Intercompany Solutions: Starting a business in the Netherlands

Why Choose To Start A Dutch Business?

Why work with Intercompany Solutions?

Our experience with international entrepreneurs has allowed us to perfectly adjust our processes in order to ensure the successful establishment of your company. Customer satisfaction is guaranteed for all the services we offer.

Our Scope Of Expertise:

- Starting a Dutch business, complete package;

- Assistance with local regulations;

- Application for issue of an EORI or VAT number;

- Accounting;

- Application for a company bank account

- Secretarial support: premium package.

Associations And Memberships :

We are constantly improving our standards of quality to deliver impeccable services.

Media

We perfect our quality standards to deliver services of the highest degree.

Featured In

The Benefits Of Starting A Business In Netherlands

The Netherlands is known worldwide for its beneficial environment for entrepreneurs.

Many global investors and entrepreneurs consider starting a business in the Netherlands. In this guide, we explore the Netherlands as a jurisdiction to start a company. Here are some of the benefits of establishing a business in Holland:

- Corporate tax rate of 19%, among the lowest in Europe;

- No value added tax (VAT) for transactions between member states of the EU;

- In 2018, Forbes rated the Netherlands as the 3rd best country in the world for businesses

- The Netherlands has recently attracted many businesses and multinationals from the UK regarding Brexit

- The #1 country worldwide for double tax avoidance treaties;

- The Netherlands is among the founding members of the EU;

- Local companies have a great reputation in global commerce. The Netherlands gives a big advantage in representation;

- Of the Dutch people, 93% speak English; many are proficient in German and French;

- Highly educated labor force (3rd in the global top for education level);

- Outstanding international business atmosphere;

- Holland is 4th in the global report of the WEF and first in the European top for most innovative and competitive economies;

- According to a recent investigation by G. Thorton, starting a business in Netherlands is one of the best choices for foreign investors.

- The country welcomes foreign entrepreneurs and investors: from small enterprises to multinational companies included in the Fortune 500 list;

- The Netherlands attracts international companies from all sectors with its stable legislation and politics, coupled with excellent international relations.

Procedures To Follow To Gain Dutch Citizenship

EU, EEA and Swiss citizens

Non-EU citizens

Which Visa-Permit Do You Need To Live In The Netherlands?

Start-up permit:

Self-employed permit:

Starting A Company In The Netherlands:

All Legal Entities

In the Netherlands, you can choose from a wide variety of legal business entities. There is a significant distinction between unincorporated business structures (‘rechtsvormen zonder rechtspersoonlijkheid’) and incorporated business structures (‘rechtsvormen met rechtspersoonlijkheid’). The main difference between these two is that there is no distinction between your private and business assets in an unincorporated business. So if you create debts with your business, you can personally be held accountable. If you choose an incorporated business, you separate private and business assets and thus enjoy protection from business debts.

There Are Four Types Of Unincorporated Business Structures:

- Sole trader/single-person business (Eenmanszaak or ZZP)

- Limited partnership (Commanditaire vennootschap or CV)

- General partnership (Vennootschap onder firma or VOF)

- Commercial/professional partnership (Maatschap).

There Are Five Types Of Incorporated Business Structures:

- Private limited company: ltd. and Inc. (Besloten vennootschap or BV)

- Public limited company: plc. and Corp. (Naamloze vennootschap or NV)

- Cooperative and mutual insurance society (Coöperatie en onderlinge waarborgmaatschappij)

- Foundation (Stichting)

- Association (Vereniging).

Legal requirements differ between the business structures. In general, the business structure that is most often chosen by foreigners is the Private limited liability company (BV).

Starting A Business In The Netherlands:

Company Types In Depth

The Dutch Foundation

Dutch NV company

Branches and Subsidiaries

General partnership

Dutch Limited partnership

Professional Partnership

BV And NV: Differences Between The Two Limited Companies

Quick fact: Around 99% of our clients choose for a BV company. Unless you want to be publicly listed (NV), or you are looking to form a charitable foundation (Stichting). The Dutch BV is likely the company type you are looking for.

BV or NV: how do you choose which one is best for you?

Potential clients often ask us which option is the best fitting choice: the BV or the NV. The BV is comparable to a limited liability company, which means that the liability for the owner is limited. Some comparable structures are the private liability company in the UK (Ltd), the French société a responsabilité limitée (SARL) and the German Gesellschaft mit beschrankter Haftung (GmbH).

The NV is comparable to a corporation. The NV is also the legal entity that is traded at stock exchanges. In the UK, the NV is comparable to the public liability company (plc), in Germany to the Aktiengesellschaft (AG) and in France to the Société Anonyme (SA).

The Dutch BV (comparison)

The BV is a privately held company comparable to the ‘limited liability company’

- There is an annual general meeting (GM) for shareholders.

