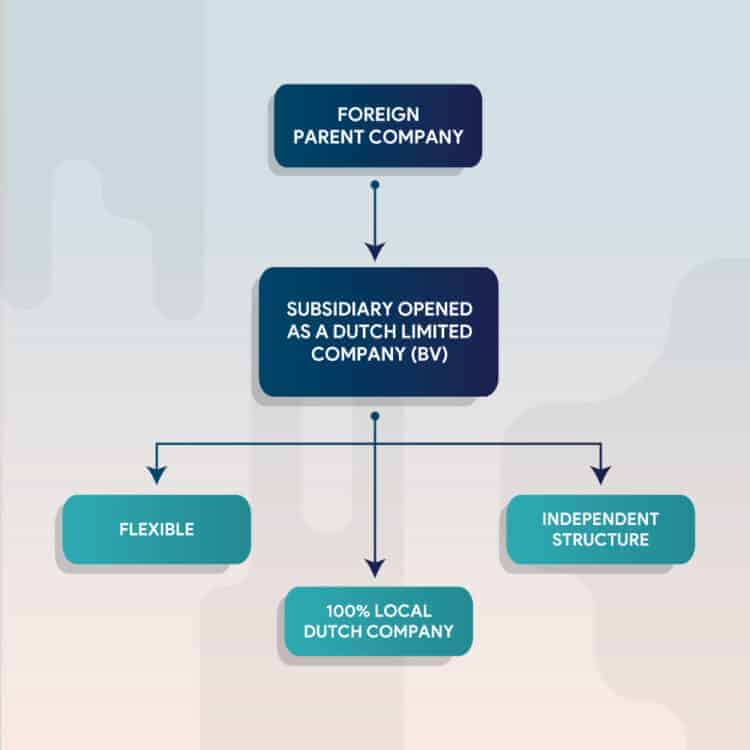

The Private Limited Company (BV in Dutch) holding structure saves money and mitigates business-related risks.

As a minimum, the holding structure includes two companies: one is the active company performing business operations, and the other is a personal company holding shares issued by the active company. The law does not differentiate between BVs with respect to their function, therefore the terms “Active BV” and “Holding BV” have no legal meaning.

What is the general structure of a BV holding?

Two Dutch BVs are incorporated using the services of a notary. The first BV performs the business operations of the structure (Active BV). The second BV is a holding company which remains mostly inactive (Holding BV). The owner of the business holds all shares issued by the Holding which, in turn, holds the Active BV’s shares. Our explainer video explains different aspects of the Dutch BV and the Holding structure.

If two shareholders (SH 1 and SH 2) plan to set up a single active company and to hold equal amounts of its shares, the usual scenario is the following: One active BV performing real business operations is incorporated using the services of a notary. Then two holding companies are incorporated above the active company. Both of them own 50% of the active BV. Holding 1 is fully owned by SH 1, while Holding 2 is fully owned by SH 2.

Advantages of the holding structure

The Dutch holding offers two main advantages to entrepreneurs with respect to their business: lower tax burden and decreased business risk. Holding structures may provide tax advantages. The main benefit is the Dutch participation exemption (“deelnemingsvrijstelling” in Dutch).

For instance profits generated by selling the active company and transferred to the holding company are exempt from profit tax. Also, operating from a local holding structure involves a lower risk. The holding BV serves the function of an additional layer between the owner of the business and the actual business activity. Your holding structure can be set up to protect the equity of the company. You can accumulate pension provisions and profits safeguarded from business risks.

How to know if a Dutch holding structure is suitable for your company?

Most tax advisors in the Netherlands would say that setting up just one private limited company is never enough. The incorporation of a holding where the owner of the business is the shareholder is usually more beneficial in comparison to a single BV. In particular situations we certainly recommend setting up a holding, e.g. in case your industry involves higher business risks. The holding BV provides an additional layer of protection between you as the business owner and your actual business activities.

Another valid reason to open a holding is if you are intending to sell the company at some future point. The profits from selling the business will be transferred free of tax to the holding BV thanks to the participation exemption or “deelnemingsvrijstelling” (described in more detail below).

Practical advantage of the holding structure

When you sell (partially or entirely) the shares issued by your Active BV, the profits from the sale are transferred to the Holding BV. Holding companies do not pay taxes on realized profits from selling shares issued by Active BVs. The resources accumulated by the holding can be used for reinvestment in another business or retirement benefits.

If you own shares of the active company, but you have not yet established a holding, you will need to pay from 19 to 25,8% corporate tax with respect to the profit in 2024.

