Netherlands Company Formation

Our incorporation agents and notaries have over 10+ years industry experience with entrepreneurs from over 50+ countries. Saving you time and effort. Your new company is just a short call away!

The corporate tax in the Netherlands is 19% up to EUR 200.000 profit a year, the profit of EUR 200.000 and more is taxed at 25,8%.

The Netherlands has a 21% VAT rate on goods and services delivered in the Netherlands. Between European countries, goods and services may be offered at a 0% VAT rate. Corporations with a VAT number may claim back the VAT.

For non-EU investors, starting a business in the Netherlands and obtain a residency visa through business immigration is a possibility.

Memberships And Associations

Why Work With Us?

Media

Intercompany Solutions CEO Bjorn Wagemakers and client Brian Mckenzie are featured in a report for The National (CBC News) ‘Dutch Economy braces for the worst with Brexit’, in a visit to our notary public on 12 February 2019.

We perfect our quality standards to deliver services of the highest degree.

Featured In

Why Dutch Company Formation Is A Good Opportunity For Your Business

- 19% corporate tax, one of the lowest tax rates in Europe

- 0% VAT for business between EU member states

- No borders or customs between The Netherlands and 26 European countries

- The Netherlands ranks 3rd place in Forbes Global Business list

- 5th place in the World Economic Forum's Global Competitiveness index

- Leading world banks (ING bank, ABN Amro, Rabobank)

- 93% English-speaking natives

- Netherlands is a logistical hub as a gateway to Europe

- High-tech infrastructure

- Possibility of business immigration

- Remote company setup

The Netherlands And Company Formation:

What Type Of Company Should You Choose?

The Dutch BV (limited company) is the most chosen type for a Netherlands company registration by foreign investors. The Dutch limited company can be registered with a minimum share capital of 1 EUR, according to corporate law. A Dutch BV by law is deemed to be a tax resident in the Netherlands.

A personal visit is not required to incorporate a Netherlands company, the formation procedure can be completed from abroad. We can also assist with remote bank account applications. With certain banks, the director has to be present to apply for a bank account.

In the case of corporate shareholders, the Dutch company will be a subsidiary. It is also possible to register a Dutch branch; a branch office has less substance than a subsidiary and may be treated differently by the Dutch tax authorities.

Video explainers on the Dutch BV:

Ready To Start Your Company?

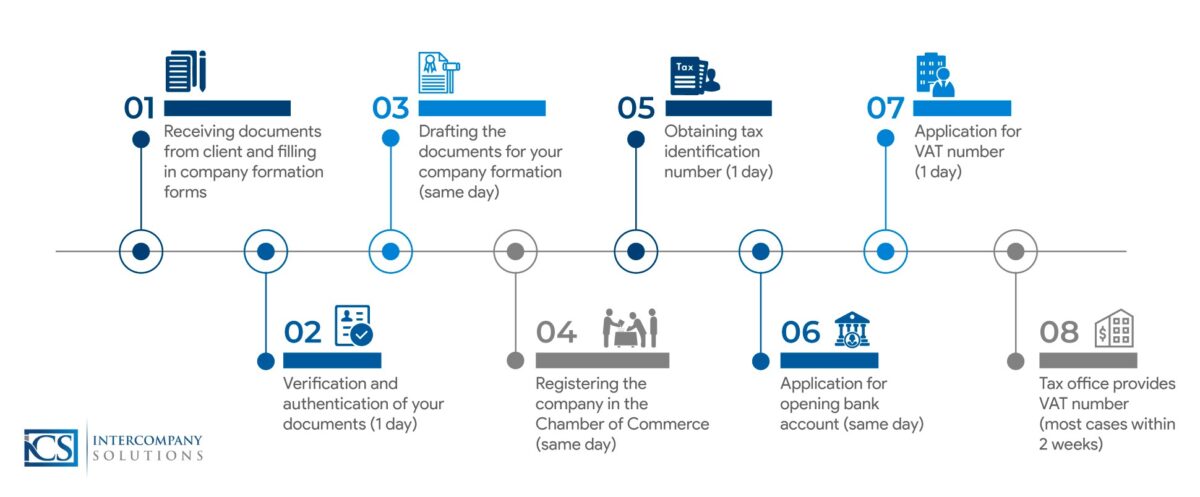

Company Formation Netherlands: The Procedure

Step 1

- A copy of passport of all the directors, shareholders and other ultimate beneficial owners.

- Our filled-out form regarding the formation of a business.

Step 2

After we have prepared the initial documentation for the formation of the business, the shareholders sign for the company formation remotely.

Step 3

Our firm will process the company formation in the Netherlands, and file the company in the Dutch company register.

Update 7 February 2024

Our notary is able to perform remote formation. That could save time and effort with your documents.

In the normal procedure: If the documents are signed in your home country, the documents will have to be verified by a local notary public. There is no need to visit the Netherlands, we have options for remote Netherlands company formation.

Accounting services

After the formation is complete, the company must obtain a tax number or VAT number. A registration at the local tax office is needed.

It is neccesary to have an accountant or use the ICS services for the VAT application. After the VAT application, the company needs to have accounting services for quarterly VAT filings (4x per year), corporate tax filings and an annual statement, which needs to be published at the chamber of commerce.

Cost Of Dutch Company Formation

Taxation Of Netherlands Companies

Any Netherlands company has to pay tax in The Netherlands. The lower corporate tax rate is currently 19% up to €200.000 profit a year. The higher tax rate is 25,8%.

Many international companies have found the Netherlands to be an excellent country to optimize their global taxes. The Netherlands has excellent tax treaties and tax benefits.

Profits taxation

2024: 19% until €200.000, 25,8% above

The VAT rates Are:

21% standard VAT rate

9% lower VAT rate

0% tax-exempt rate

0% for transactions between EU countries

Economic Opportunities In

The Netherlands

The Netherlands is known for its accessibility to large markets. The ports of Rotterdam and the Europoort port area are connecting international trade with the mainland of Europe, ‘Europoort’ is Dutch for: ‘Gateway to Europe’.

The country has maintained a 3rd position as the most competitive business climate in the world thanks to the Dutch trade mentality and strong transportation infrastructure. The Dutch workforce is stable, well-educated, and fully bilingual.

Some Of Our Recent Clients