- A one-tier board and a two-tier board are both possible.

- A supervisory board (or non-executive directors in the board) is optional.

- The articles of association can contain regulations granting shareholders limited possibilities to give general instructions to the management board.

- Practically no minimum capital is required. Issued and required paid-up capital is determined by founders. This is registered in the articles of association.

- Different types of shares allow varying voting and dividend rights, plus non-voting shares.

- Particular class shares may limit profit sharing entitlement, however such shares must always have voting rights.

- Transfer restrictions are sometimes allowed.

- Shares are not admitted on stock exchange.

- The director decides about profit distribution.

The Dutch NV (Comparison)

The NV is a Public Company Comparable to the ‘Public Limited Company’

- The minimum capital is EUR 45,000.

- Different types of shares allowed (such as bearer shares).

- All shareholders receive voting rights as well as profit rights.

- Transfer restrictions are sometimes allowed.

- Shares are admitted on stock exchange.

- There is an annual general meeting (GM) for shareholders with and without voting rights.

- A one-tier board and a two-tier board are both possible.

- A supervisory board (or non-executive directors in the board) is generally optional.

- The articles of association can contain regulations granting shareholders the right to give specific instructions to the management board.

- The GM decides about profit distribution.

- If a certain contribution might threaten the continuity of the company, the management board may refuse approval to the distribution of profit, dependent on the outcome of a liquidity test.

- Interim dividends are possible.

The articles of association determine a large part of the rules regarding the possibility of transferring shares freely in a BV. Oftentimes, there are certain transfer restrictions that limit some (or all) shareholders. In that case, the other shareholders need to give their consent when a shareholder wants to transfer shares.

Also, the other shareholders have a preemptive right to buy shares from a selling shareholder. Since 2012 the flex-BV was introduced. One of the most notable changes was the decision to cancel the obligation to bring in a minimum share capital in order to start a BV completely. For most companies, a BV structure is the best option.

Ready To Start Your Company?

Dutch Limited Liability Company (Dutch BV)

Shareholders

A limited company is established by at least one incorporator, either a legal entity or an individual. The entity or individual, resident or foreign, can act both as an incorporator and a complete management board for the new company. A Dutch BV can be registered remotely by the director(s) and shareholder(s).

It is not compulsory to have a secretary. If the shareholder is just one, this does not result in personal liability. Still, the name of the shareholder will appear on the registration certificates of the company prepared by the Commercial Registry. Shareholdings are recorded in the register of shareholders maintained at the company’s office.

Incorporation deed

To start a business in the Netherlands, an incorporation deed is drafted in the presence of a public notary and submitted to the Trade Registry at the Commercial Chamber and to the Tax Office.

The official incorporation deed must be prepared in Dutch (our company will also prepare an English version of the notary deed for your convenience). This document lists the details of incorporators and initial board members, their participation amounts and payments made to the starting equity.

The deed also contains the AoA (Articles of Association) that include, as a minimum, the following details: company name, city location of the registered office, company purpose, amount of authorized capital (EUR), share division and share transfer conditions.

Company name

Intercompany Solution will check before we start your Dutch business if the chosen company name is not already in use as a trademark or a commercial name.

This is done as the holders of prior registrations have the right to require a name, The name of your company must either end or begin with “BV”. In addition to the company name, a BV has the freedom to choose one or several trade names to label the whole business or parts of it.

Shares and share capital

Incorporators can decide on the amount of share capital; A minimum share capital of €1 is required.

A single share with a corresponding voting right is required as a minimum. Shares can have profit and/or voting rights.

Dutch private limited companies can have corporate directors and shareholders.

Timeframe

The incorporation procedure to start a business in the Netherlands will usually take 5 working days. Please note that the procedure can take longer in busier periods.

The timeframe depends on how complex the shareholding structure is and, also, on the prompt provision of papers by the client.

Advantages Of Opening a BV in The Netherlands

Limited Liability

Minimum Capital

Innovation

No Taxes On Interest, Royalties And Dividends

When Should I Consider Starting A Holding Structure For My Netherlands Business?