Profits taxation

2024: 19% below €200.000, 25,8% above

In case your holding owns shares in multiple private limited companies, you don’t need to pay off a wage from each stake. This saves money from income tax, administrative procedures and fees. If the holding owns ≥95% of the active BV’s shares, the two private limited companies can file a request to be treated as a single fiscal unit by the Tax Administration.

This allows you to easily settle expenditures between the two companies and gives you an advantage with respect to the annual tax liabilities. The active company (subsidiary) and the holding (parent company) are considered as one taxpayer and therefore you are obliged to submit one tax return for two private limited companies. By keeping shares and profit reserves (including real estate, pensions savings, company cars) in a holding, you are protected from losing accumulated gains if the active company goes bankrupt.

Participation exemption (deelnemingsvrijstelling)

Both the holding and the active limited companies need to pay income tax. Still, double taxation of profit is avoided thanks to the so called participation exemption. According to this measure profits/dividends of the active business can be transferred to the holding free of taxes on corporate income and dividends. The main condition that needs to be met in order for this measure to take effect is that ≥5% of the active company’s shares are owned by the holding. Our specialists can support you throughout the process of company establishment. Please, contact us, to receive guidance and further information.

Headquarters in the Netherlands

The Netherlands has a strategic central location with respect to the largest markets in Europe. The country is a veritable magnet for foreign businesses and firmly holds its place among the leading sites for regional or European headquarters. In this respect particularly the conurbation of Western Holland offers enough space and locations.

The Netherlands is recognized for its business supporting environment, international orientation, superior technology infrastructure & logistics, and highly qualified workforce. It is among the most dynamic industrial and trading hubs in the EU, offering companies the perfect atmosphere for successful competition in Europe.

Distribution and logistics

The Netherlands is 6th in the global rating for overall performance in logistics. It is a centre for international distribution and logistics operations. Actually the country hosts more European centres of distribution than its major neighbours combined.

The national infrastructure for transportation and logistics in combination with the presence of first-class providers of logistic services is a significant asset to businesses intending to start international distribution/logistics operations on the European continent.

Start-up in Holland

Holland is internationally recognized for its welcoming culture and highlight on innovation and entrepreneurship. The country has developed a collaborative, vibrant start-up ecosystem. As a matter of fact, Holland is rated first in the European Union for its business climate for start-ups, according to EDF’s report for 2016.

Ranked fourth in the European Union in the 2018 edition of the Innovation Scoreboard, Holland hosts more than 10 major innovation hubs, offering start-ups excellent incubators and facilities for Research and Development (R&D). The country grants residence permits valid for 1 year to ambitions entrepreneurs intending to start innovative companies locally.

Dutch R&D

Holland is an R&D hub fostering innovations fuelled by dedicated supportive tax credits, top research institutes and numerous strategic partnerships of the government with scientific and industrial organizations.

The global index for innovation (2018) puts Holland in the 2nd place in the list of most innovative countries worldwide. The country has consistent high scores in fields like creative outputs, business sophistication, technology and knowledge outputs, and Foreign Direct Investment net outflows.

Sales and marketing

With its flourishing creative industry, Holland is very attractive for foreign sales and marketing operations and hosts divisions of large multinational corporations. Its strategic location on the European continent offers instant access to the most profitable markets in the EU. Furthermore, the availability of international talent allows foreign companies to advertise their products and services to an extensive range of clients worldwide.

Data centres in The Netherlands

Holland is rated among the best wired states worldwide and boasts a particularly advanced market for operations related to data centres. Approximately a third of the data centres in Europe are situated in the area of Amsterdam and benefit from the services of AMS-IX, the biggest internet exchange in the world. The national Datacenter Association confirms that almost all key digital economy players have establishments in Holland with head offices and equipment. Currently 20% of the foreign investments in the country are motivated by digital operations.

The national telecommunication network is among the best in the world in terms of reliability, quality and speed. Also the mild local climate and the robust cluster for renewable energy production provide affordable and sustainable options for the establishment of energy efficient date centres.

Service centres

Holland’s convenient geographic location, well developed infrastructure for transport and telecommunication and open service-oriented mindset provide the perfect environment for establishment or consolidation of centres for shared services on the European continent.

As a European multilingual hotspot, Holland boasts a skilled, productive and diverse labour force. The country’s cultural amenities, high living standard and comparatively low living costs allow corporations to easily attract skilled personnel and expats to their shared services centres.

Manufacturing

The well qualified engineering workforce in the Netherlands, as well as the developed supplier collaboration network offer significant advantages for manufacturers intending to start or move their operations to Europe.

As a matter of fact, big multinational corporations active in a variety of industries, from life sciences and agriculture/food to IT, chemicals and maritime industry, already have manufacturing operations in progress in Holland.

Do you plan to start a business in Holland? Please, contact our expert advisors in incorporation who will assist you throughout the whole process.