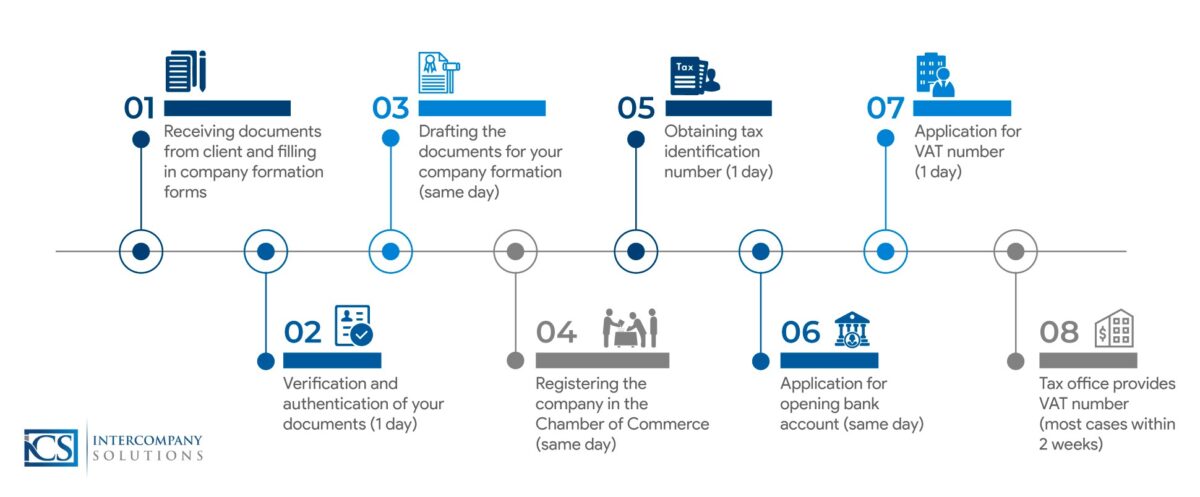

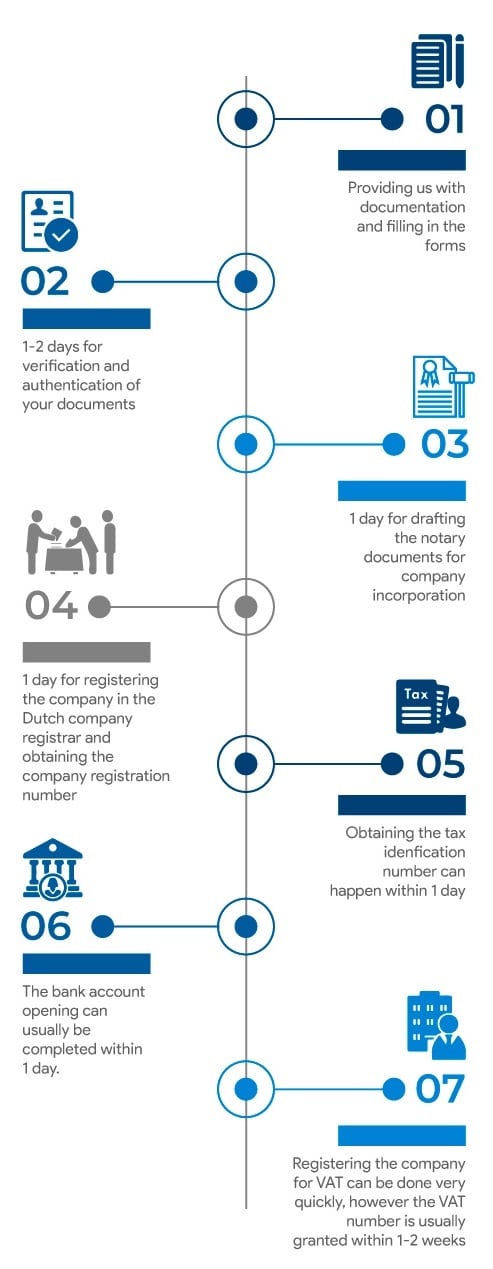

Company Formation Netherlands: The Procedure

In order to form a Netherlands company, you will obviously need to fill out the necessary paperwork. The required documents for the formation of a legal entity consist of a legalized copy of valid identification and proof of address. These documents need to be sent with an apostille, which you can obtain at a local notary’s office. Also, a power of attorney is required, which must be signed by a notary for remote formation.

However, it is not necessary to travel to the Netherlands. All shareholders may authorize us in order to take care of all mandatory filings on their behalf. Other necessary actions, such as applying for a bank account for your company, may also be performed remotely. Only in some cases, the director needs to be present, but this depends entirely on the bank you choose. If you so wish, we can advise you on practical matters such as these, so every step can be done remotely.

The whole procedure of company formation in the Netherlands can be completed in only 5 working days, assuming all documentation meets the requirements. Please note that the procedure can take longer in busier periods.

The largest portion of time is spent in the verification of the documents. The procedure for the formation of a Dutch BV is as follows:

Step 1

Step 2

Step 3

What Are The Costs Of Starting A Business In Netherlands?

The exact costs will be calculated according to your specific business needs and wishes, but you should consider the following fees and costs involved with the entire procedure:

- Preparing all legal documents and documents for identification purposes

- The fee at the Dutch Chamber of Commerce for registering a Dutch company

- The costs for registration at the local tax authorities

- Our incorporation fees covering the formation of the company as well as extra services such as application for a Dutch bank account

- Our fees for assisting you with the VAT number and optional EORI number applications

The annual costs cover our accounting services. Of course, we will happily provide you with a detailed personal quote for the formation of a Dutch company.

Company Formation Netherlands Timetable

Taxation Of Netherlands Companies

Every Dutch business is of course subject to taxation. You will have to pay tax over all profits of your company.

Currently, the corporate tax rate is 19% up to €200.000 annually, all profits above this threshold are taxed at 25.8%.

Profits taxation

Profits The VAT rates Are:

9% lower VAT rate

0% tax exempt rate

0% for transactions between EU countries

Tax Advantages And Obligations

After incorporation private limited companies are registered at the Tax Office and the required tax numbers are issued. Dutch companies have particular obligations and need to submit different tax returns. Find more information below.

Dutch corporate tax

Participation exemption

Participation exemption for international companies

Economic Opportunities In The Netherlands

Due to the strong Dutch trade mentality as well as a solid transportation infrastructure, the Netherlands have been able to maintain a 20th position as the largest economy in the world. The Dutch workforce well-educated and fully bilingual, providing many possibilities regarding recruitment and doing business with other cultures. This and the substantially low costs for company formation makes the Netherlands extremely attractive compared to other Western European countries.

Value Added Tax (VAT) In Holland

Holland uses a VAT system, similarly to other EU members. Some transactions are not subject to value-added tax, but it is commonly charged by the authorities. The regular rate, 21%, is charged with respect to almost all services and goods offered by Dutch businesses.

This rate might also apply to products imported from non-EU countries. In Holland, there is also a lower VAT rate of 9% regarding specific services and goods, e.g. medicine, food, art, medicine, books, antiques, entry to sports events, museums, theaters and zoos.

VAT for international entrepreneurs: when your company is established in a foreign country, but you are also operating in Holland, you need to conform to the national regulations. If you are offering products or services in Holland, in most cases you need to cover VAT there. Still, VAT is often charged in reverse to the individual receiving the product or service, resulting in 0% rate.

Reverse-charging is an option if your clients are legal entities or entrepreneurs established in Holland. Then you can omit the VAT from the invoice and insert reverse-charged instead. Otherwise, you need to pay the tax in Holland. Starting a company in The Netherlands will allow your business to make full advantage of the Dutch VAT regulations.

30% tax reimbursement ruling: international employees hired in the Netherlands can make use of a tax exemption called “the 30 percent reimbursement ruling”. If you meet certain conditions, the employer will transfer to you 30% of your wages free of tax. This allowance is meant to compensate the additional expenses of employees who work outside their home countries.

Eligibility conditions: in order to qualify for reimbursement, candidates have to meet the following requirements:

- the employer is registered at the Tax Office in the Netherlands and covers payroll tax;

- there is a written agreement between the employee and the employer that the reimbursement ruling applies;

- the employee is either transferred or recruited abroad;

- upon hiring, the employee had resided more than 150 kilometers away from the border of the Netherlands for at least 18 months out of the past two years;

- the yearly salary of the employee is equal to or exceeding € 37 000;

- the employee has qualifications that are scarce on the Dutch labour market.

The Netherlands Compared To Other Countries

The Dutch tax rates were further reduced in 2021. The goal is to achieve a strengthened investment climate, providing foreign investors with better opportunities. There has probably never been a better time to start a business in the Netherlands.

Intercompany Solutions In Brexit Report

We perfect our quality standards to deliver services of the highest degree.

Some Of Our Recent Clients

Frequently Asked Questions

On Business In The Netherlands

Procedure and requirements

Is it possible to establish a Dutch company if I reside elsewhere?

How many days does it take for starting a business in Netherlands?

Is it compulsory to have a Dutch company address?

What is the minimum required share capital?

What is the procedure for Starting a Netherlands company?

1) Drafting and submission of the deed of incorporation

2) Registration in the chamber of commerce

3) Tax registration

4) Bank account application

What are the documents necessary for starting a Dutch business?

Is it possible to start a business in the international trade through a company in Holland?

Questions Dutch BV

Can you provide further information on Dutch BVs?

What taxes do companies pay in Holland?

Can you list the main legal aspects of company establishment in Holland?

What are the company types in Holland?

Do I have to obtain any special licenses or permits for my newly established Dutch company?

Visa and Citizenship

Is a visa necessary to enter Holland? What is the procedure for obtaining it?

What is the procedure for obtaining Dutch citizenship?

Legal questions

Can you list the main legal requirements that foreign entrepreneurs must meet in order to make investments in the Netherlands?

Can you explain the requirements for employment in Holland?

How to register a brand or a trademark?

Download brochure: Set up a Dutch Limited Liability Company

Our brochure describes the possibilities of The Dutch BV (besloten vennootschap) as the most popular entity to be used as a financing, holding or royalty company in international structures.